The crypto market has experienced a modest correction, with several major coins witnessing small declines amid a broader bull run.

This dip comes amid significant whale activity, revealing divergent strategies among the crypto market’s largest players.

Crypto Whales Play Both Sides: Accumulating and Selling

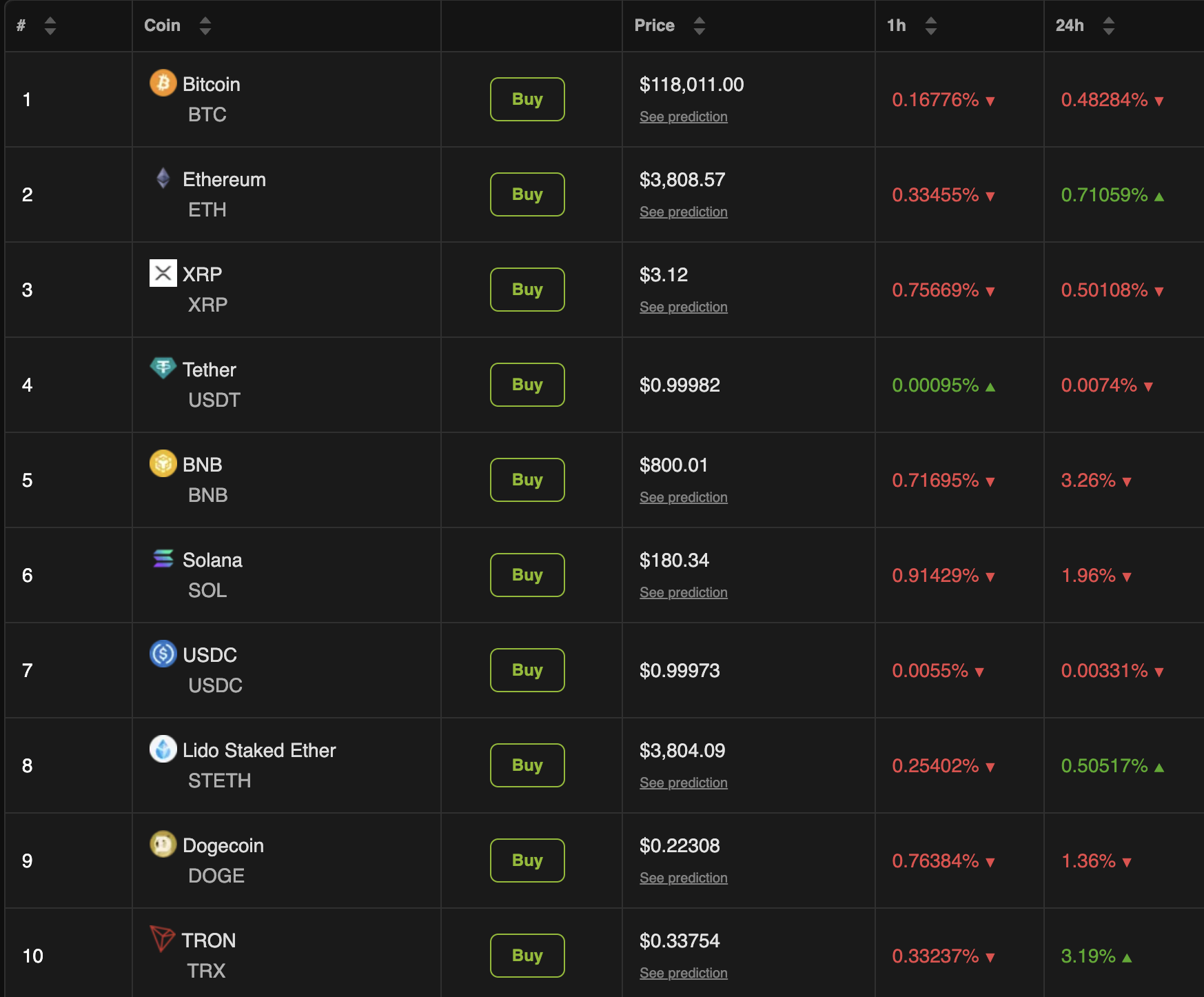

BeInCrypto Markets data revealed that over the past 24 hours, the broader crypto market has dropped 3.83%. Furthermore, 7 of the top 10 cryptocurrencies are in the red.

Bitcoin (BTC), the flagship crypto, dipped 0.48% over the past day. Ethereum (ETH), Lido Staked Ether (STETH), and TRON (TRX) bucked the trend, with the latter posting the highest gains of 3.19%.

Meanwhile, (Micro) Strategy has bought the dip. The firm announced the acquisition of 21,021 BTC, valued at approximately $2.46 billion. The average purchase price was $117,256 per coin.

This purchase, funded through a $2.5 billion initial public offering of Variable Rate Series A Perpetual Preferred Stock (STRC), increases the company’s total holdings to 628,791 BTC. The firm is now sitting at an unrealized profit of $28.18 billion.

“With approximately $2.521 billion of gross proceeds, this is the largest US IPO completed in 2025 to date based on gross proceeds and the largest U.S. exchange-listed perpetual preferred stock offering in the U.S. since 2009,” the firm added.

Furthermore, its year-to-date BTC yield stands at 25%. This acquisition aligns with the company’s pattern of leveraging equity and debt to bolster its BTC reserves, a strategy that has positioned it as a leading institutional holder.

Besides Strategy, Lookonchain highlighted that Anchorage Digital, a digital asset platform and infrastructure provider, has also increased its Bitcoin exposure.

“Anchorage Digital has accumulated 10,141 BTC($1.19 billion) from multiple wallets over the past 9 hours,” Lookonchain posted.

In contrast, a previously dormant investor’s activities indicated a more profit-oriented approach. Lookonchain reported that after 12 years of dormancy, a Bitcoin holder transferred out 343 BTC, worth $40.52 million. Of this, the ‘Bitcoin OG’ deposited 130.77 BTC, valued at $15.45 million, to Kraken.

“This OG received 343 BTC (around $29,600 at the time) 12 years ago, when the BTC price was $86. That’s a 1,368x return!,” the blockchain analytics firm revealed.

This small transfer follows one of the largest Bitcoin transactions ever executed in the cryptocurrency’s history. BeInCrypto reported that Galaxy Digital sold over 80,000 Bitcoin, worth more than $9 billion, on behalf of a long-term investor.

Ethereum’s market has similarly seen contrasting whale behaviors. A new wallet (0x3dF3) accumulated 12,000 ETH worth over $45 million through Galaxy Digital.

“Since July 9, a total of 9 fresh wallets have accumulated 640,646 ETH ($2.43 billion),” Lookonchain wrote.

However, this accumulation is offset by sell-offs. An on-chain analyst noted that Galaxy Digital deposited 5,000 ETH worth $19.28 million into Coinbase, and Cumberland also transferred 10,592 ETH worth approximately $40.79 million to the same exchange.

Moreover, Fidelity also followed the same path and sent 12,981 ETH valued at around $49.7 million to Coinbase.

“The institutional address suspected to be HashKey Capital transferred 12,000 ETH to OKX the day before yesterday, and then withdrew 46.16 million USDT from OKX yesterday. In other words, those 12,000 ETH have been sold at a price of $3,847,” analyst EmberCN added.

Thus, the crypto whales’ divergent strategies—accumulation versus liquidation—illustrate varying risk appetites and outlooks in the market.