The dYdX decentralized exchange (DEX) announced that it successfully raised another $10 million in a Series B funding round. The process, which was spearheaded by Three Arrow Capital and DeFiance Capital, also got the support of other investment firms.

According to an official blog post from dYdX, other investors that were part of this funding round; Scalar Capital, SCP, Spartan Group, Wintermute, RockTree Capital, GSR, and Hashed.

This was the second round after a 2018 Series A round led by a16z and Polychain Capital. Notable investors included Coinbase co-founder Fred Ehrsam, Kindred Ventures, 1confirmation, and former Twitter VP Elad Gil.

dYdX Investors Come Back for More

Some participants from the first round didn’t hesitate to join in for the second phase. One such firm is Defiance Capital, whose founder, Arthur Cheong, expressed his excitement;

“Antonio and the team have built a solid foundation for dYdX as one of the earliest and most successful DeFi protocols.”

He stated that his firm has always been involved with dYdX and will continue to do so in the future.

Cheong also added;

“We have been users since the early days and are excited to back dYdX in the current round to accelerate its mission to build the most powerful decentralized trading platform for crypto assets”

The blog post stated that it would channel the newly generated funds into making its platform more decentralized. This effort will serve the purpose of further distributing control to its users.

Collaboration between significant players in the world of decentralized finance (DeFi) and centralized finance (CeFi) is also a priority for dYdX. It aims to bridge the gap between these two worlds by harnessing the best part of both.

This second round was dedicated to budding startups and firms that have attained a significant number of users. The funds generated will be used to help these platforms expand their user bases and networks.

Over the past few days, dYdX has enjoyed a significant boost in trade volume accompanied by increased volatility.

DEXs Race for Dominance

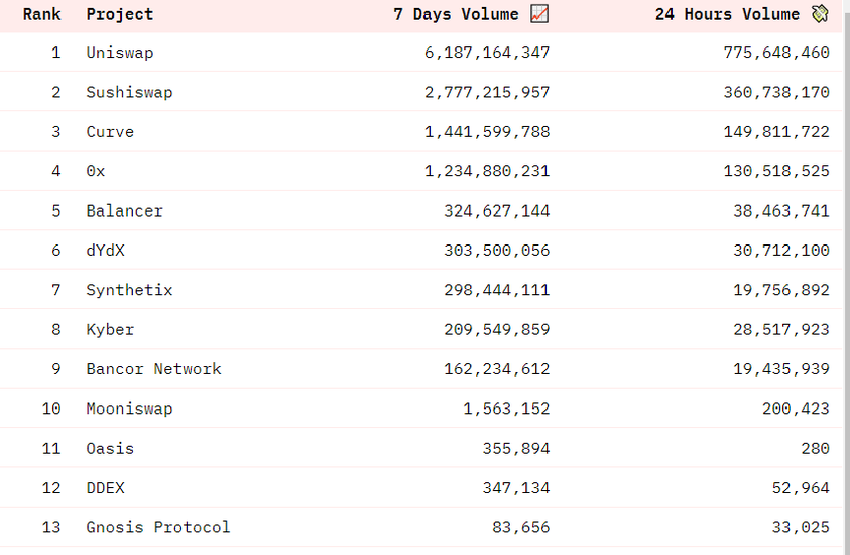

Records from statistics aggregator, Dune Analytics show that the weekly trade volume from the liquidity provider currently sits in the sixth position.

With transactions worth over 300 million in the last seven days, the platform has maintained its position over Synthetix and Kyber. Meanwhile, Uniswap and Sushiswap continue to compete for the top spot on the list.

dYdX regards this achievement as a milestone that will hopefully attract more users to its platform.