When I was a child, my parents went out of their way to teach me the importance of getting a good education, finding a well-paying job, and being independent. However, the concept of financial literacy was foreign to us. The closest my family came to investing was having several bank deposits, with the annual return barely covering inflation.

Being a true Gen-Zer, it wasn’t until 2017 and the first crypto boom that I learned about Bitcoin. At that time, social media was teeming with stories about people making big money on crypto, so I was very intrigued, to say the least. Luckily, I was spared the shame of losing money on memecoins — I was never much of a “risk” person, so I only bought a little bit of Bitcoin to dip my toes in the water.

Since crypto didn’t make me rich, the question remained: how do I achieve financial freedom without having to work until death? Without any family money at my disposal to start a business or invest in buy-to-let properties, I revisited the concept of investing more thoroughly.

The first thing I learned is that this is a complex market. There are numerous investment options and tools, making it nearly impossible for beginners to get a grasp.

The second thing I learned is that there was a lot of misinformation. Numerous platforms offered sky-high returns for buying into crypto, futures, start-ups, etc., with the majority being straight-up scams.

Almost 10 years later, equipped with a career in finance, I still don’t know how to become a millionaire through investing, and I wouldn’t dare give you any financial advice. Instead, in this article, I want to explain the basics of the most popular investment options so that you can choose the option that fits your needs best and explore it in the future.

By the time you’re done reading, you’ll be equipped with:

- A brief history of investing

- The pros and cons of investing in crypto, stocks, indices, and commodities

- A comparison of top investment options by historical price and ROI

The History of Investing — How Did It All Begin?

Although the average person probably associates “investing” with an online brokerage platform used to purchase stocks, bonds, crypto, and so on, the concept of investing dates back more than 400 years.

Setting the Stage in 17th Century Europe

In the 1600s, the European shipping industry was booming. British, Dutch, and French vessels made regular commercial trips to the East Indies and Asia, bringing back valuable goods such as spices and silk. Although the demand for these products was high, the shipping process was very challenging.

Considering the costs and risks of a trip were too great for the ship owners to handle on their own, they began attracting investors for funding. In return, investors would receive a share of the profits if the voyage succeeded. To further minimise risk, investors often diversified their investments across multiple voyages.

Not long after, shipping companies emerged, making it possible for investors to buy the first stocks and leverage all the voyages a company undertook. At this point, these stocks came in the form of physical sheets of paper that could be bought and sold.

- 1602 — The Amsterdam stock exchange was founded, the first in the world.

- 1792 — Twenty-four New York City stockbrokers and merchants signed the Buttonwood Agreement, founding the NYSE.

- 1801 — London’s first regulated stock exchange was established.

- 1800s — The American Stock Exchange (AMEX) got its start, known as the “Curb Exchange.”

Entering the Technology Era

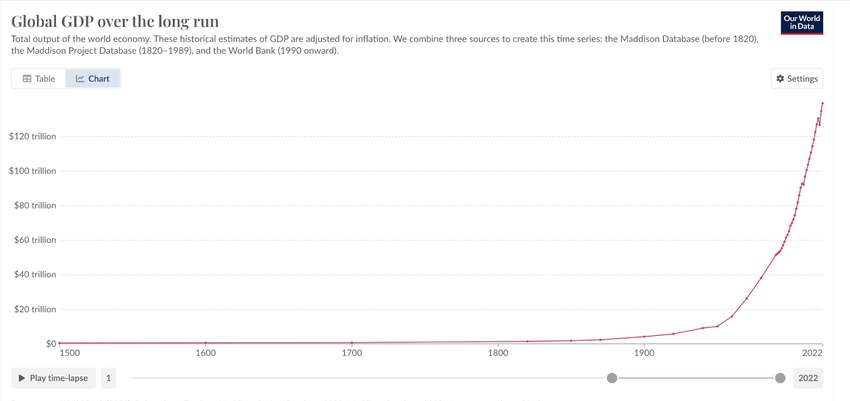

The real development of the investment markets and exchanges began in the second half of the 20th century with global digitalisation. As the chart below indicates, the global GDP skyrocketed in the 2000s, proving a significant impact of technology adoption on the economy growth.

- 1971 — Nasdaq, the pioneering electronic stock market, began its operations. At first, it only offered a “quotation system” without the ability to conduct electronic trades.

- 1992 — E*Trade, one of the world’s first online brokers, was launched, allowing anyone with a computer or phone access to trade.

The 2010s kicked off with technology advancing at an astonishing pace. By 2010, the market penetration rate of smartphones reached 27%, paving the way for a new era of mobile investing. Mobile applications and robo advisors (modern trading bots) flourished, providing consumers with lower fees, smart automation, and greater flexibility.

Top Investments in 2024

Considering there are hundreds of investment options today, it would be practically impossible to evaluate and compare them all. As such, I’ve chosen three of the most widely adopted investment markets and evaluated them in comparison with cryptocurrencies: commodities, stocks, and index funds.

Stocks

What is a stock?

A stock represents partial ownership in a company, entitling investors to a portion of its earnings and assets. Stakeholders, also known as company investors, can be described as co-owners of the company. The stock’s value fluctuates with the business’s performance, increasing or decreasing accordingly.

What companies can you invest in?

You can buy the stocks of any company that has passed an IPO (Initial Public Offering) and, in the process of doing so, launched an exchange-traded stock. Popular options include:

- Apple (AAPL)

- Microsoft (MSFT)

- NVIDIA (NVDA)

- Google (GOOG, GOOGL)

- Amazon (AMZN)

Where can you buy stocks?

Today, you can easily buy stocks online via specialised brokerages. You’ll typically need to provide some personal information, such as your ID and bank statements.

Commodities

What is a commodity?

A commodity is a basic good, usually a resource, used in commerce. Commodities are most often raw materials used to manufacture consumer products.

What commodities can you invest in?

The most traded commodities can be divided into three main categories:

- Energy commodities: oil, gas

- Precious metals: gold, silver

- Agricultural or soft commodities: wheat, coffee, sugar

- Metal commodities: nickel, zinc, aluminium, copper

Where can you buy commodities?

- Precious metals can be purchased and stored physically in bullions, with standard size and purity. However, this option comes with security and storage concerns.

- Energy, agricultural, or soft commodities: The easiest way to invest in these commodities is to purchase shares and stocks of companies that trade them.

Index Funds

What is a stock market index?

A stock index is a collection of shares that indicate the performance of a sector, exchange, or economy. Typically, it includes a fixed number of top shares from a particular exchange.

While a stock index itself has no intrinsic value, it tracks several stocks and moves in points, reflecting the prices of its underlying assets. Some indices give equal weight to all their stocks, while others prioritize larger stocks.

What is the difference between stocks and indices?

A stock allows you to get part ownership in a single specific company. An index fund, on the other hand, is a collection of assets that typically includes shares from various companies, along with bonds and other types of investments.

Where can you buy indices?

Similar to the process of purchasing stocks, you can buy indices online via brokerage platforms.

Cryptocurrencies

What is a cryptocurrency?

A cryptocurrency is a form of digital asset based on blockchain technology. Although most people associate crypto with Bitcoin and Ethereum, at the time of writing, the cryptocurrency market consists of over 10,000 assets and has a market cap of over $2.4 trillion.

Where can you buy cryptocurrencies?

Digital assets can be purchased using online crypto exchanges. However, be mindful to choose a reliable platform that operates legally and has a proven track record to avoid getting scammed.

Investing in Сrypto vs Traditional Finance

Now, let’s move on to a practical comparison – a practical comparison between crypto and traditional investment options — stocks, indices, and commodities. We’ll not only see the dynamics of each of these assets over the last 3-5 years but also compare their profitability.

Crypto vs. Stocks

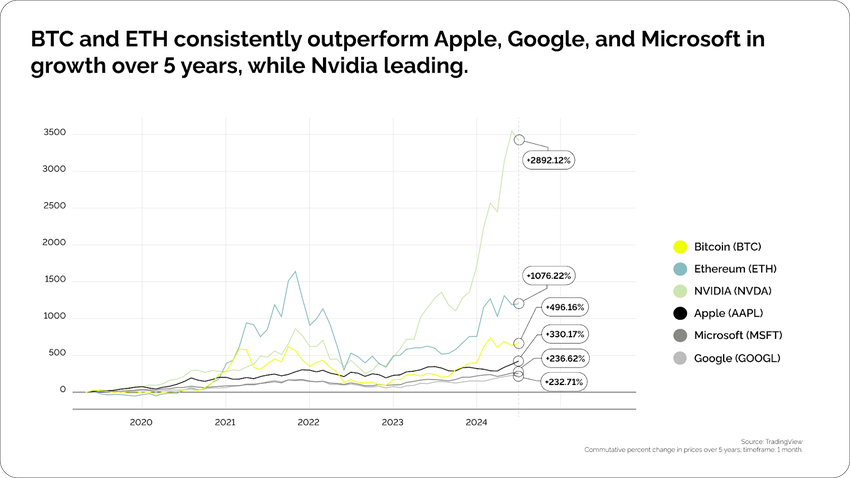

Let’s compare the historical prices and profitability of the two most popular cryptocurrencies, Bitcoin and Ethereum, with stocks of four giants: NVIDIA, Microsoft, Apple, and Google.

Comparing Price Dynamics

| Since 2024 (1.01.24–1.07.24) | Since 2022 (1.01.22–1.07.24) | Last 5 years (1.07.2019 –1.07.2024) | |

| BTC | +42.26% | +31.67% | +496.16% |

| ETH | +46.25% | -8.69% | +1076.22% |

| NVDA | +158.06% | +312.67% | +2892.12% |

| MSFT | +23.15% | +36.44% | +236.62% |

| AAPL | +16.76% | +19.09% | +330.17% |

| GOOGL | + | +232.71% |

*The main difference between the GOOG and GOOGL stock ticker symbols is that GOOG shares have no voting rights, while GOOGL shares do.

Source: TradingView

Insights:

- BTC and ETH showed more significant growth over the past 5 years compared to Apple, Google, and Microsoft.

- NVIDIA is the undisputed leader and has surpassed both cryptocurrencies and other stocks in price increase over the past 5 years.

- All investment options show positive price dynamics long-term despite market downturns.

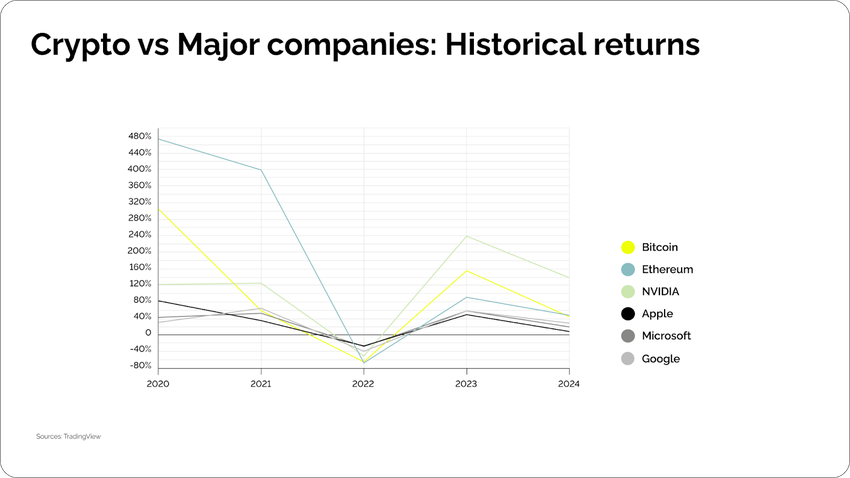

Comparing Profitability

| 2020 | 2021 | 2022 | 2023 | 2024 | Sortino ratio | |

| BTC | 304.45 | 59.4 | -64.24 | 155.68 | 44.47 | 3.94 |

| ETH | 473.21 | 398.52 | -67.5 | 91.04 | 47.52 | 3.65 |

| MSFT | 42.53 | 52.48 | -28.02 | 58.19 | 19.48 | 2.34 |

| NVDA | 122.3 | 125.48 | -50.28 | 239.02 | 138.52 | 4.58 |

| AAPL | 82.31 | 34.65 | -26.4 | 49.01 | 8.39 | 0.99 |

| GOOGL | 31.03 | 65.17 | -38.67 | 58.83 | 29.23 | 2.39 |

Source: TradingView

*Comparison of risk-adjusted performance of crypto vs traditional markets assets in terms of Sortino Ratio. The Sortino ratio is used to determine the risk-adjusted return on investment. It is a refinement of the Sharpe ratio but only penalises the returns, which have downside risks. The higher Sortino ratio, the better risk adjusted returns are. Sortino ≥2 – good, = 0-1 – satisfactory; ≤0 – unmitigated risk.

Insights:

- NVIDIA leads in terms of risk-adjusted return with the highest Sortino ratio of 4.58.

- BTC and ETH occupy the 2nd and 3rd places, with Sortino ratios of 3.6-3.9.

- Apple stock is the least preferable asset in terms of risk-adjusted performance.

Insights:

- All investment options experienced a significant decrease in profitability in 2022, with further partial recovery in 2023-2024.

- Crypto tends to fluctuate more compared to the most popular stocks.

- NVIDIA remains the most profitable company for its shareholders.

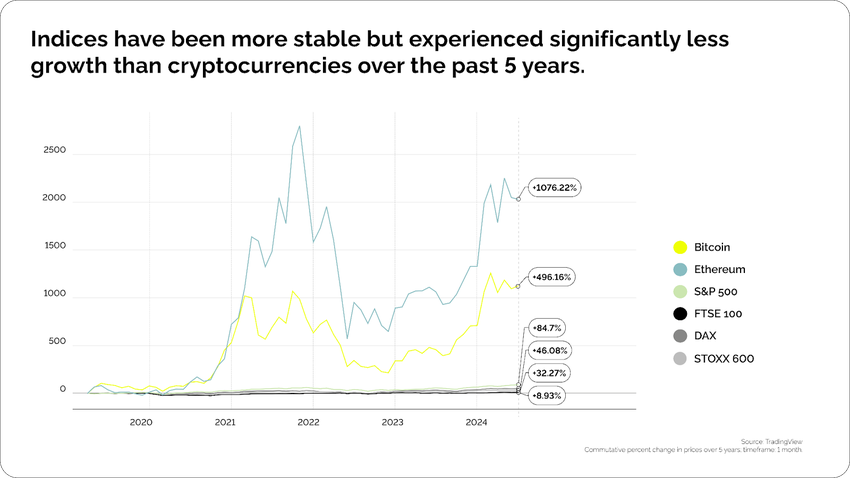

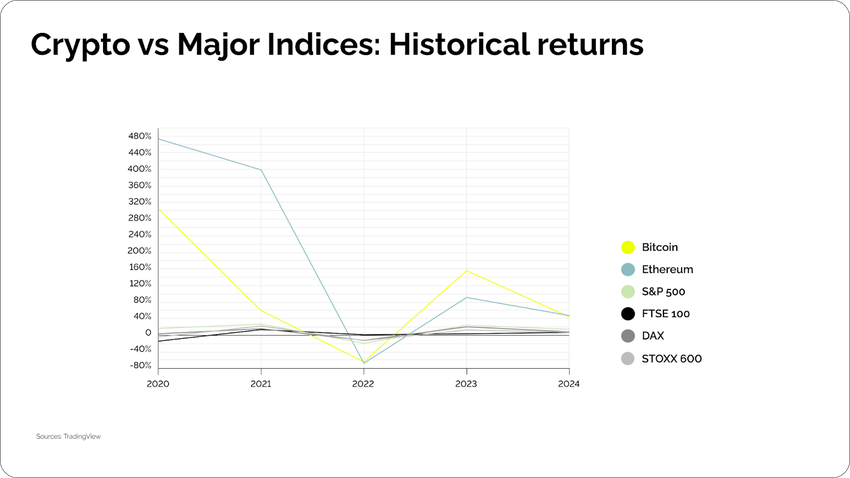

Crypto vs. Indices

Now, let’s compare the historical prices and profitability of Bitcoin and Ethereum with four popular indices:

- S&P 500: Measures the stock performance of 500 large companies listed on stock exchanges in the United States.

- UKX – FTSE 100: An index of the 100 companies listed on the London Stock Exchange with the highest market capitalization.

- STOXX 600: A stock index representing 600 publicly traded companies based in European countries.

- DAX: German Stock Index, consisting of 30 major German blue-chip companies.

Comparing Price Dynamics

| Since 2024 (1.01.24–1.07.24) | Since 2022 (1.01.22–1.07.24) | Last 5 years (1.07.2019 –1.07.2024) | |

| BTC | +42.26% | +31.67% | +496.16% |

| ETH | +46.25% | -8.69% | +1076.22% |

| S&P 500 | +15.44% | +14.15% | +84.7% |

| UKX | +5.77% | +8.82% | +8.93% |

| SXXP | +7.22% | +4.71% | +32.27% |

| DAX | +9.07% | +14.17% | +46.08% |

Source: TradingView

Insights:

- All assets experienced a price decline in 2022, having mostly recovered by May 2024.

- ETH is the best-performing asset in this comparison group and has increased in price twice as much as BTC.

- Although indices show significantly less growth over the past 5 years compared to crypto, their prices are more stable and less prone to fluctuations.

Comparing Profitability

| 2020 | 2021 | 2022 | 2023 | 2024 | |

| BTC | 304.45 | 59.4 | -64.24 | 155.68 | 44.47 |

| ETH | 473.21 | 398.52 | -67.5 | 91.04 | 47.52 |

| S&P 500 | 16.26 | 26.89 | -19.44 | 24.23 | 14.22 |

| FTSE | -14.21 | 13.58 | 1.3 | 3.55 | 6.88 |

| DAX | 3.55 | 15.79 | -12.35 | 20.31 | 8.36 |

| SXXP | -4.04 | 22.25 | -12.91 | 12.76 | 7.29 |

Year-over-year returns; crypto vs major indices

Source: TradingView

Source: TradingView

Insights:

- ETH is the most profitable asset from 2020 to 2024.

- All assets tend to experience fluctuations in profitability that correlate with global economic trends.

- Indices have generally lower profitability compared to cryptocurrencies.

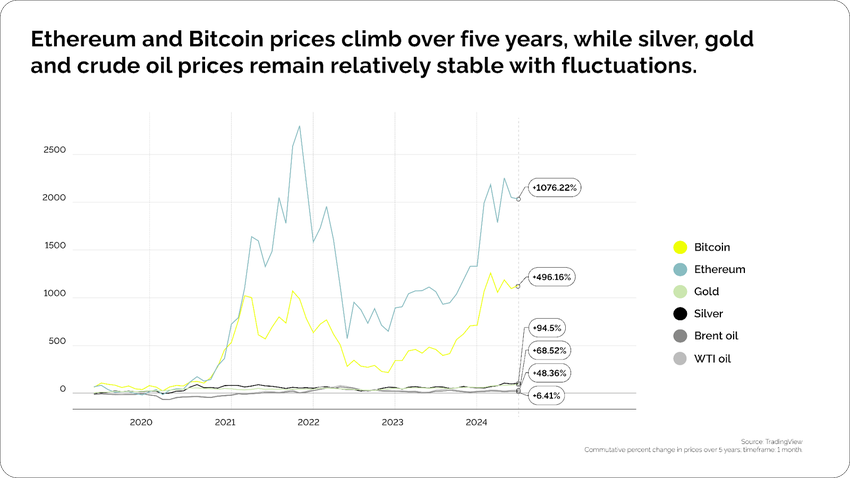

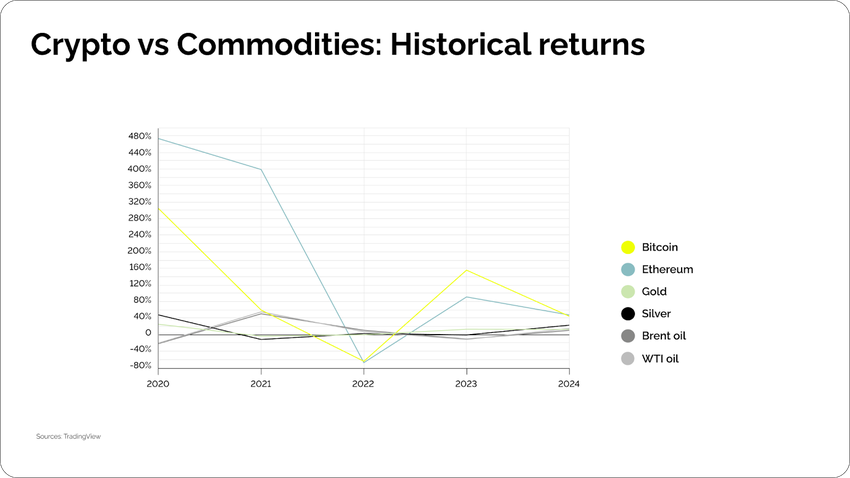

Crypto vs. Commodities

Lastly, we arrive at the final comparison group: crypto vs. major commodities. As you have probably guessed, this section will also feature BTC and ETH as cryptocurrencies, as well as the most traded commodities:

- Gold

- Silver

- BRENT (oil, UK)

- WTI (oil, USA)

Comparing Price Dynamics

| Since 2024 (1.01.24–1.07.24) | Since 2022 (1.01.22–1.07.24) | Last 5 years (1.07.2019 –1.07.2024) | |

| BTC | +42.26% | +31.67% | +496.16% |

| ETH | +46.25% | -8.69% | +1076.22% |

| GOLD | +13.23% | +29.42% | +68.52% |

| SILVER | +24.48% | +28.58% | +94.50% |

| BRENT | +18.78 | +9.58% | +48.36% |

| WTI | +13.77% | +8.67% | +6.41% |

Source: TradingView

Insights:

- Cryptocurrencies, ETH and BTC, are growing in price much faster than all commodities.

- Prices of silver, gold, and oil tend to remain more stable, although they experience occasional ups and downs.

Comparing Profitability

| 2020 | 2021 | 2022 | 2023 | 2024 | Sortino ratio | |

| BTC | 304.45 | 59.4 | -64.24 | 155.68 | 44.47 | 3.94 |

| ETH | 473.21 | 398.52 | -67.5 | 91.04 | 47.52 | 3.65 |

| Gold | 25.08 | -3.65 | -0.29 | 13.05 | 12.67 | 2.32 |

| Silver | 47.65 | -11.65 | 2.71 | -0.68 | 22.86 | 1.49 |

| BRENT | -21.68 | 50.35 | 10.56 | -10.6 | 10.45 | 0.23 |

| WTI | -20.42 | 55 | 7.16 | -11.59 | 14.77 | 0.26 |

Source: TradingView

Insights:

- In 2022, commodities mostly had positive returns compared to cryptocurrencies.

- In 2023-2024, BTC and ETH lead in profitability based on the Sortino ratio.

- Oil tends to be the least profitable asset in this group.

So, What Is a Better Investment: Crypto or Traditional Assets?

That is a question only you can answer for yourself. As mentioned, there are no shortcuts or guaranteed paths to becoming a millionaire.

First of all, I highly advise you not to trust investment advice you find online without extensive research. Each asset has its pros and cons, and your choice should depend on your personal financial situation and goals.

In this article, I aimed to provide you with the basic information and knowledge needed to compare cryptocurrency with traditional investments, enabling you to conduct further research with a clearer understanding than a simple Google search would offer.

Let’s Recap!

| DeFi (Crypto) | TradFi (stocks, indices, commodities) | |

| Profitability | High | Low-moderate |

| Risks | High | Moderate |

| Regulation | Under regulated | Regulated |

| Value | No intrinsic value | Intrinsic value |

| Accessibility | High | Moderate-low |

- All forms of investing come with risks and should be handled with knowledge and caution.

- TradFi is generally associated with stability and moderate returns, while crypto offers higher profitability with more volatility and legal risks.

- Examined crypto (BTC and ETH) tend to grow faster in price and show better profitability compared to stocks, commodities, and indices.

- Stocks, indices, and commodities are considered more stable investments, as they are not as susceptible to price fluctuations as digital currencies.

About Author:

Susanna Bondarenko, Content Marketing Lead at CoinsPaid, has been creating and managing content since Bitcoin’s price was in triple digits. One of the leading voices in the crypto industry, Susanna has been included in the 2023 Rising Women in Crypto Power List. Her blend of finance knowledge and a background in English and German philology helps her break down complex crypto concepts for everyone to understand.