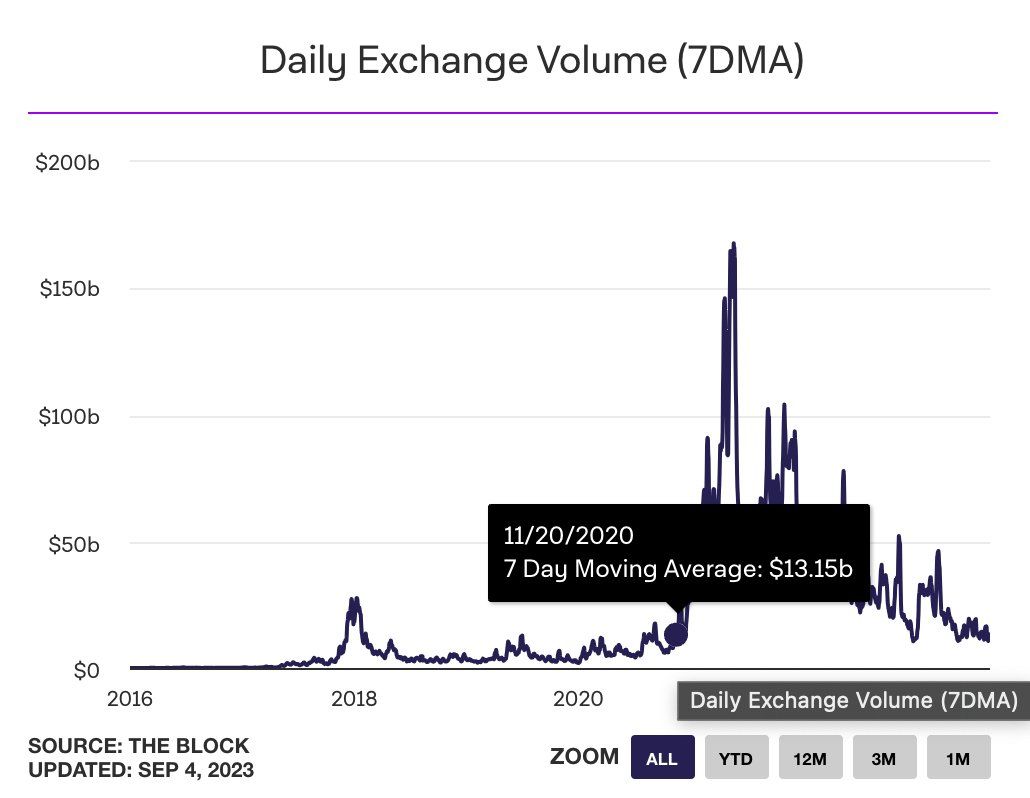

Crypto exchange activity and volumes are dwindling, falling back to levels not seen for three years as the bear market deepens. Moreover, institutional investors are also getting cold feet as funds continue to see capital outflows.

Daily centralized exchange (CEX) volumes are at the same levels as in late 2020. Crypto derivatives are also slumping in terms of open interest and activity.

Crypto Exchange Volume Ghost Town

Citing data from The Block, crypto researcher Aylo likened crypto markets to a ghost town. “By now most have capitulated and disappeared swearing never to return,” he added.

However, many experienced this before, during the 2018-19 bear market that was equally as brutal. The researcher added that this was an opportunity zone.

“Historically speaking, we are in the opportunity zone, and smart buyers in the past have been very profitable purchasing assets whilst volume and interest were so low.”

Read more: Bitcoin Halving Cycles and Investment Strategies: What To Know

The sentiment was echoed by Chainlink community leader “Chainlinkgod,” who said the reality is that there is no net new money coming into crypto at the moment. “Retail is rekt,” and institutions are waiting for regulatory clarity, he added.

“It seems like to me, institutions are most likely to be the next wave of capital to enter the crypto economy.”

Institutions have been repeatedly signaling the benefits they would reap from tokenized assets and the market opportunity it presents, he added.

Institutional Crypto Outflows Cooling

The likes of BlackRock and Grayscale could well catalyze the next bull market, but at the moment, there is very little market activity.

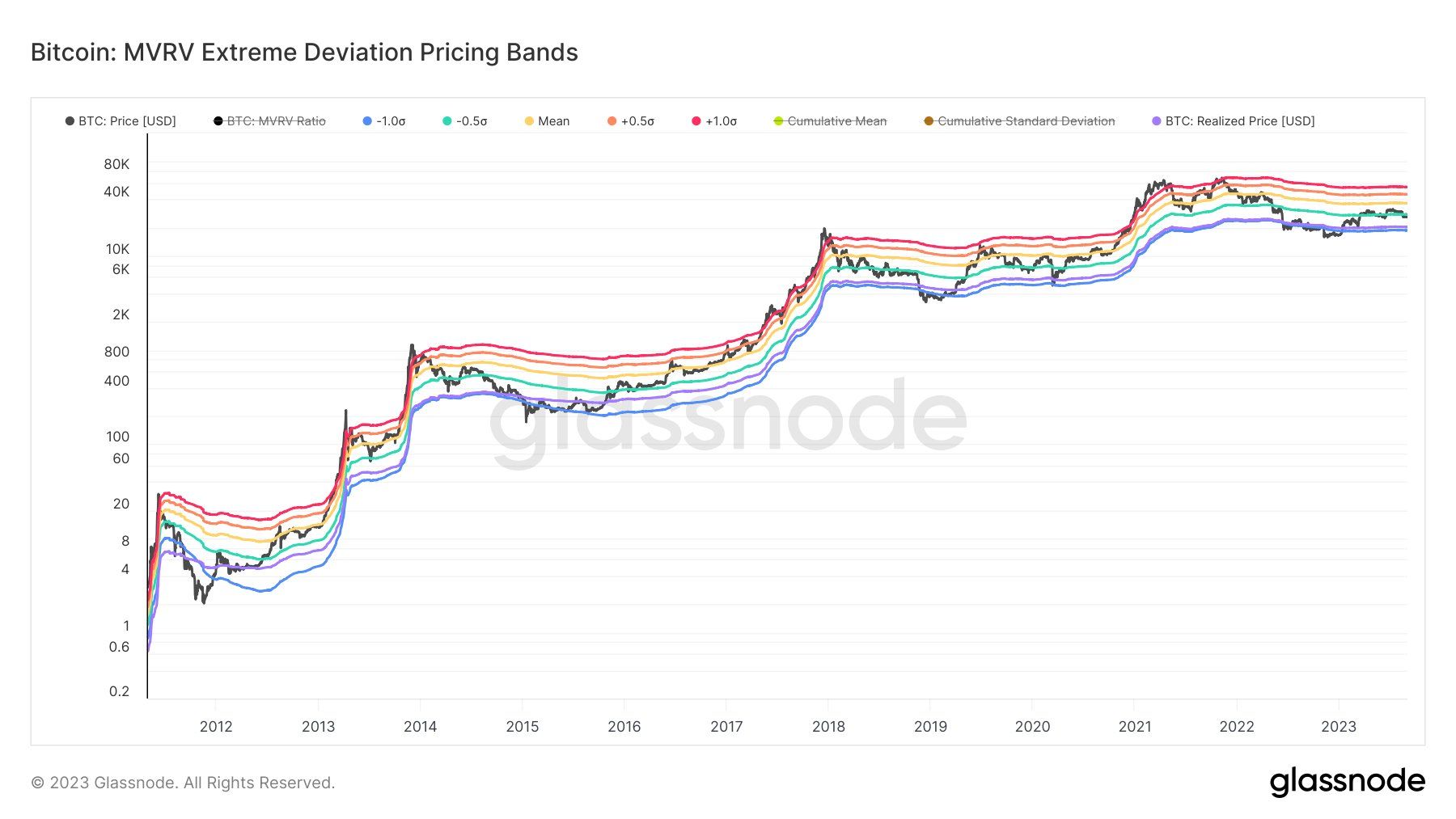

Will Clemente commented that there was still a real possibility of BTC retesting lower bounds similar to Q1 2020. This could drop prices back towards the low $20,000 level. “Any retests of those lower bounds are for buying,” he added.

Digital asset investment product flows have cooled off with relatively minor outflows totaling $11.2 million, reported CoinShares on September 4.

This run of negative sentiment over the last seven weeks now totals $342 million, it added.

Bitcoin funds saw inflows totaling $3.8 million, while short BTC funds saw outflows for their 19th consecutive week totaling $3.3 million.

Ethereum and Polygon funds saw larger outflows as altcoin sentiment waned.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.