The token swap platform for the Sui Network, Suiswap, is getting lambasted by the crypto community.

The much-hyped Sui blockchain is taking a beating over its decentralized exchange. An initial DEX offering (IDO) is planned for Suiswap on June 3.

Sui: Another VC Payday

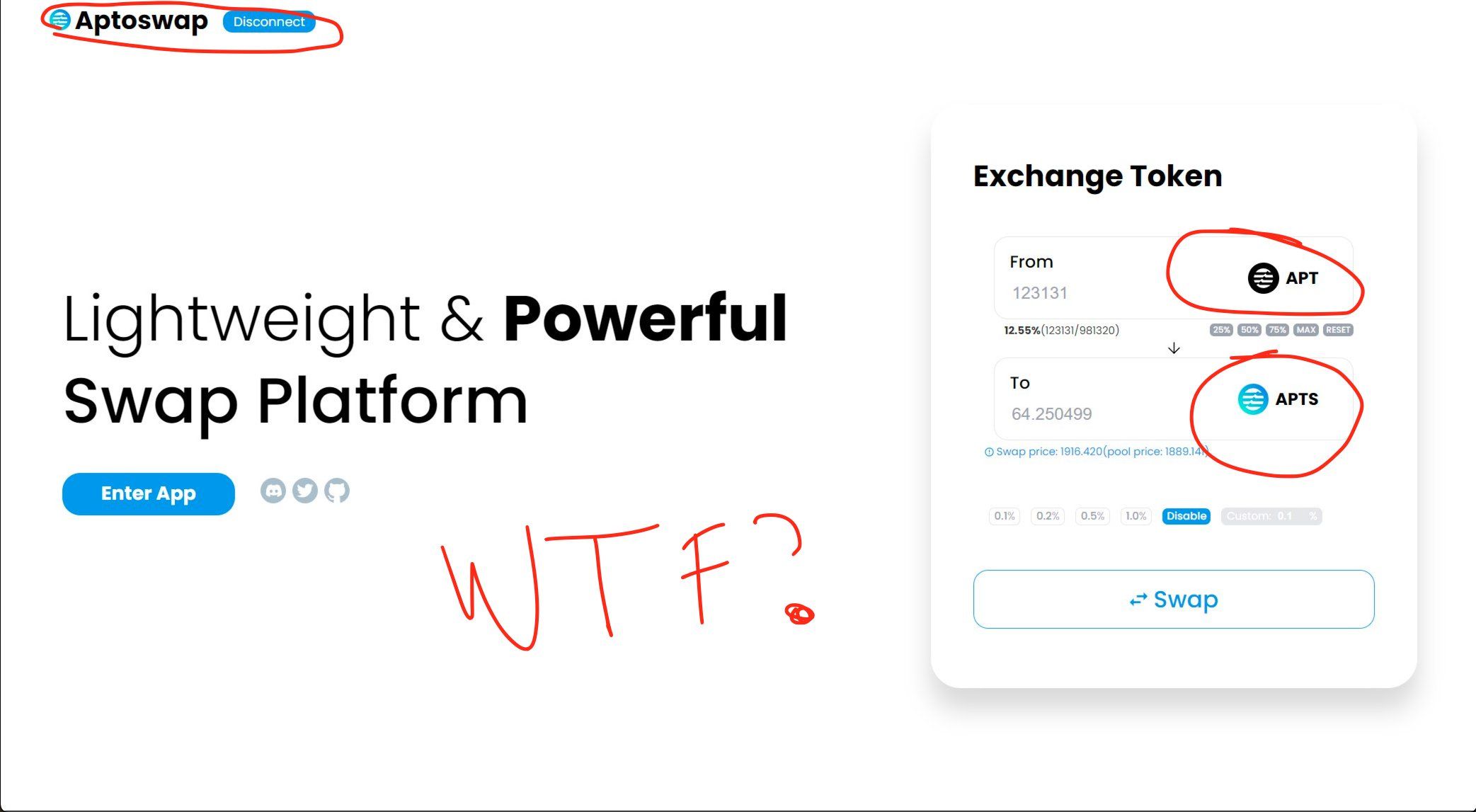

An eagle-eyed DeFi observer found similarities between Suiswap and Aptoswap. The latter is a DEX on the Aptos Network, another much-hyped Ethereum competitor.

“The metadata for SuiSwap site is a picture of AptosSwap. The devs literally could not even be bothered to change the metadata for this low effort copy and paste.”

The IDO is for 10 million SUI and values Suiswap at $200 million FDV (fully diluted value).

Sui has also been heavily criticized for being venture capital controlled. DeFi Squared mentioned this commenting on the copy/paste effort on May 30:

“LOL no way, SUI’s $200M flagship DEX copy pasted so hard from Aptos that they didn’t even remember to change the name in their website’s preview from Aptoswap.”

“But surely at a $10 billion valuation, SUI isn’t just more vaporware to give VCs a fat payday, right? …right?” he added.

The IDO price is 0.02175 SUI for a maximum allocation of 500 million SSWP tokens. It will run until June 5, according to the official documentation.

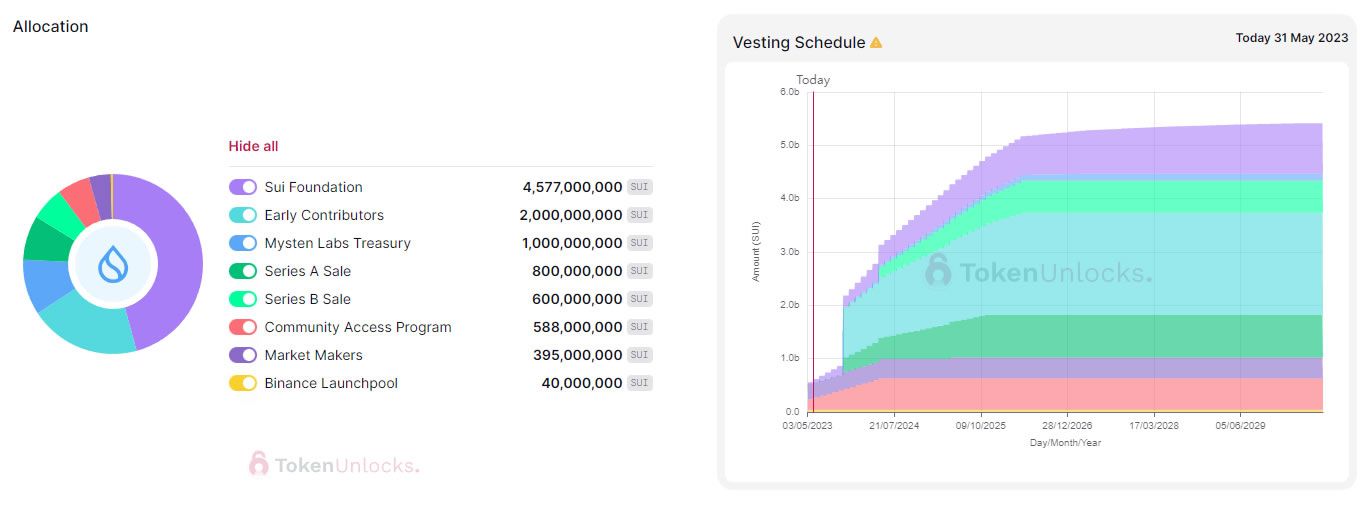

Furthermore, 61 million SUI tokens worth $59 million are scheduled for unlock on June 3, according to Token Unlocks.

The platform also reveals the extent of VC and insider influence over SUI tokenomics. A whopping 90% of the tokens allocated are controlled by the Sui Foundation, early contributors (insiders), Mysten Labs Treasury, and the VC Series A and B sales.

SUI Price Plunges

Unsurprisingly, SUI prices have tanked leading up to the big unlock event. As a result, the token was trading down 7% on the day at $0.973 at the time of writing.

Furthermore, SUI has lost almost 15% over the past fortnight as the hype over this VC chain fades. Additionally, SUI prices have plunged 55% since their all-time high just after launch less than a month ago on May 3.

Rival VC-backed project Aptos is in a similar situation, with its APT tokens tanking 57% since their all-time high in January.

It appears that retail traders are wising up to the heavily insider-controlled projects now as their token prices continue to devalue.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.