Earlier today, Israel launched a ‘pre-emptive strike’ on Tehran and declared a state of emergency. This rapid escalation of the conflict drove the crypto market into a freefall.

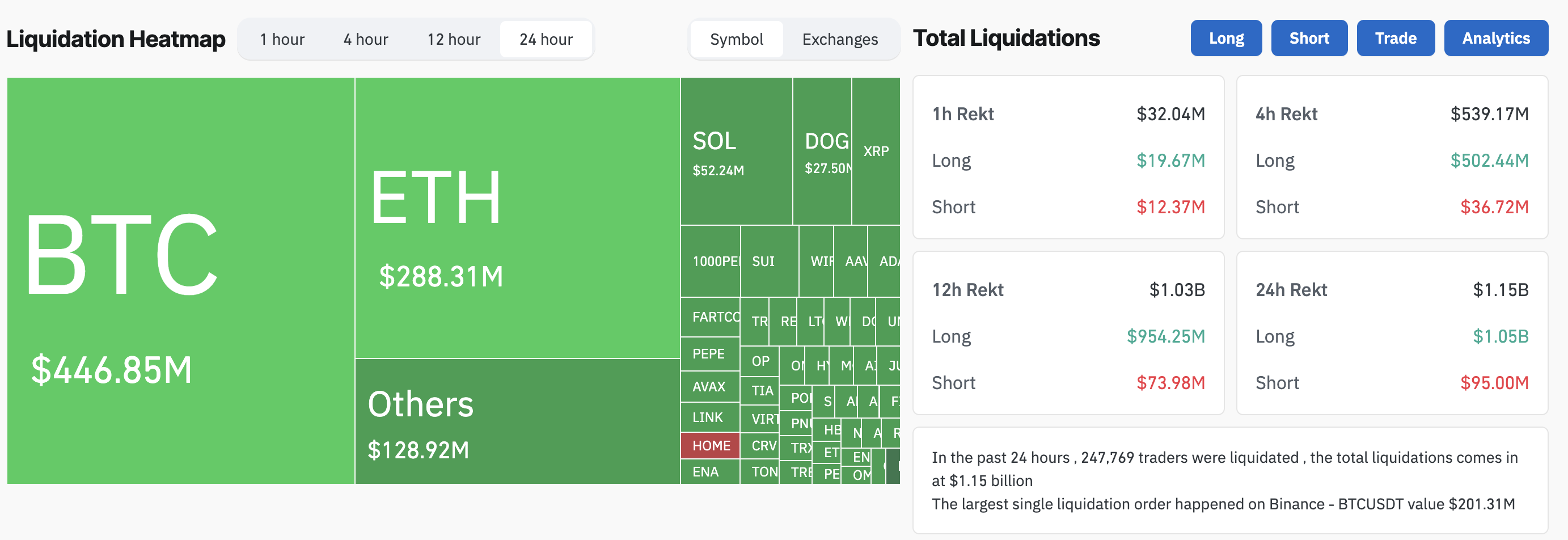

Over the past 24 hours, total liquidations amounted to $1.15 billion. Additionally, the overall market is down by 6.6%.

Crypto Market Plunges Amid Israel-Iran Conflict

According to CNN, Israel’s strikes targeted Iran’s nuclear program and missile capabilities, affecting dozens of locations. The attack reportedly eliminated Iran’s top military leaders and senior nuclear scientists.

It was confirmed that General Hossein Salami, the Commander-in-Chief of Iran’s Islamic Revolutionary Guard Corps (IRGC), was killed.

“Iran’s state television says Deputy Commander in Chief of all Armed Forces, General Gholam Ali Rashid, has been killed, along with nuclear scientist Fereydoon Abbasi,” The Kobeissi Letter posted.

To prepare for potential retaliation, Israel has declared a state of emergency, closing schools, banning gatherings, and mobilizing tens of thousands of soldiers.

Furthermore, Iran is preparing a ‘lethal‘ response against Israel following the attacks. It has already appointed General Vahidi, the former head of the Quds Force, as the new commander of the IRGC.

The rising tension between the two nations has caused significant turbulence in the market. Dow Jones Industrial Average futures fell by 1.3%, S&P 500 futures dropped 1.4%, and Nasdaq 100 futures plunged by 1.6%.

Meanwhile, the crypto market wasn’t spared. Earlier on Thursday, BeInCrypto reported that any escalation in the Iran-Israel conflict would significantly impact the crypto market due to FUD.

This materialized as the latest data showed that the crypto market depreciated by 6.6%.

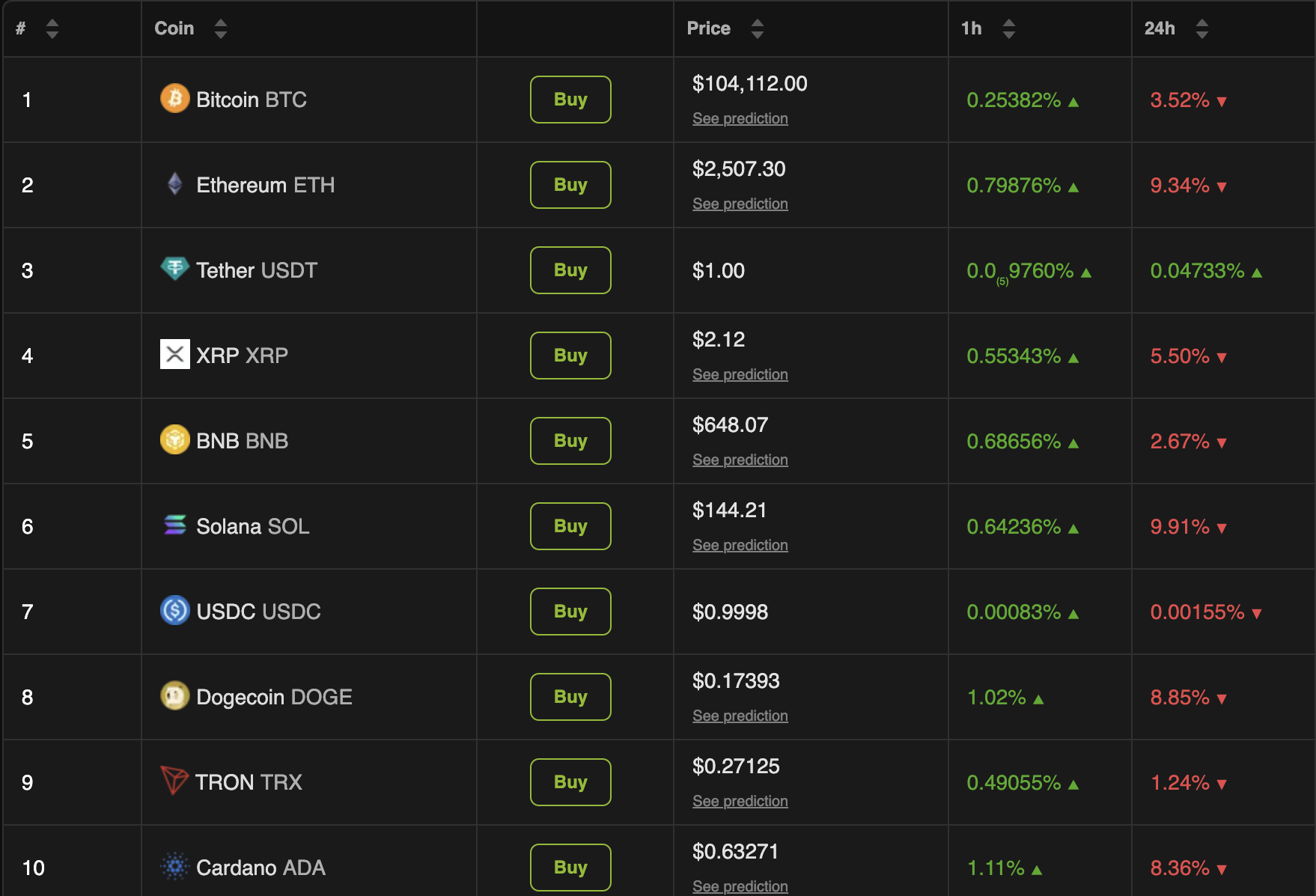

Nine of the top ten coins saw losses over the past day. Bitcoin (BTC) nosedived from over $108,000 to $104,112. However, altcoins suffered the harshest blow.

Solana (SOL) lost nearly 10% over the past day. Ethereum (ETH) trailed closely with a 9.3% downtick. Among the top 100 coins, Fartcoin (FARTCOIN) and Ethena (ENA) stood out for double-digit losses of 17.3% and 15.9%, respectively.

These declines forced 247,769 traders out of their positions over the past 24 hours. According to Coinglass data, $1.15 billion has been liquidated from the crypto market.

Bitcoin faced $427.75 million in long and $19.10 million in short liquidations. Ethereum followed with $244.74 million in long liquidations and $43.57 million in short liquidations, highlighting the scale of market turmoil.

Nonetheless, the conflict drove oil and gold up. Oil prices spiked by more than 10%. U.S. West Texas Intermediate rose to $74.99 per barrel, marking a 10.21% uptick.

The global benchmark Brent increased by 10.28% to $76.48 per barrel. Gold also gained 1.2% to reach $3,426.

Analysts Divided Over Israel-Iran Conflict’s Impact on Crypto

As Iran prepares for retaliatory actions, it’s clear that the impact will be felt across markets. Amid this volatility, the cryptocurrency market, particularly Bitcoin, has become a focal point of debate among analysts.

Opinions are sharply divided on its role as a “digital gold” during geopolitical crises. Veteran economist Peter Schiff argued that Bitcoin’s price drop contrasts starkly with gold’s rise as investors sought safe havens.

“Bitcoin’s failure to rise against gold—despite over 3.5 years of hype, including a dozen ETFs, Super Bowl ads, El Salvador, NFTs, tens of billions of leveraged buying by MSTR, other Bitcoin treasury companies, the election of a Bitcoin president, and the establishment of a Bitcoin Strategic Reserve—is strong evidence that the bubble has peaked,” Schiff said.

Another analyst echoed his view, claiming that Bitcoin is not a safe haven but more akin to a tech stock.

“It is important to understand that Bitcoin shows its true colors as Israel attacks Iran. It is not an alternative-currency, it is not a safe haven, it is a risk asset, just like another tech stock, that will decline when the market goes to a risk-off posture,” the post read.

However, crypto advocate Anthony Pompliano maintained an optimistic outlook. Drawing parallels to an earlier incident when Iran launched 300 missiles at Israel, Pompliano noted that Bitcoin rebounded to outperform both oil and gold.

“Bitcoin ended up outperforming the other two over the first 48 hours in that situation. Will be interesting to see what happens here,” Pompliano stated.

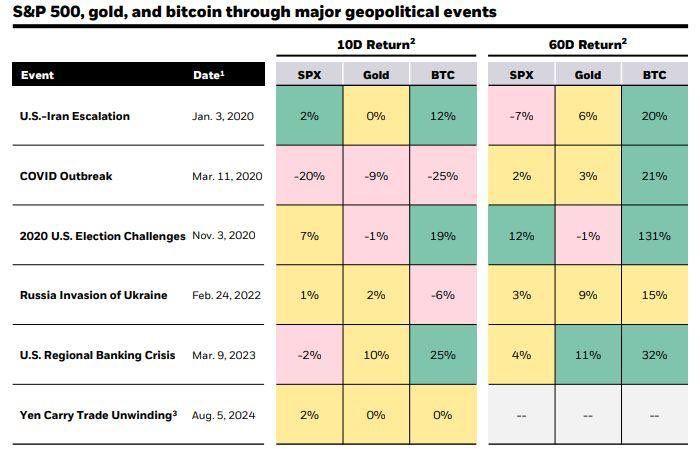

Moreover, a recent BlackRock report revealed that while Bitcoin may underperform in the short term during geopolitical shocks, it has historically rallied double digits within 60 days post-crisis, outpacing gold and equities.

Despite immediate market jitters, this suggests a longer-term bullish outlook for the cryptocurrency.

Still, the divide reflects broader uncertainties about Bitcoin’s maturity as an asset, with gold’s millennia-long stability pitted against Bitcoin’s 16-year track record.

As markets stabilize, analysts will closely monitor price movements, with some betting on Bitcoin’s recovery and others clinging to gold’s proven reliability.