Crypto is becoming more widely adopted. But who are the newbies and why are they onboarding now?

Cryptocurrency uptake is accelerating. The onboarding process has recently been put under the microscope by the consumer insights platform, DISQO. They conducted a study about how people are using new online financial services and cryptocurrency.

Here’s how newbies have been reacting to financial sector disruptors:

1. Peak engagement with cryptocurrency and new service providers is driven by self-confidence. It is then fueled by sentiment amplified in the news and social media

2. Consumers at all income levels visit cryptocurrency exchanges at similar rates

3. All incomes and ages are open to experimenting with new investments.

Carl Van Ostrand is VP of Data Solutions for DISQO. “Consumers are at different stages of consideration and adoption of cryptocurrencies and new financial services. So we wanted to dig deeper to aid our clients’ understanding of these important behavioral changes. We explored the behaviors, demographics, and attitudinal dimensions of today’s cryptocurrency exchange visitors to learn who is driving digital transformation in finance.”

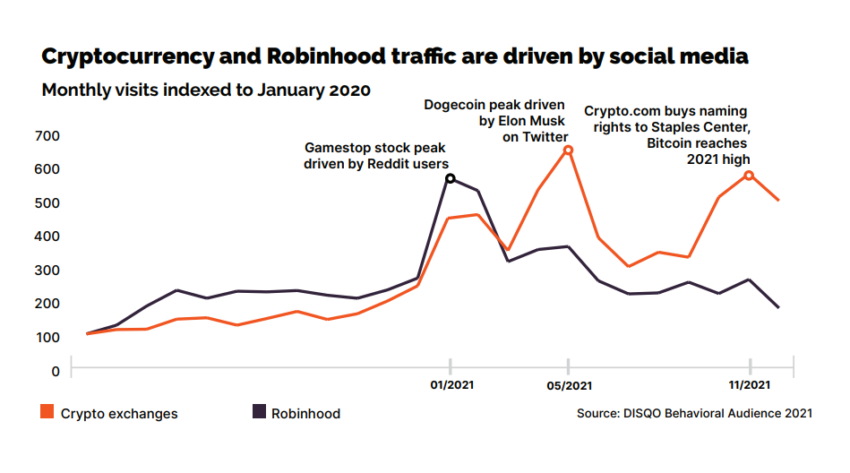

Social media and news drive behavior

Visits to crypto exchanges in the study were driven by stories appearing in the news and on social media. The Gamestop story drove newbies to crypto sites in 2021, Elon Musk tweeting about dogecoin also had the same effect. Crypto.com securing naming rights to the Staples Center in Los Angeles was also another massive driver.

Crypto: Confidence and risk aversion

People who visited cryptocurrency exchanges were asked about their risk tolerance when it came to personal finance. People who purchased cryptocurrency were more confident in managing their personal finances (72% vs 63%). They were more open to high-risk / high-reward investments vs non-buyers (44% vs 23%).

Gender, age, income

The study found that newer financial services are attracting way more men than women. But, the good news is that there was little difference in their incomes.

Traditional stockbroker sites saw a steady rise of visits from people in higher income brackets. The gap between women and men was less pronounced – only a few percentage points (22% vs 29%).

Crypto platforms were most likely to be visited by 35-44 year-olds, while the traditional investment firms kept their older crowd, and retained people well over the age of 65.

Van Ostrand said, “By connecting what people think, with what they do online, we can challenge the notion that new financial services and currencies are only for the young or wealthy. For financial institutions and brands in general, our findings suggest leaning into more tech-friendly and innovative approaches over the long term.”

Disqo says that despite the hype, they found evidence that both cryptocurrencies and new financial services meet real underlying needs. “This is particularly among younger investors who may be looking for new ways to think about managing their personal finances. They may feel underserved by traditional financial services firms.”

Got something to say about crypto uptake or anything else? Write to us or join the discussion in our Telegram channel.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.