Bitcoin and crypto mixers have seen an uptick in usage this year as cybercriminals and sanctioned entities seek avenues to hide their ill-gotten gains.

Cryptocurrency sent through mixing services has surged to its highest ever levels according to a July 14 report by blockchain analysis firm Chainalysis.

Mixers have got a bad reputation as they have become the method of choice for cybercriminals and rogue states to launder digital assets. Chainalysis reported that almost 10% of all funds sent from illicit crypto addresses are sent to mixers.

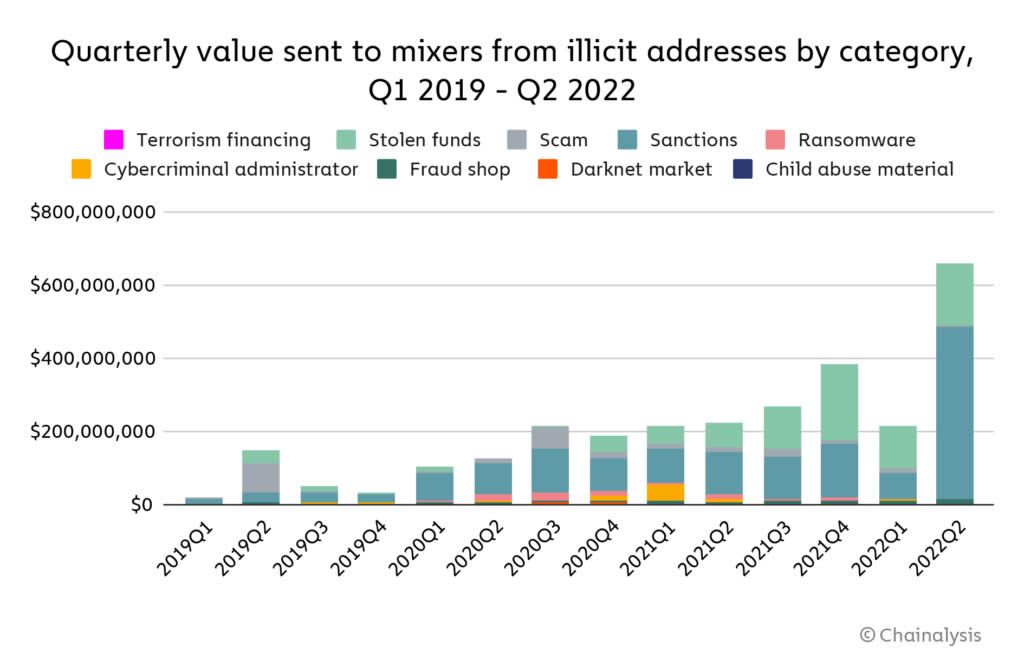

It added that the 30-day moving average of crypto sent to mixers reached an all-time high of $51.8 million in April. The amount sent to mixers in Q2, 2022 topped $600 million but the vast majority of it came from sanctioned entities and stolen funds.

It would be safe to deduce that the war in Ukraine and global sanctions imposed on Russia have had a large impact on mixer usage for the first half of this year.

“What stands out most is the huge volume of funds moving to mixers from addresses associated with sanctioned entities, especially in Q2 2022.”

Mixer legalities

Mixers are not illegal and offer legitimate services for those that need some financial privacy for whatever reasons. The U.S. Financial Crimes Enforcement Network (FinCEN) has clarified that mixers are money transmitters that require registration under the Bank Secrecy Act (BSA). Naturally, this is not going to happen as it negates their purpose.

Taking advantage of this legal loophole, addresses associated with sanctioned entities such as the Russian darknet market Hydra and the North Korean hacker group Lazarus, accounted for 80% of funds sent to mixers in 2022.

The report added that hackers associated with the North Korean regime have stolen more than $1 billion worth of crypto assets, mostly from DeFi protocols, so far this year. The remainder is made up of crypto derived from protocol exploits, scams, ransomware, and other nefarious sources.

In April, Be[In]Crypto reported that the Ethereum mixer Tornado Cash had agreed to block sanctioned addresses.

How do crypto mixers work?

Mixers obfuscate transactions by using a number of different methods. They sever the connection between the sending address and the receiving one making assets very difficult to trace.

Crypto sent to mixers is pooled or “mixed” at random before being sent to the recipient which makes tracing the originating address very difficult. Further anonymity can be achieved by staggering the times of transactions and altering the fees and deposit types.

Their weak point is large transactions that overwhelm the mixing pools, making it easier for blockchain sleuths to trace.

Another major problem is that ill-informed policymakers associate mixers with the entire crypto industry yet illicit activity makes up around 0.62% of all crypto transactions according to a Chainalysis report earlier this year.