Digital assets and their role in finance will continue to increase, with the barriers between them and traditional finance continuing to fade, says Miles Paschini is CEO of FV Bank.

The global financial service market has entered the era of digital transformation. The era where the rapid development of the digital asset ecosystem presents new opportunities. Here, banking-as-a-service (BaaS) and embedded finance are essential factors in further cryptocurrency adoption.

As a result, more and more individuals and businesses recognize the value of digital assets and seek legitimate and safe ways to use and store them.

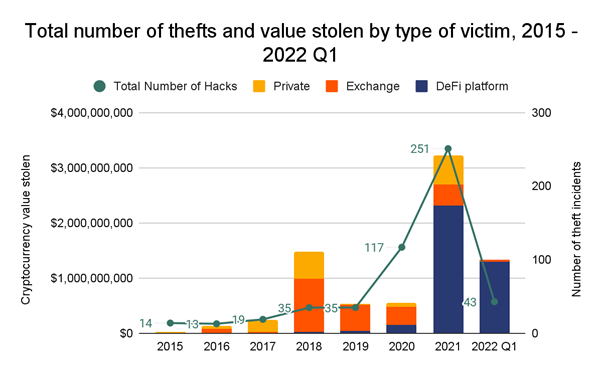

This puts excessive pressure on custodial services since you cannot fully take advantage of digital assets, without knowing they are safe. These concerns have a solid foundation: cybercriminals stole a whopping $3.2 billion equivalent in digital assets in 2021, according to Chainalysis. And it seems that in 2022, they intend to beat this record.

The variety of digital assets is not limited by cryptocurrencies like bitcoin (BTC) and Ethereum (ETH). There is a growing sector of decentralized finance (DeFi) built on top of digital assets. Among other use-cases are non-fungible tokens (NFTs). They allow users to define ownership of unique items, such as artworks, both digital and physical.

Thus, here comes the number one priority for modern custodial service providers. They need to develop advanced, secure, and scalable solutions to allow both individual and institutional investors to purchase, exchange, and store their digital assets. Making those services accessible to the major public is another critical point to overcome on the long journey to mass adoption of digital assets.

Digital assets: What is digital asset custody?

Digital asset custody is in many ways similar to specialized custodial services for traditional financial assets. Custodians offer safe storage space and protection for assets on behalf of their users in exchange for a fee. The immutable nature of the underlying blockchain technology, however, imposes additional responsibilities on custodial service providers.

Bitcoin, as well as the majority of cryptocurrencies, is typically acquired via a process called “mining.” Then, it is transferred among users within a blockchain network. In most cases, the transaction records serve as the only confirmation that a particular user had a particular asset in possession at a particular moment.

Sets of cryptographic keys are the only tools that allow users to be in command of their assets. A blockchain address, or a public key, is the only data users need to know to make a transfer. But to authorize it, they would need a private key. Digital assets themselves never leave a blockchain network. It means that only those who own the governing private keys can manage them.

To secure digital assets, custodial service providers do not technically need to store their clients’ digital assets. Even presuming there is hardware space for that. Instead, they store sets of their clients’ cryptographic keys for if they are lost, there is no way to recover them.

Digital asset custody: An overview of the current landscape

Digital asset custodial solutions come in a variety of shapes and each comes with its own features. Some of them are designed to store specific cryptocurrencies. Others support multiple blockchains and can contain different types of digital assets. Regardless of their nature, they are all designed with a single purpose in mind – to keep their clients’ private keys away from prying eyes.

The idea behind custodial wallets is that digital asset owners rely on custodians to store their private keys on their behalf. Such an approach presumes that the end user may not have access to their private keys or even know them at all. To get access to their funds, they use more typical access methods such as a login and password.

Alternatively, some custodial services store only a part of the private key and initiate a so-called “signing ceremony.” There, both the owner and custodian enter their part of the private key whenever the assets are required to be moved. This method is called multi-signature.

Technically, such an approach may resolve the trust issue. This is because both parties have no access to the entire key and cannot move digital assets, without each other’s permission.

The digital asset custody market landscape is rapidly changing. But with that said, most of the offerings are the following.

Non-custodial storage of digital assets, or self-storage

Hardware storage devices are a great option for those who prefer to be in charge of their assets and do not wish to rely on a custodial service. They allow for keeping the user’s private keys safe.

With greater control, however, comes greater responsibility. If the keys are lost or stolen, there is no way to restore access to one’s digital assets and no entity that can grant reimbursement.

While this is an approach that safeguards against any issues with a custodian, it has its own challenges. One needs to back up the seed phrase (mnemonic) by storing it on a memory storage device, writing it down on a piece of paper, or any other suitable way.

This is also important if you plan to pass your crypto savings to your heirs securely and confidentially. If they know the private key, they can easily access your self-custody (non-custodial) wallet and access the assets.

The other issue about such wallets is compliance. Since such wallets are not KYC-ed, they can be subject to higher compliance checks and are not travel rule compatible. It makes them very unfriendly for commercial use.

Crypto exchanges

Trading platforms specialized in exchanging digital assets were, de facto, the pioneers of the digital custody market. Even now, they remain among the biggest players in the industry. The 2014 Mt. Gox collapse — which resulted in 740,000 bitcoin stolen from users’ wallets — highlighted how ignoring security in favor of rapid growth can be extremely dangerous.

Custodial services offered by digital exchanges have since evolved. Users can now choose from ready-to-use hot wallets to military-grade cold storage facilities not connected to the internet and thus, not vulnerable to cyberattacks.

If you choose a custodial exchange crypto wallet to store your assets, the exchange will hold your keys and take responsibility for the security of your funds. It is possibly not as secure as having your assets in a non-custodial wallet. Still, most users prefer this option for the sake of convenience.

If you lose the password to a non-custodial wallet, there will be no one to help you get access to your funds. But trusting your assets to an exchange means it will allow you to reset the password. Especially if you follow all the security measures advised by the exchange.

What’s worrying is that most exchanges are unregulated and often technology startups have poor risk management practices. This puts private keys at a higher-security risk.

We will never forget the case of the Canadian crypto exchange Quadriga. It ostensibly did not have multi-signature systems, which resulted in a $145 million loss. Although Quadriga claimed it actually used multisig wallets, when its founder Gerald Cotten died, all the crypto allegedly died with him. Otherwise, the exchange could have regained access to the cold wallets and returned the funds to the affected users.

Sub-custodians

Companies that act as digital custody solution providers usually do not interact with individual clients. These services, however, are popular among financial institutions like banks and exchanges. Those rely on sub-custodians to outsource storing and transactional matters.

This approach can be extremely helpful for banks who wish to engage in digital asset operations. Institutions that are not equipped with the necessary technologies or not willing to manage additional risks, also lean toward this solution.

At the same time, relying on third-party products has a slew of drawbacks. Financial institutions that choose third-party services become limited by the technical capabilities and risk profiles of their sub-custodians. This can also relate to the number of assets available for storing and trading.

Payment providers, custodian banks, or trusts

Fintech projects have been offering their clients to purchase, exchange, and store digital assets for several years already. Traditional financial organizations like banks and investment funds are gradually developing expertise in the crypto market, too. They tend to increase their exposure to this asset class and develop custodial services of their own.

Moreover, the rise of regulatory clarity and increasing demand from customers also push banks to explore this new field and expand their custodial role.

Custodian banks provide a complete suite of solutions. Among them are traditional custody services, analytics, asset servicing, lending, pricing and valuation, trading, payments, settlements, and collateral.

Direct custodial solutions allow banks to onboard new customers based on their risk assessment criteria. They also give additional freedom when it comes to choosing trading options and security solutions.

Custodian banks or trusts are ideal for institutional investors, family offices, insurance companies, and other types of clients. These are financial institutions that safeguard and manage customer financial assets. Those may include stocks, precious metals, bonds, or cryptocurrency holdings.

Such entities have physical possession of their clients’ assets and they may be both global and domestic. As of 2022, the market size of custody, asset, and securities services in the U.S. is estimated at $32.5 billion.

Digital assets and trust

Banks and trusts as custodians are the most trusted ones. The reason is that the assets there are customers’ assets. Thus, they cannot be used to pay off any debt or liability in case of bankruptcy.

This is very relevant these days, with wallets, exchanges, and other yield providers pausing withdrawals or redemptions and treating the digital assets in their custody as uncollateralized debt.

When using the services of a custodian bank, customers want to make sure their assets are safe. So it is worth checking how the custodian bank navigates risk in the current environment, how it responds to cybersecurity attacks or prevents them, as well as assessing the risk of the custodian bank becoming insolvent.

Future of custodial services for digital assets

Trends that shape the digital asset custody landscape today are remarkably similar to those of the traditional financial market almost one hundred years ago.

Cryptocurrencies, DeFi protocols, and NFTs continue getting traction. Financial experts predict the further expansion of this digital asset class. What’s more, digitally-native stocks and securities traded exclusively on blockchain are to enter the market in the foreseeable future.

World governments and regulators are trying to follow suit and aim to create a transparent system of requirements that should be applied to this asset type. They are also busy defining custodial requirements for it. This all combined means that the role of digital assets will continue to increase, with the barriers between them and traditional finance continuing to fade.

Ensuring the client’s assets are safe and at the same time, easily accessible for trading plays a critical role in building a clear path for mass adoption of digital assets. It is also vital for making both individuals and businesses willing to invest in them.

About the author

Miles Paschini is CEO of FV Bank, a global digital bank providing fintech and blockchain companies with integrated banking, payments, and digital asset custody services. Miles is an investor and serial entrepreneur, who built numerous, innovative financial services businesses. He was awarded seven patents related to payment processing services during the development of EWI Holdings, acquired by Blackhawk in 2006. In addition to developing the industry’s first cryptocurrency-linked debit cards implemented worldwide, Miles and FV Bank CRO Nitin Agarwal are the first in history to be awarded a U.S. patent for the development of stablecoin instruments to be backed by sovereign debt and on-chain KYC.

Got something to say about digital assets or anything else? Write to us or join the discussion in our Telegram channel. You can also catch us on Tik Tok, Facebook, or Twitter.