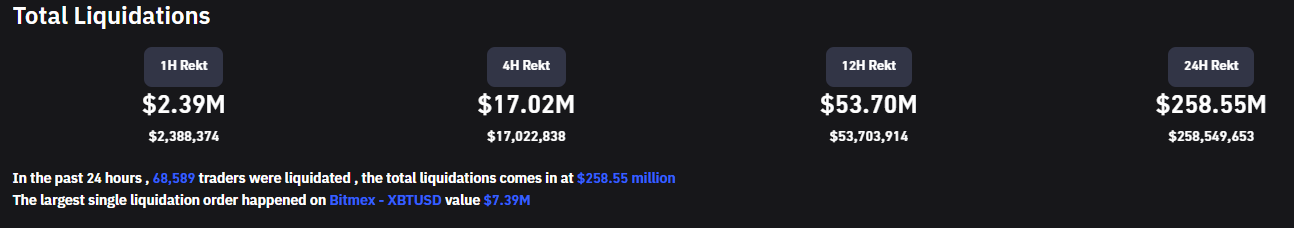

Crypto traders had a whirlwind day after nearly 68,000 positions got liquidated in the past 24 hours. Total crypto liquidations surpassed the $257 million mark.

The news comes amid a rate hike by the U.S. Federal Reserve and the SEC’s regulatory action against crypto businesses.

Coinglass data revealed that liquidations on Bitcoin, Ethereum, and XRP dominated the trend in the period.

BTC Crypto Liquidations Surpass $130M

Total liquidations on Bitcoin stood close to $132 million, while Ethereum traders lost $51 million at press time based on market value. Around $8 million in liquidations were from XRP positions.

Coinglass notes that the largest single liquidation order worth $7.39 million was carried out on Bitmex.

The figures come after U.S. Fed hiked the interest rate by 25 basis points. Several analysts believed the apex bank could pause its monetary policy tightening amid turmoil in the banking sector. But with consumer inflation moderating at 6.0% YoY, per the last government data, the Federal Reserve did not pivot.

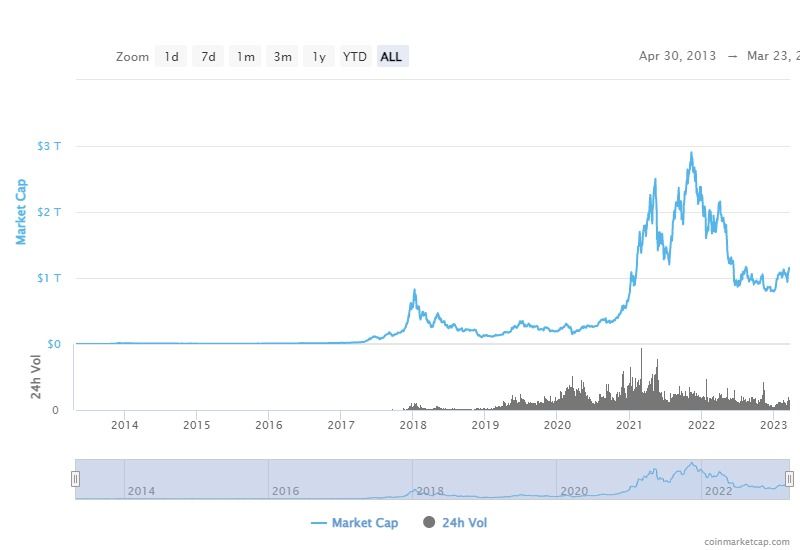

Meanwhile, the global cryptocurrency market cap has decreased by 2% over the past 24 hours. However, the cumulative capitalization is still above the $1 trillion mark. Bitcoin has also lost value in the same range but remains afloat at over $27,000 at a several-month high.

Digital Asset Fund Flows Weekly Report by CoinShares also recorded outflows for six consecutive weeks. Based on the report published on March 20, digital assets saw withdrawals close to $500 million in the period. Bitcoin led the trend with outflows of $113 million in the last week.

According to CoinShares, the outflow is caused by the need for liquidity during this banking crisis more than a negative outlook. It mentions that a comparable scenario was observed when the COVID panic first broke out in March 2020.

Regulators Pull up Crypto Businesses, Influencers

Large liquidations also come amid tight action by the securities regulator. The U.S. Securities and Exchange Commission recently sued crypto mogul Justin Sun, the TRON Foundation, BitTorrent Foundation, Rainberry Inc, Austin Mahone, and Deandre Cortex Way for selling unregistered securities.

Meanwhile, several celebrities are also part of securities violation charges. Eight celebrities, including Lindsay Lohan and Jake Paul, are held for promoting illegal crypto-based products, a release by the agency confirmed.

The SEC has also issued a Wells Notice against the largest U.S. crypto exchange, Coinbase. The securities regulator brought an enforcement action against Coinbase Global Inc for some of the products it offers.

That said, there is a positive outlook among many in the industry. Ark Invest’s Cathie Wood told Bloomberg that Bitcoin’s resilience amid the banking crisis could make way for institutional investors back into the system.

She noted,

“The fact that Bitcoin moved in a very different way from the equity markets in particular was quite instructive. We do believe that the behavior of the price through this crisis is going to attract more institutions.”