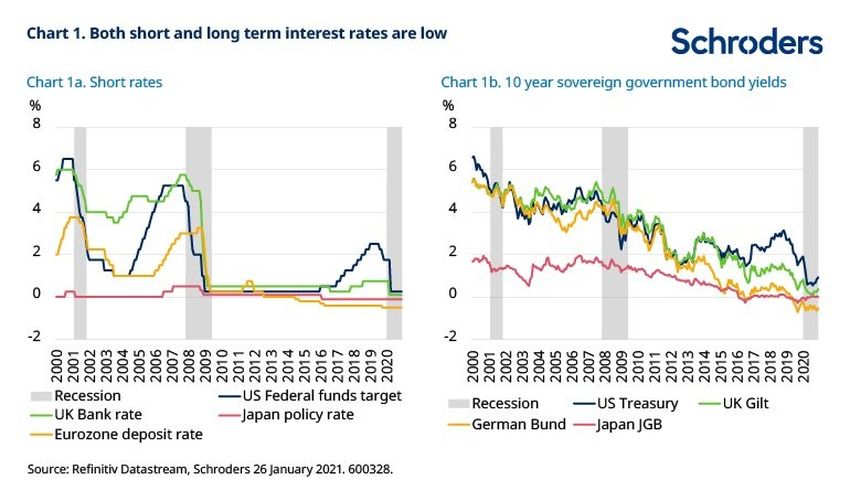

Since the global financial crisis government interest rates have remained low, further exacerbated by the COVID-19 pandemic that has seen global economies come to a near standstill as countries have been forced to effectively shut down global trade.

Despite the re-opening of global trade and the optimism following the arrival of COVID-19 vaccines, the low-to-negative rate environment doesn’t look like it is going to change any time soon.

In a post-Covid environment, which has seen economies come to the brink of collapse, central banks have had to intervene to support financial markets, with the resulting outstanding debts affecting fiscal policy for a long time to come.

A report by the asset management company, Schroders, paints a pessimistic picture of the medium to long-term future of interest rates: “In this environment, the pressure on central banks to keep rates low will remain strong. Not just to maintain overall policy stimulus, but to ensure that high debt levels remain sustainable. In this respect, the Fed will become more like its Japanese counterpart where low-interest rates are important to ensure government debt remains on a sustainable track”

With global nations experiencing the deepest recession of the post-war period, Schroder’s report predicts a continued low-interest-rate economy that is reinforced by high government debt levels.

The report also highlights the fact that, despite economic activity picking up in 2021, and short-term inflation, the low rate environment will persist for some time. In order for the Federal Reserve to bring the average inflation target (of 2%) back up, the Federal Reserve will need to maintain low rates, with periods of undershooting that will likely be followed by a spell of overshooting to bring the target back up.

In order for the Federal Reserve to achieve this, their interest rates would have to remain low, and governments will have to relax their deflationary targets, at least for the short term while economies begin to recover from the effects of the past year and a half.

With the economy slowly emerging from the recession, Schroder’s predictions do not entirely rule out a period of sustained higher inflation, the result of the global disinflationary trend that was the economic norm prior to the pandemic. This will be sustained with high government debt levels, and as such the resulting low rate environment is bound to persist.

In the middle of a global financial crisis, and with the pandemic driving interest rates even lower, one industry that has emerged as a harbinger of financial hope for many is the DeFi industry.

As one of the only financial industries that boomed during the pandemic, decentralized finance has garnered great attention during this period, with disruptive financial technology providing an alternative to the existing financial system.

Needless to say, the effects of Covid 19 upon the economy have certainly drawn attention to the many failings of centralized finance. And with the shortcomings of centralized finance highlighted, major asset management funds have started to take DeFi very seriously.

One of the many reasons behind the explosive growth of DeFi is the increased distrust of central banks and a desire for greater financial autonomy. Despite the short-term bearish conditions that the cryptocurrency industry has seen over the past few months, the DeFi industry has maintained its upward momentum year after year.

While traditional finance provides users with negligible interest rates, which is unlikely to change in the foreseeable future, DeFi provides a global, open, alternative to the current financial system. Crucially, DeFi offers astronomical returns compared to traditional financial institutions.

Yield farming is one of the branches of DeFi that has proved to be incredibly popular among cryptocurrency investors who want exposure to their investments while earning interest at the same time. As DeFi removes middlemen from the equation, permissionless liquidity protocols allow liquidity providers to add funds to liquidity pools, and earn ‘rewards’ in return.

What this means in layman’s terms, is that you can lend your cryptocurrency to a product and see how your funds grow from the passive interest accrued. Interest rates from yield farming are considerably higher than from comparable TradFi, and even the safest, most risk-averse, yield farming avenues are designed to provide attractive interest rates for their liquidity providers.

Bumper Finance has created a price protection protocol that features single token staking, which means that liquidity providers are able to generate yield, paid by the protection taker premiums, with no risk of impermanent loss.

The Bumper community can get involved as early supporters, depositing USDC into the protocol and yield-farming BUMP tokens. It should be noted that LPs will always receive risk-free interest, regardless of what stage they participate, however the Bumper token price and the TVL are connected, with the higher the TVL, the higher the token price. In this way, it makes sense to be an early LP in order to receive the optimal passive yield.

Additionally, the funds in the pool have the capacity to be farmed out to third-party protocols, such as Yearn Finance and Uniswap, which adds an additional layer of rewards and a secondary source of yield for LPs to maximize their returns.

The protocol not only protects from downside risk but also provides users with exposure to the potential upside. And whether the market pumps, dumps, or crashes, your cryptocurrency assets will be protected against volatility.

The growth of DeFi and the technological advancements of blockchain means that there is constant innovation within this industry. Advanced trading options are constantly being developed, as is the institutional support and participation of DeFi.

While the global pandemic may have been partially responsible for the DeFi boom in 2020, the low-interest rate economy of traditional finance is drawing investors to the open financial alternative – one that is worth tens of billions of dollars and opens up financial services to just about anyone with an internet connection.

For more information on Bumper, follow them on Twitter, or speak to the team directly in their Telegram.