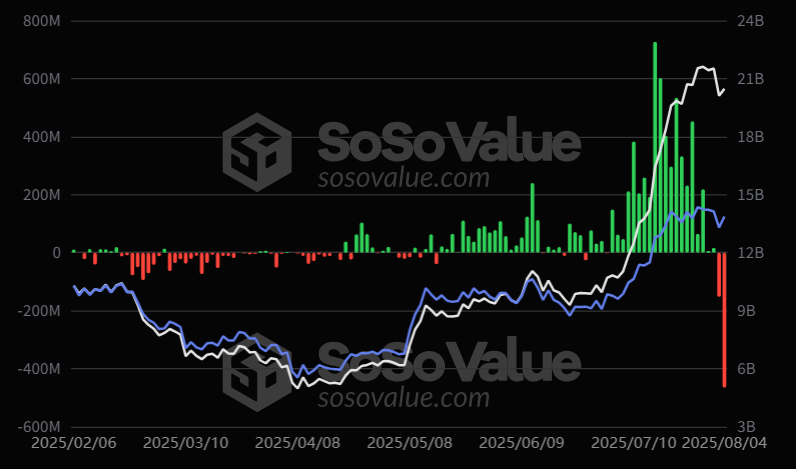

US spot ETF inflows—a key driver behind Bitcoin and Ethereum’s Q2 rally—have sharply reversed.

On Monday, US Bitcoin and Ethereum ETFs suffered record outflows of $333 million and $465 million, respectively.

Largest Outflow Ever from Ethereum ETF

According to crypto data platform SoSoValue, US spot Bitcoin ETFs saw a net outflow of $333.19 million.

Most notably, BlackRock’s IBIT, the largest Bitcoin-holding spot ETF, recorded a net outflow of $292.21 million—the largest since May 30. IBIT has been the strongest buyer defending Bitcoin prices over the past two months during market downturns.

The situation was even worse for US spot Ethereum ETFs. Total net outflows reached $465.1 million—the largest since these products launched in July 2024. Again, BlackRock’s ETHA accounted for the bulk of withdrawals, seeing $375 million leave the fund in a single day. This ends its 21-day inflow streak and slashed 3% of its ETH stash.

Despite record-breaking outflows, both Bitcoin and Ethereum rose around 1% and 5%, respectively, supported by a rebound in the three major US stock indexes that day.

ETF demand, alongside institutional buying, was a key factor in the Q2 crypto rally. It’s unclear whether the outflow trend will continue to the next day or the week. If ETF inflows continue to slow, however, the top two largest cryptocurrencies could face growing downward pressure in the coming weeks.

The investors are confused as the markets appeared to be stabilizing from the aftermath of last week’s shock from the US employment data.

According to FedWatch, a rate prediction tool by the CME Group, the probability of a Fed rate cut in September has surged to 95%. Goldman Sachs expects the Federal Reserve to cut rates three times in a row starting in September.

Trump is expected to announce a new Federal Reserve Board member and the next head of the Bureau of Labor Statistics (BLS) later this week.