Investment in artificial intelligence (AI) within the crypto space surged dramatically in the past quarter, accompanied by a significant uptick in investor interest this month.

Hence, it appears that the crypto venture capitalists (VCs) might be betting big on the AI narrative for the next cycle.

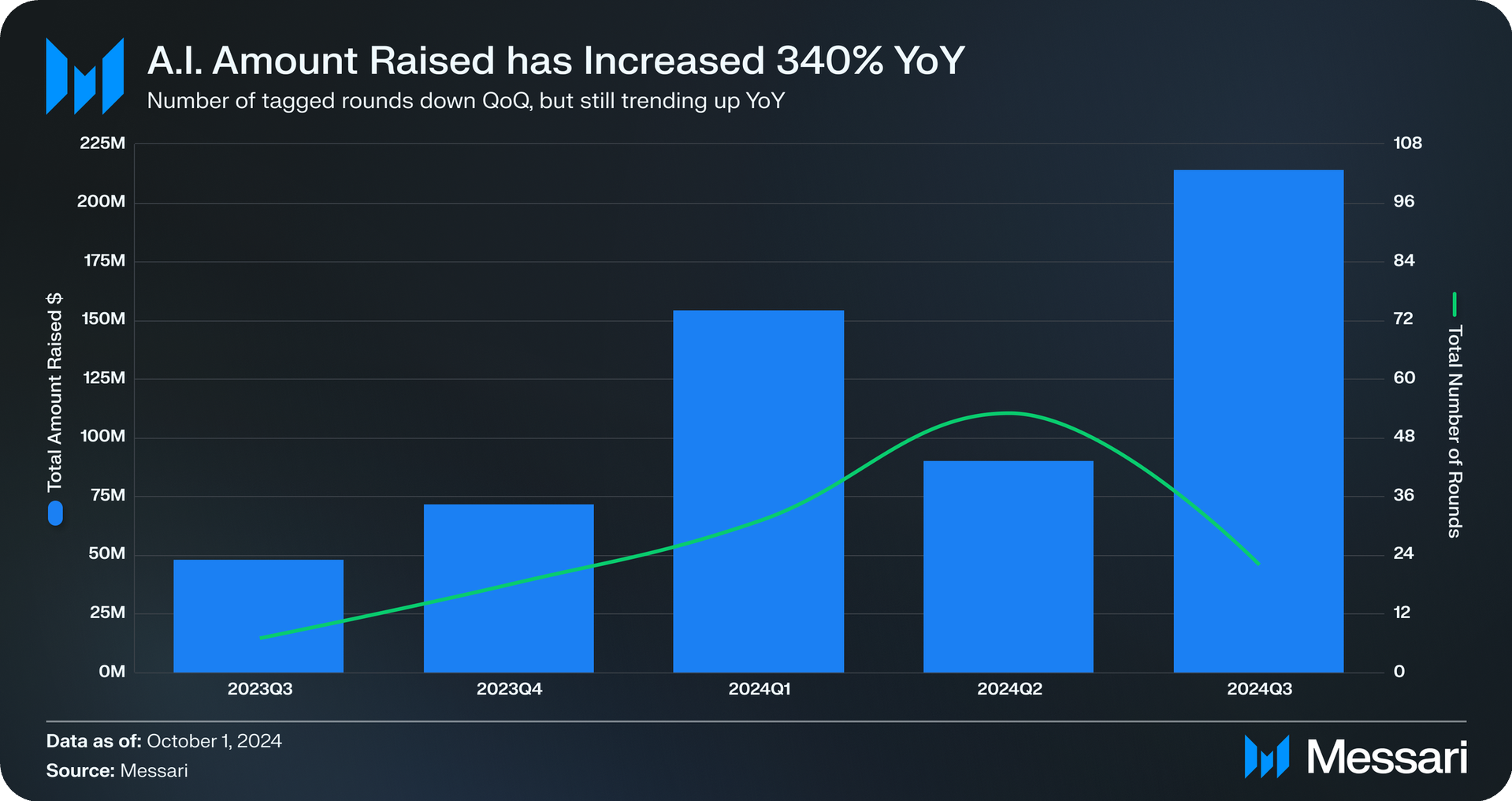

Crypto VCs Invest Over $213 Million in AI During Q3

A recent report from Messari revealed that VCs poured over $213 million into AI-related projects last quarter. This figure marks a 340% increase year-over-year and a 2.5x jump from the Q2.

Read more: How To Invest in Artificial Intelligence (AI) Cryptocurrencies?

According to Messari, in addition to projects focused on leveraging AI for decentralized platforms, many AI initiatives have entered various market sectors. These projects now combine AI with social networks, DeFi, and DePin, among others. Moreover, a recent report indicated that AI tokens have the potential to outperform meme coins.

“While overall venture funding in Q3 2024, totaling $3.8 billion, represented a slight dip compared to previous quarters. The strong focus on AI and DePIN suggests that venture capitalists are positioning themselves for long-term growth in sectors they believe will define the next phase of the crypto industry,” Messari commented.

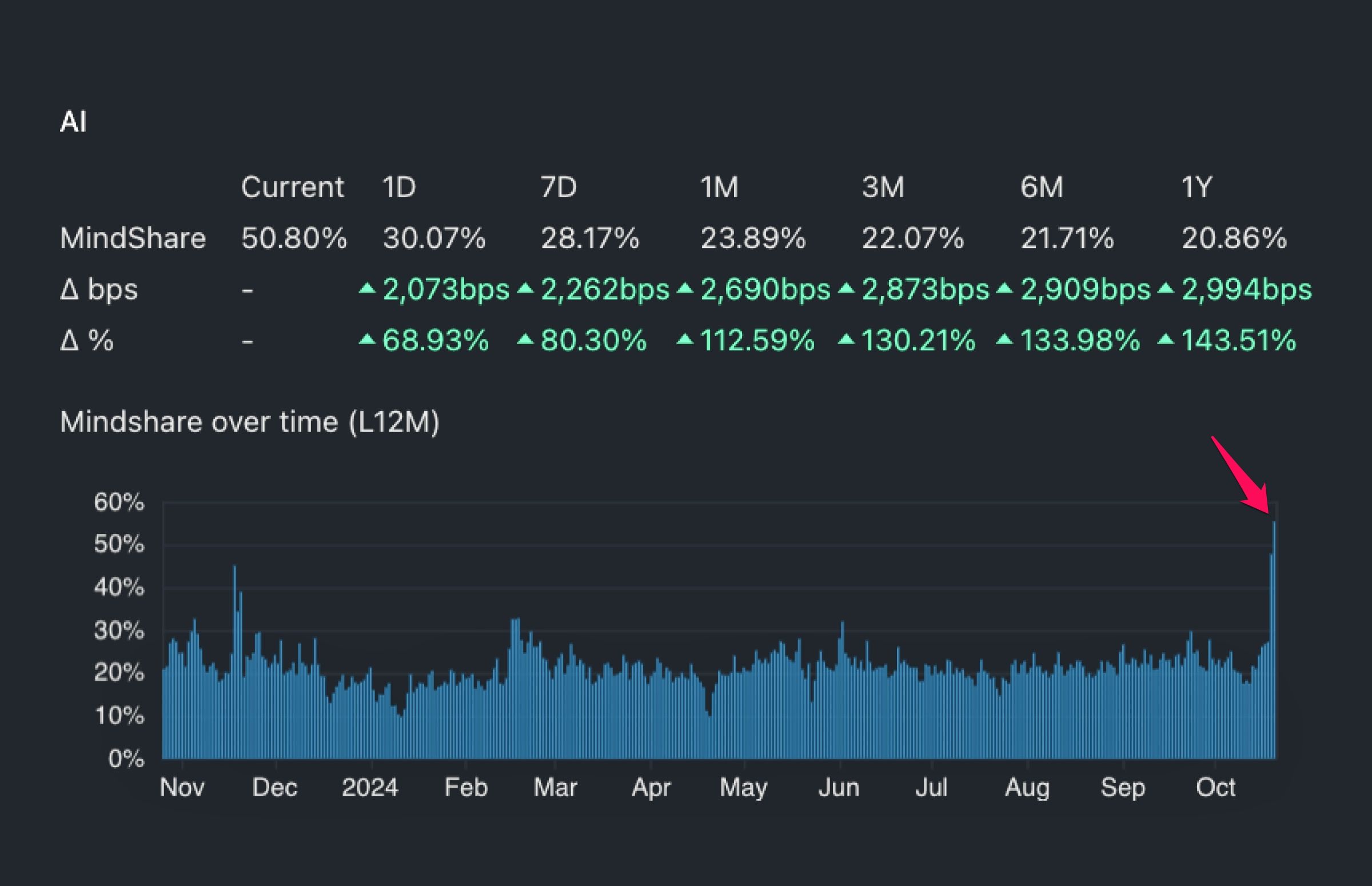

Investor Interest in AI Rises in October

Data from Kaito shows that AI-themed discussions reached a new high in October, with mindshare surpassing 50%. This metric tracks the level of community discussions on a specific topic, and the higher the percentage, the greater the investor interest.

Moreover, the rising interest in AI parallels the resurgence of Nvidia’s (NVDA) stock price to record highs. Last week Nvidia’s market capitalization hit an all-time high of $3.41 trillion, making it the second-largest company globally by market cap.

According to The Kobeissi Letter, Nvidia’s stock has skyrocketed by 190% year-to-date, making it the second-best-performing company in the S&P 500.

This data highlights the correlation between Nvidia’s stock and the growing interest in AI within the crypto market. As such, Nvidia’s upcoming earnings report in November could impact AI token prices.

Read more: Top 9 Artificial Intelligence (AI) Cryptocurrencies in 2024

At the time of writing, the market cap for AI tokens stands at $36.7 billion, a 100% increase from its August low. According to CoinMarketCap, the daily trading volume for AI tokens has reached $1.7 billion.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.