It’s ironic that amidst the speculative frenzy surrounding meme-inspired cryptocurrencies like Dogecoin (DOGE), wallet addresses holding the coin have surged by a staggering 85%.

Even more intriguing is that most Dogecoin investors find themselves in profitable positions. Despite this, there appears to be a collective reluctance to part ways with their Dogecoin holdings.

Dogecoin’s Bullish Trend: 90% of Addresses Profitable

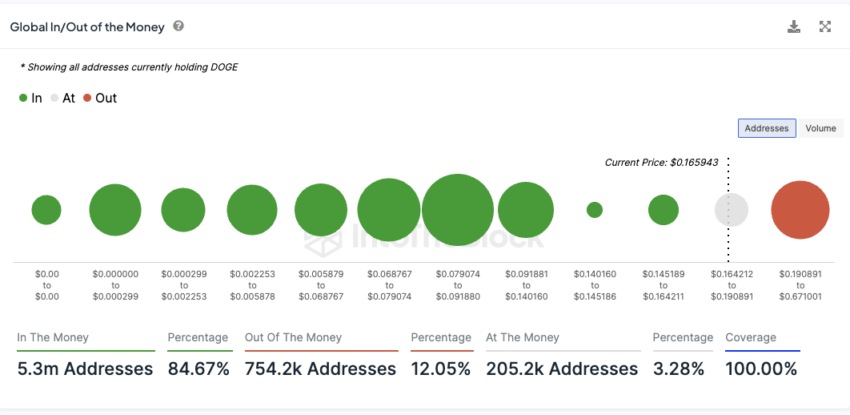

Looking closely at the blockchain data provided by IntoTheBlock, a valuable crypto analytics tool, we find that nearly 85% of Dogecoin addresses are currently in the green zone, indicating profits.

Conversely, only 12% of addresses are in the loss zone at the current price of DOGE, while approximately 3.3% hover around the break-even point.

Crypto Exchanges Face High Withdrawals Amidst Investor Gains

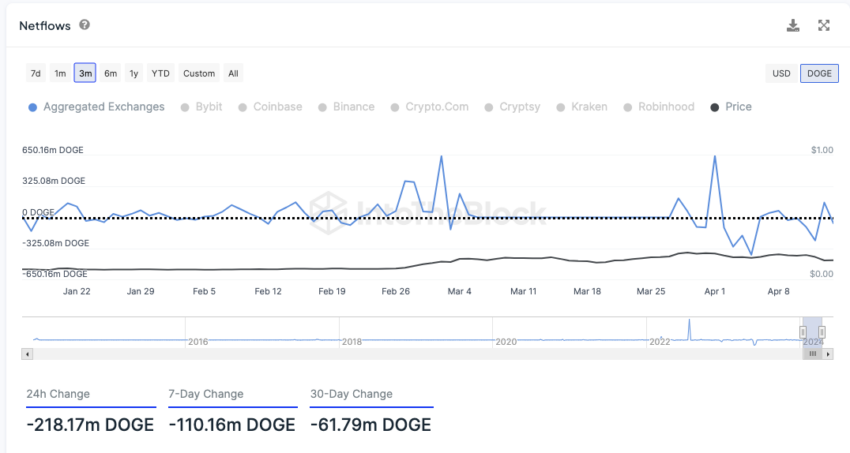

Despite the majority of Dogecoin holders being able to sell their tokens at a profit, there’s been a notable trend of increased withdrawals from crypto exchanges. Over the last seven days, exchanges witnessed a net withdrawal of 110 million more DOGE tokens than deposits.

Read More: How To Buy Dogecoin (DOGE) and Everything You Need To Know

This trend extends over the last 30 days, with approximately 62 million DOGE tokens withdrawn, and in the last 24 hours alone, a surplus of around 218 million DOGE tokens was observed. Such a pattern typically signals bullish sentiment, as individuals tend to transfer tokens they intend to sell to exchanges.

Transferring them to a private wallet might be preferred for those looking to hold rather than sell their tokens.

Dogecoin Network Sees Renewed Growth

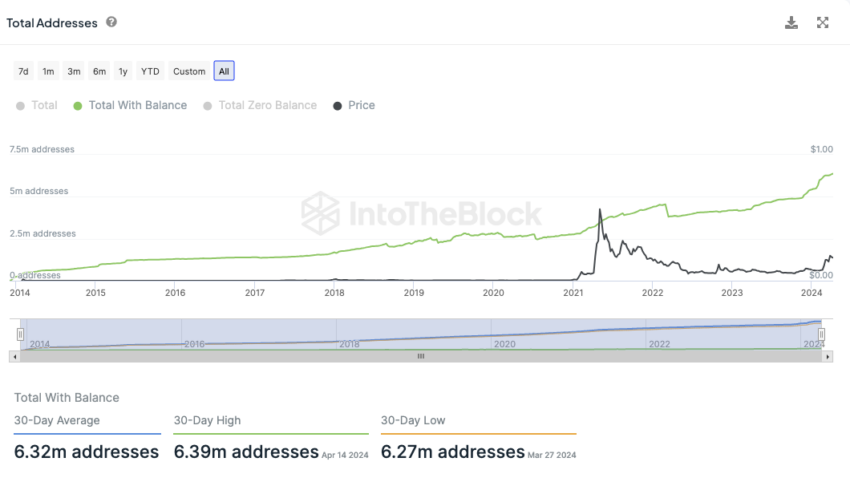

Since the start of the year, the Dogecoin network has demonstrated robust growth. Over the last 30 days, an average of 6.3 million DOGE addresses have been recorded, each holding a balance of Dogecoin.

Slight Downturn: A Dip in Network Activity Noted Recently

Conversely, Dogecoin’s network activity has experienced a slight downturn. Over the past seven days, there has been a decrease of approximately 12.73% in creating new addresses, coupled with an almost 8% decline in the proportion of active addresses.

Interestingly, there has been an uptick of nearly 1% in the number of Dogecoin addresses devoid of DOGE balances.

Retail Investors Own More Than 33% of Dogecoin

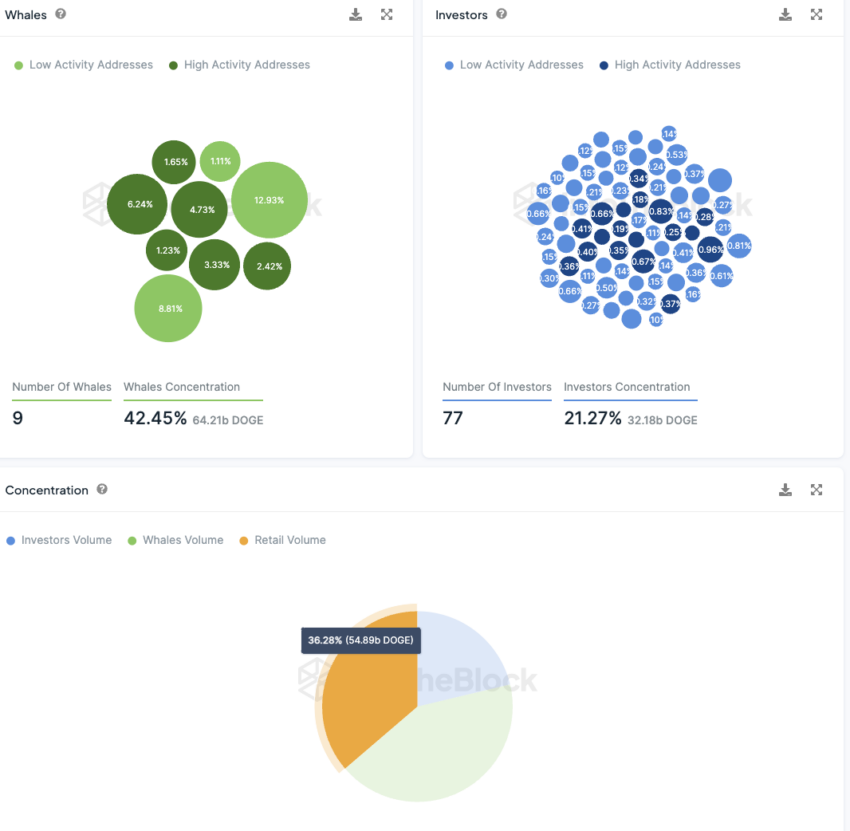

In the realm of Dogecoin, a select few major investors hold a significant proportion of token ownership. Approximately 77 entities possess holdings ranging from 0.1% to 1% of the total tokens, collectively representing around 21.3% of the overall supply.

Moreover, 9 notable “whale addresses” collectively harbor almost 42.5% of all Dogecoins, each individually holding more than 1% of the available tokens.

Read More: Dogecoin (DOGE) Price Prediction 2024/2025/2030

For smaller-scale investors, whose stakes are less than 0.1% each, only approximately 36% of the total Dogecoin supply remains within their purview.