Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee to digest Deutsche Bank’s warning on equities. This warning, paired with a cautious stance on global growth, provokes the thought of where capital will flow next and what it could mean for Bitcoin (BTC).

Bitcoin News of the Day: Deutsche Bank Predicts Bitcoin on Central Bank Balance Sheets by 2030

Bitcoin is edging closer to recognition as a reserve asset, with Deutsche Bank predicting it will join gold on central bank balance sheets by the end of the decade.

The bank’s Research Institute argues that the two assets are complementary diversifiers rather than rivals.

“There is room for both gold and Bitcoin to coexist on central bank balance sheets,” read an excerpt in the paper.

Matthew Sigel, head of digital assets research at VanEck, highlighted the findings in a summary of the report on X (Twitter).

However, the crypto executive noted that Bitcoin’s volatility is set to decline, adding that neither asset needs to replace the US dollar.

Gold continues to prove its relevance as a reserve asset, reaching a record $3,725 per ounce on September 22.

“20 years ago. Gold was $470…. today above $3700. Gold is up almost eightfold. Any professional money managers out there outperforming this? If you think gold is expensive, it is because you don’t understand the dollar is actually a worthless piece of paper,” Buck, a popular user on X, remarked.

Its role as a hedge against inflation and political risk remains entrenched.

However, Deutsche Bank notes that Bitcoin shows similar resilience, breaking $123,500 in mid-August while its 30-day volatility slipped to just 2%.

Bitcoin’s Path From Volatile Bet to Central Bank Asset

The bank sees this trend as part of a structural shift. As adoption rises and regulatory frameworks mature, Bitcoin’s volatility could follow gold’s historical path, stabilizing over time.

“Gold was once risky, too,” Sigel added.

Notably, Bitcoin’s maturity stretches from MiCA in the EU to the FCA’s crypto roadmap in the UK.

Despite the bullish outlook, Deutsche Bank stresses that neither gold nor Bitcoin will supplant the US dollar as the world’s primary reserve currency.

This stance aligns with remarks from Marcin Kazmierczak, co-founder and COO of cross-chain data oracle provider, RedStone. In a recent US Crypto News publication, Kazmierczak questioned Bitcoin’s readiness to replace traditional assets.

Just as Washington resisted gold’s threat to dollar dominance in the 1970s, policymakers are expected to ensure that digital assets do not undermine the greenback.

Instead, Bitcoin and gold are framed as complementary stores of value with low correlation to traditional assets, enhancing central bank portfolios rather than competing with sovereign money.

“With correlations between BTC and the S&P 500 ranging from -0.2 to 0.4, Bitcoin demonstrates a variable relationship with equities rather than providing the consistent negative correlation truly needed for effective portfolio protection… This relationship puts Bitcoin in a diversifier category…Bitcoin can add diversity to a portfolio but won’t reliably protect against stock market crashes since it doesn’t consistently move in the opposite direction,” Kazmierczak told BeInCrypto.

Perhaps most striking is the report’s framing of Bitcoin as part of a long arc of financial history. From gold to oil to crypto, investors have always sought ways to diversify away from the mainstream.

“…so long as human nature exists, alternative assets will coexist,” the authors argued.

If Deutsche Bank’s forecast holds true, Bitcoin could be formally institutionalized in the next five years, potentially going beyond a speculative trade to become a cornerstone of global reserve management.

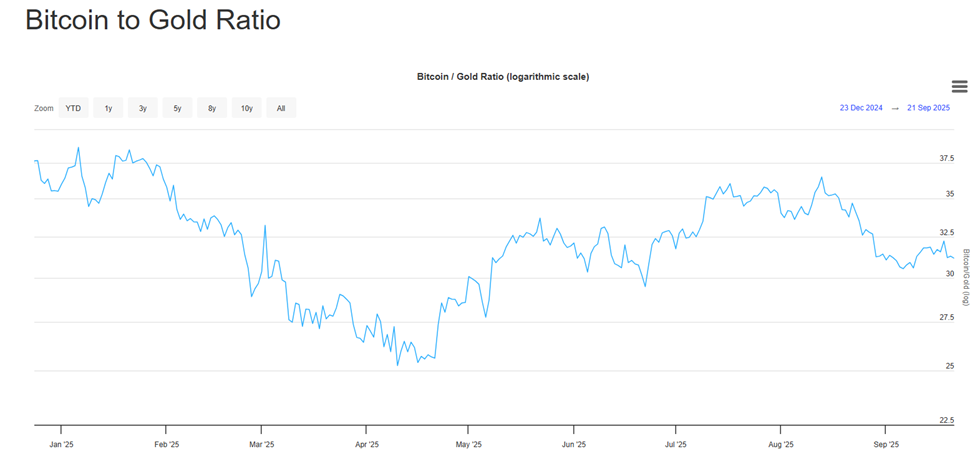

Chart of the Day

The Bitcoin-to-gold ratio chart shows BTC losing ground in early 2025, rebounding mid-year, then easing lower by September, reflecting shifting relative strength.

Byte-Sized Alpha

Here’s a summary of more US crypto news to follow today:

- Crypto inflows neared $2 billion last week as the Fed Rate cut sparked renewed demand.

- Three US economic signals to sway crypto as Bitcoin faces $116,000 rejection.

- Ethereum faces pressure as profitable ETH addresses hit new peak.

- Three warning signs of Bitcoin exhaustion in the final week of September.

- Ronin Network announces buyback plan – Will RON price rebound soon?

- Bitcoin’s sharp decline triggers $277 million long liquidation wave.

- Arthur Hayes takes profit after Binance founder Changpeng Zhao’s Aster jolts Hyperliquid. (HYPE).

- Has Tether’s USDT stablecoin become the dollar Bolivia actually trusts?

- Is charity the new utility for meme coins? Binance’s Changpeng Zhao thinks so.

- Why SharpLink believes only Ethereum can transform finance.

Crypto Equities Pre-Market Overview

| Company | At the Close of September 19 | Pre-Market Overview |

| Strategy (MSTR) | $344.75 | $337.27 (-2.17%) |

| Coinbase (COIN) | $342.46 | $332.59 (-2.88%) |

| Galaxy Digital Holdings (GLXY) | $32.87 | $31.32 (-4.72%) |

| MARA Holdings (MARA) | $18.29 | $17.69 (-3.28%) |

| Riot Platforms (RIOT) | $17.45 | $17.01 (-2.52%) |

| Core Scientific (CORZ) | $16.62 | $16.32 (-1.81%) |