The cryptocurrency market faced $1.1 billion in liquidations over 24 hours on November 14, 2025, with $968 million from long positions.

More than 246,000 traders were forced out, triggering fresh comparisons with the darkest period of the 2022 FTX collapse.

Liquidation Wave Hits Major Crypto Exchanges

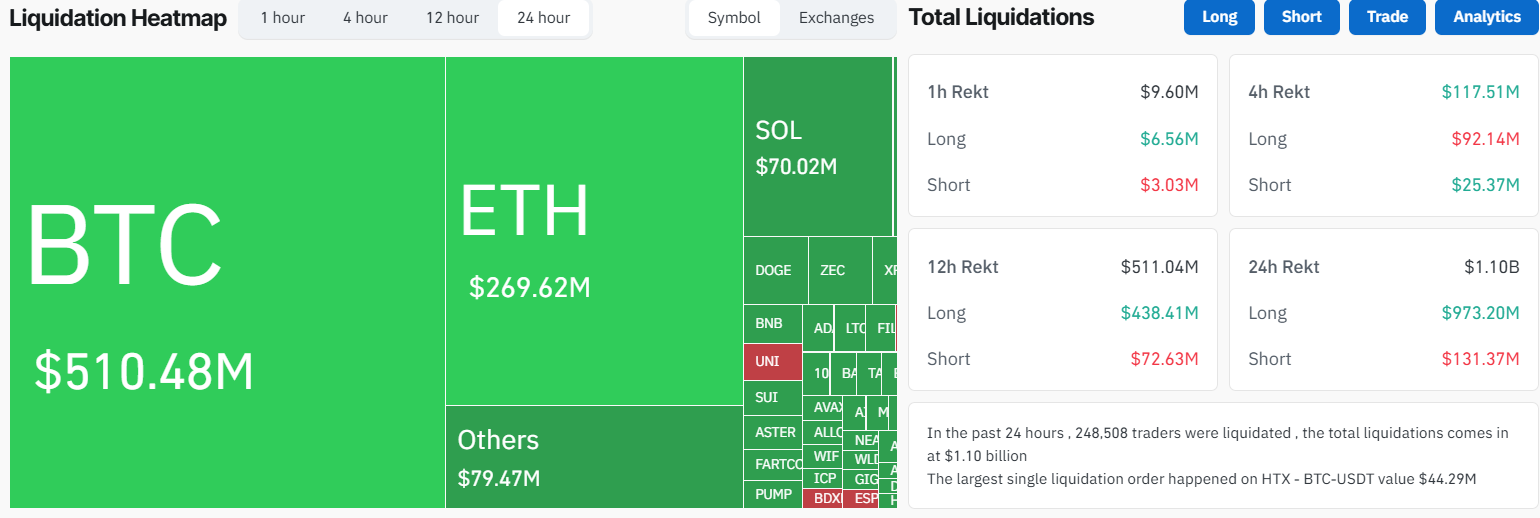

During the recent 24-hour period, $1.1 billion in positions were liquidated, with long positions suffering $973 million in losses compared to $131.37 million for shorts.

The largest single liquidation was a $44.29 million BTC-USDT position on HTX. In the four-hour window, Hyperliquid saw $134.16 million in long liquidations, with Bybit close behind at $122.57 million.

Liquidations occur when exchanges close leveraged trades due to insufficient margin. High leverage leads to automatic closures when markets turn sharply, especially during periods of volatility.

A heavy tilt toward long liquidations suggests many traders were optimistic about the price direction when the market reversed.

Against this backdrop, sentiment has dipped to lows reminiscent of the immediate aftermath following FTX’s November 2022 collapse.

Despite its impact, this incident does not rank among the ten largest recorded. The record stood at $19.16 billion in October 2025, following the announcement of a US-China tariff.

Meanwhile, Bitcoin technical indicators highlight warning signs, prompting debate about whether this signals the start of a new bear market or represents a sharp correction.

Sentiment Plummets to FTX-Era Lows

Market analyst Negentropic drew sharp comparisons to the 2022 FTX crisis when evaluating the current outlook. Bitcoin’s Relative Strength Index (RSI) now sits in massively oversold territory, a condition not seen since 2022.

For the first time in three years, the pioneer crypto has also dropped below its lower volatility band, signaling severe market stress.

The FTX collapse in November 2022 marked a watershed moment for the crypto industry, erasing billions in market value. News about Alameda Research’s finances and Binance CEO Changpeng Zhao’s move to liquidate FTT holdings sparked a bank run and ultimately led to FTX’s bankruptcy, resulting in a drastic drop in Bitcoin’s price as confidence vanished.

This comparison highlights not just price drops, but also deep uncertainty among market participants. Lower liquidity across exchanges, waning engagement from experienced builders, and fast changing narratives mirror the turmoil after the 2022 failures of Luna, Three Arrows Capital, FTX, Genesis, and BlockFi.

Experts Offer Diverging Market Outlooks

Despite negative sentiment, not every analyst sees the situation as catastrophic. CryptoQuant CEO Ki Young Ju outlined a key threshold for confirming a bear market.

In his view, Bitcoin holders from the past 6 to 12 months have a cost basis near $94,000. Unless pricing falls below this level, the bear cycle is not confirmed.

This view adds nuance to the bear market debate. The $94,000 support is both a psychological and technical floor for many holders. Unless that breaks, analysts say the current weakness might simply be a correction within a broader bullish period.

Meanwhile, Haseeb Qureshi of DragonFly Capital offered a contrasting perspective, arguing the market is not facing 2022-level systemic failures.

Unlike that period of cascading exchange collapses, bank failures, and stablecoin depeggings, Qureshi points out that now, losses are coming mainly from falling prices.

Divergent expert opinions reflect the market’s uncertainty. While indicators and sentiment show distress, the industry’s core infrastructure is holding stronger than during previous crises.