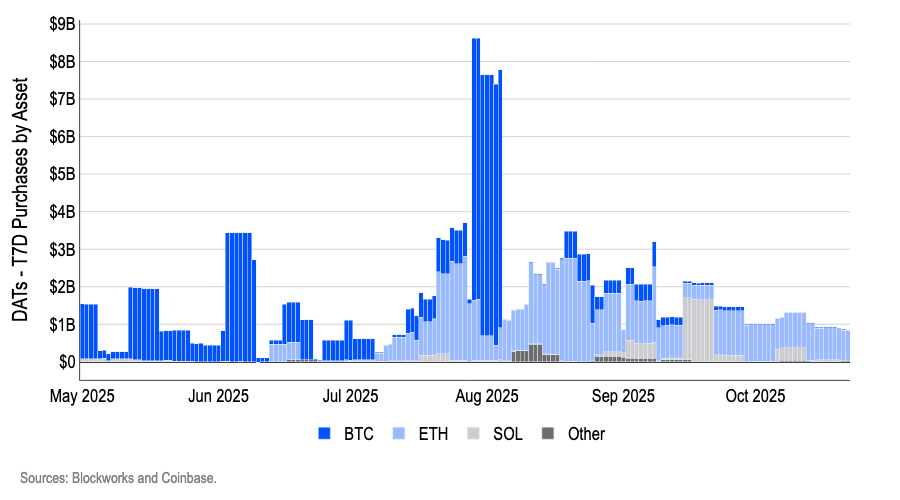

Cryptocurrency buying activity by Digital Asset Treasury (DAT) firms has plummeted since the market crash on October 10. In fact, Bitcoin purchases dropped to the lowest level seen all year, according to a top analyst.

David Duong, Head of Coinbase Research, posted the analysis on his X account on Tuesday. He started with the question, “Where are the DATs?” His data shows that most DAT purchases have been concentrated in Ethereum (ETH) in the past two weeks.

Bitcoin DAT Buying Dries Up

Duong highlighted that the area representing Bitcoin DAT purchases has virtually disappeared since October 10. The substantial buying volumes for ETH recorded in August and September set a high benchmark. Even so, despite being persistent, current ETH purchases have fallen by more than half.

Duong noted that Bitcoin DATs “are usually heavy hitters with deep pockets—the ones with the capacity to step in with size when conviction is high.” He added that their “absence for nearly two weeks signals limited confidence on their part.” DAT-led buying is often considered a critical test for confirming bullish market sentiment.

Ethereum Accumulation Centralized in One Firm

While ETH saw consistent buying after the decline, Duong explained that this purchasing power was highly concentrated in a single entity: Bitmine Immersion Technologies (BMNR), the largest ETH DAT firm by market capitalization.

On Monday, BMNR consolidated its position by adding 77,055 ETH, bringing its total holdings to over 3.31 million ETH. This immense reserve now accounts for approximately 2.8% of the total ETH supply, pushing Bitmine’s digital assets and cash holdings past $14.2 billion.

Duong noted that the recent total ETH DAT net buying remains positive. However, the analysis reveals that this single institution (BMNR) drives almost all net purchases. This concentration raises concerns that overall corporate buying momentum could falter significantly if BMNR’s purchasing pace slows or stops.

Analyst Recommends Caution

Duong attributed the lack of DAT buying in BTC to the cautious approach of large investors, following the dramatic leverage flush after the October 10 crash. Consequently, this event has left major players defensive, anticipating the potential for further market declines.

“We think this warrants more cautious positioning in the short term, because the market appears more fragile when the biggest discretionary balance sheets are sidelined.”