Despite being regarded as a coin with strong potential this market cycle, Dogecoin has seen a notable drop in value. Currently, DOGE is priced at $0.10, marking a 2.50% decline in the past 24 hours.

However, many investors remain optimistic about Dogecoin’s future. For this optimism to translate into meaningful gains, DOGE must break through a key price threshold to regain upward momentum.

Dogecoin Struggles Continue

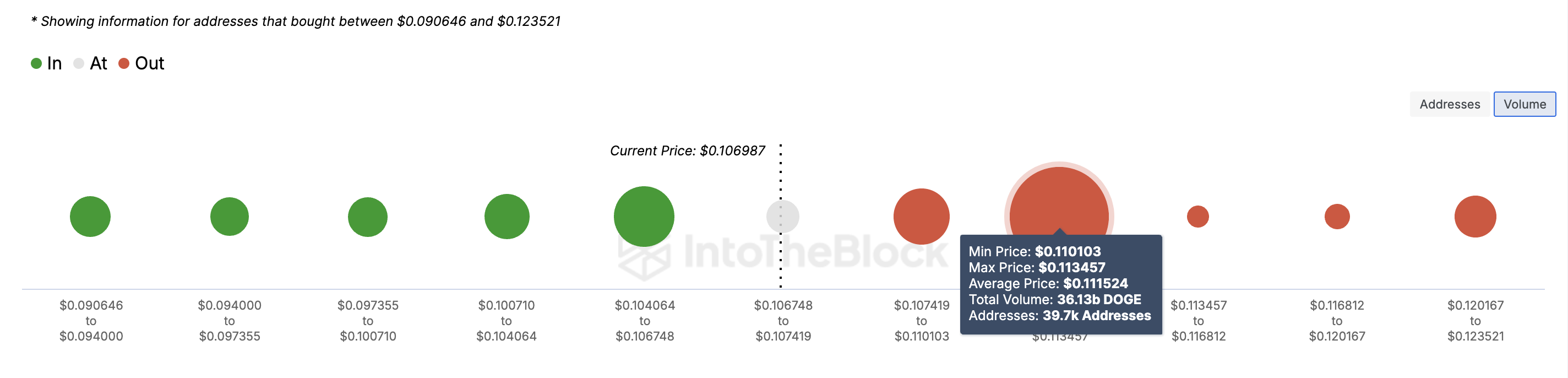

An assessment of In/Out of Money Around Price (IOMAP) shows that the most significant support for DOGE lies around $0.11. At this price level, 39,700 Dogecoin addresses purchased 36.13 billion and are holding the coin at a loss.

The IOMAP classifies addresses based on those making money, at break-even points, and losing money. It does this by comparing the on-chain acquisition cost basis with the current cryptocurrency value.

Simply put, the higher the volume at a certain price range, the stronger the support or resistance. As seen below, the largest cluster exists at $0.11, as the volume purchased at this price is much higher than every other range between $0.090 and $0.12.

Read more: How To Buy Dogecoin (DOGE) and Everything You Need To Know

This reinforces the notion that a strong supply wall is limiting Dogecoin’s ability to trade higher. To break out, DOGE must contend with this level, but it currently lacks the momentum to rise past it.

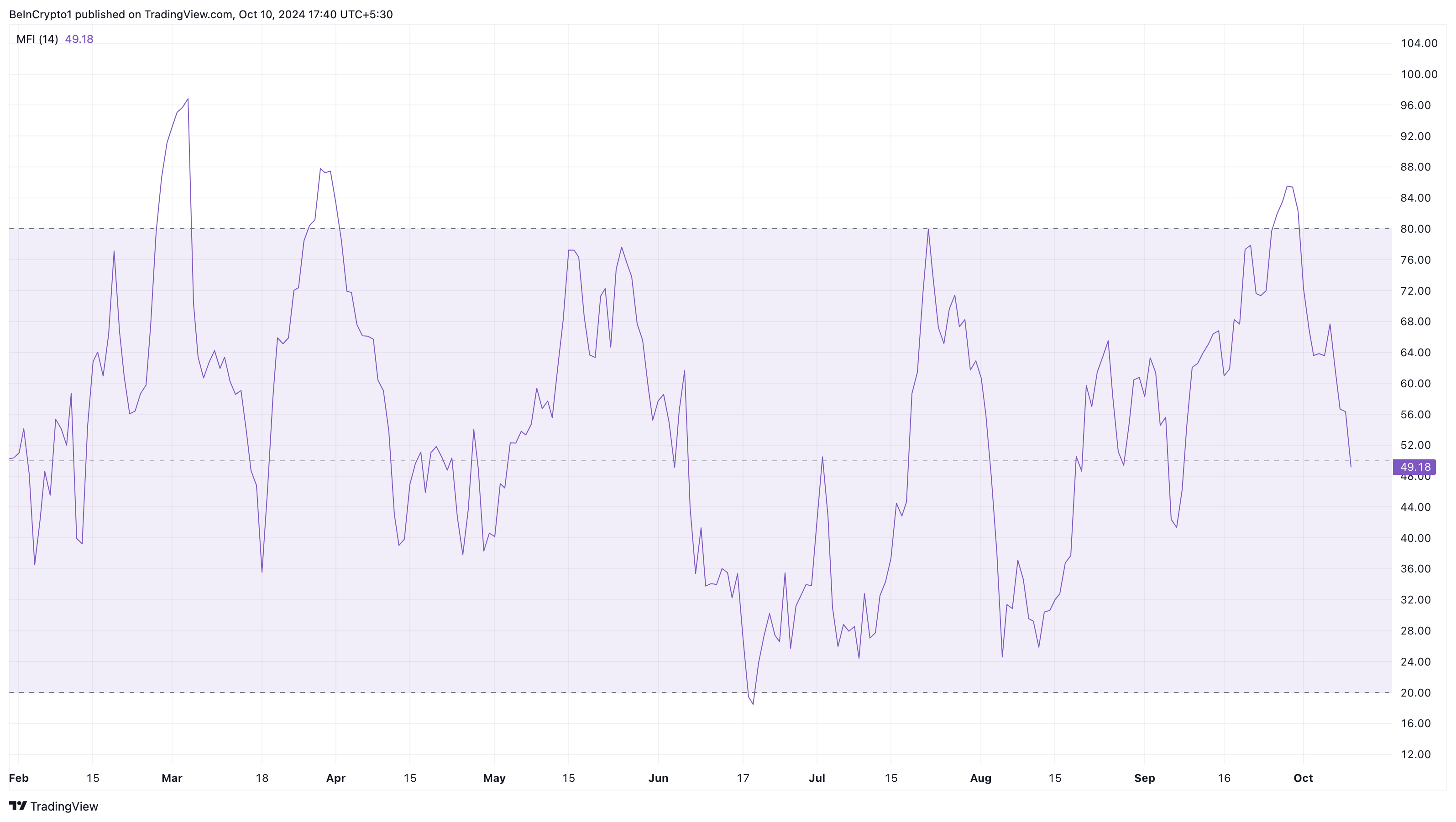

Additionally, the daily DOGE/USD chart shows a decline in the Money Flow Index (MFI), an indicator that measures buying and selling pressure using price and volume. When the MFI rises, it signals dominant buying pressure, while a drop indicates sellers are in control.

Currently, the MFI has fallen below the neutral line, suggesting sellers are outpacing buyers, making a recovery unlikely in the near future.

DOGE Price Prediction: The Meme Coin Goes Lower

Regarding the next movement, DOGE looks almost certain to drop below $0.10. One reason is its Moving Average Convergence Divergence (MACD), which uses the trend of two Exponential Moving Averages (EMAs) to measure momentum.

When the 12-day EMA (blue) is above the 26 EMA (orange), the trend is bullish, and the price can move higher. But as of this writing, the longer EMA has crossed over, the shorter one, indicating that sellers have the upper hand.

As long as this remains the case, Dogecoin’s price might fail to rebound. Instead, the meme coin’s value could decline to $0.086.

Read more: 7 Best Crypto Contract Trading Platforms in 2024

On the other hand, the coin’s price could bounce off the $0.10 support if buying pressure increases. In that scenario, DOGE’s value might climb to $0.14.