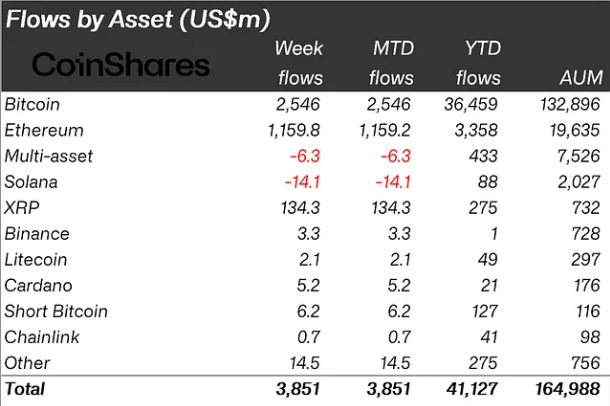

Crypto inflows experienced a record-breaking surge last week, reaching a remarkable $3.85 billion. The positive flows to digital asset investment products surpassed the previous record set just weeks ago.

This monumental activity has propelled the total year-to-date (YTD) inflows to $41 billion.

Bitcoin Leads the Charge As Crypto Inflows Approach $4 Billion

Bitcoin (BTC) led the charge, accounting for $2.5 billion of last week’s inflows. This brings its YTD total to a staggering $36.5 billion. The sustained bullish momentum has investors projecting further gains, with some analysts eyeing $100,000 as a feasible target this cycle.

Short Bitcoin products saw inflows of $6.2 million, a trend historically observed after sharp price increases. According to James Butterfill in the latest CoinShares report, this highlights cautious investor sentiment, with many hesitant to bet against Bitcoin’s current strength.

Meanwhile, Ethereum made headlines with its largest weekly inflows on record, totaling $1.2 billion. This surpasses the excitement seen during the launch of Ethereum ETFs (exchange-traded funds) in July. The significant inflows highlight growing confidence in Ethereum’s long-term potential, particularly as the blockchain cements its role in decentralized finance (DeFi) and NFT (non-fungible token) ecosystems.

However, Ethereum’s success appears to be coming at the expense of competitors like Solana (SOL), which saw $14 million in outflows last week. This marks the second consecutive week of declines for Solana, signaling a shift in investor sentiment away from altcoins.

Institutional players like BlackRock, which recently delayed plans for altcoin ETFs, opting instead to prioritize products centered on Bitcoin and Ethereum, have further reinforced the market’s preference for these. The record-breaking inflows reflect a broader trend of institutional interest in digital assets.

Firms like MicroStrategy and BlackRock have been at the forefront of this movement. For the latter, its Bitcoin spot ETF offering continues to serve as a major catalyst for market optimism.

With Bitcoin and Ethereum commanding the lion’s share of inflows, questions remain about the future of altcoins in an increasingly competitive market. The outflows from Solana could signal broader challenges for smaller blockchain ecosystems, particularly as institutional money gravitates toward the market’s giants.

Investor Sentiment: Profits and Strategies

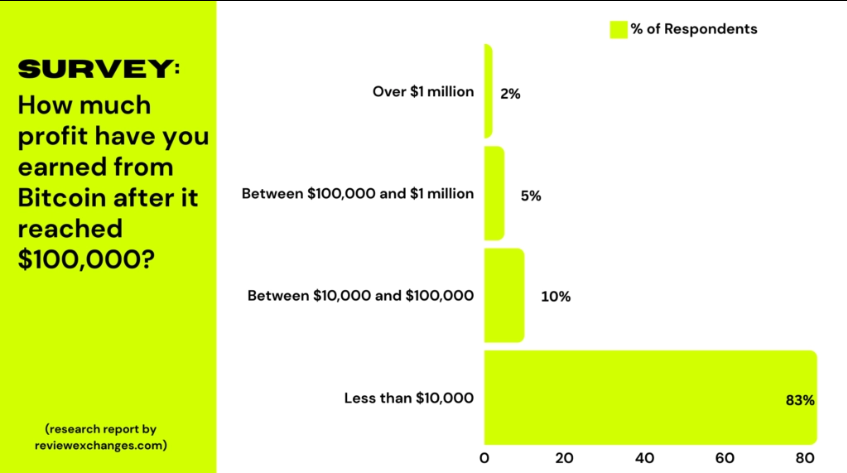

Elsewhere, a recent research by ReviewExchanges sheds light on how Bitcoin’s rise to $100,000 has impacted US crypto investors. A survey of 719 investors revealed mixed emotions, strategies, and expectations following the milestone.

A significant 48% of respondents admitted they missed out on major gains during Bitcoin’s bull run and regret not acting earlier. Another 31% believed it was still not too late to invest. Meanwhile, only 15% reported successfully timing their investments to achieve financial goals, while 6% revealed they were not interested in Bitcoin during its surge.

The survey also showed that 83% of investors earned less than $10,000 from the bull run, with only 2% making over $1 million. This reflects the rarity of substantial gains and highlights the importance of timing and strategy.

The survey also found that 72% of participants view cryptocurrency as a major future investment. While 43% expressed increased confidence in the market, 29% remained cautiously optimistic due to inherent risks. Meanwhile, 7% reported low confidence, reflecting concerns over volatility.

A majority of respondents, 67%, indicated they are holding their assets for long-term gains, while 18% are diversifying their portfolios. Only 10% chose to cash out fully, and 5% reinvested profits into altcoins, reflecting a growing interest in blockchain innovation beyond Bitcoin.