As investors prepare for a busy week ahead filled with a packed economic calendar, they have their sights set on one key piece of data: inflation.

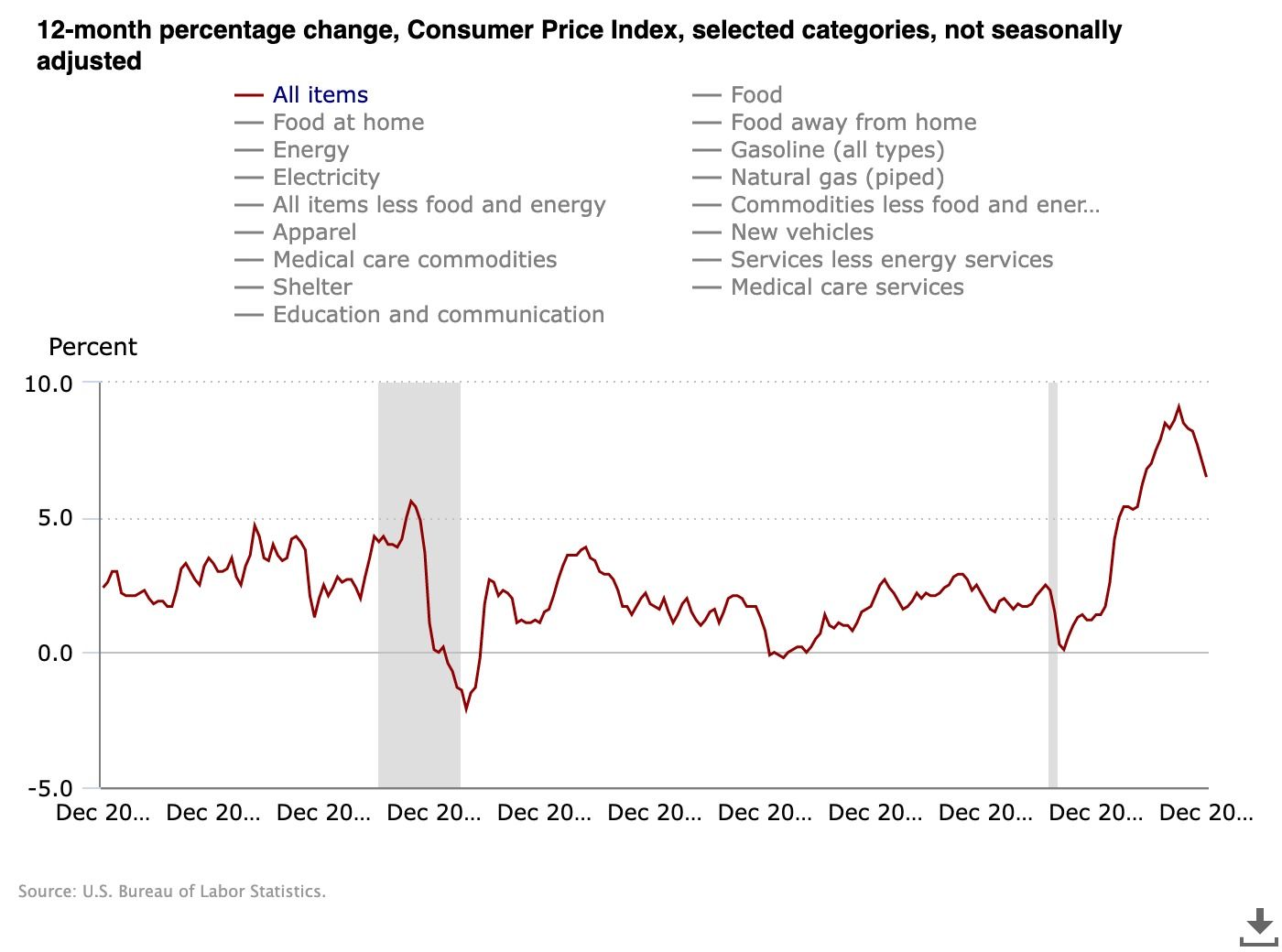

The release of January’s Consumer Price Index (CPI) from the Bureau of Labor Statistics on Tuesday is highly anticipated, especially after Federal Reserve Chair Jerome Powell acknowledged the presence of “disinflation” in the US economy.

Inflation Data Expected to Impact Stock and Crypto Markets

According to economists, the headline CPI is expected to have risen 0.5% month-over-month in January, a significant increase from recent months. The Bureau of Labor Statistics released new seasonal adjustments last Friday, which revised December’s initial monthly drop in headline inflation from 0.1% to an increase of 0.1% in the year’s final month.

According to Bloomberg’s consensus estimates, despite the expected monthly rise, the annual headline number is projected to decrease to 6.2% from 6.5% the previous month.

One of the key metrics monitored by the Federal Reserve, the core CPI, is forecast to show a 0.4% rise over the month after removing the volatile food and energy components. On an annual basis, economists expect the core CPI to have risen 5.5% over the year, a modest decrease from 5.7% in December.

Policymakers focus more closely on core inflation as it provides a nuanced look at key inputs like housing, while the headline CPI has largely been affected by volatile energy prices this year. For Chair Powell, shelter inflation, which has remained stubbornly high, is a crucial factor in determining the path of interest rates.

In a recent interview in Washington D.C., Powell stated that he expects housing inflation to decline by the middle of the year.

“There has been an expectation that [inflation] will go away quickly and painlessly; I don’t think it’s guaranteed that’s the base case,” Powell said last Monday at the Economic Club of D.C. “It will take some time.”

CPI, PPI, and More Financial Reports

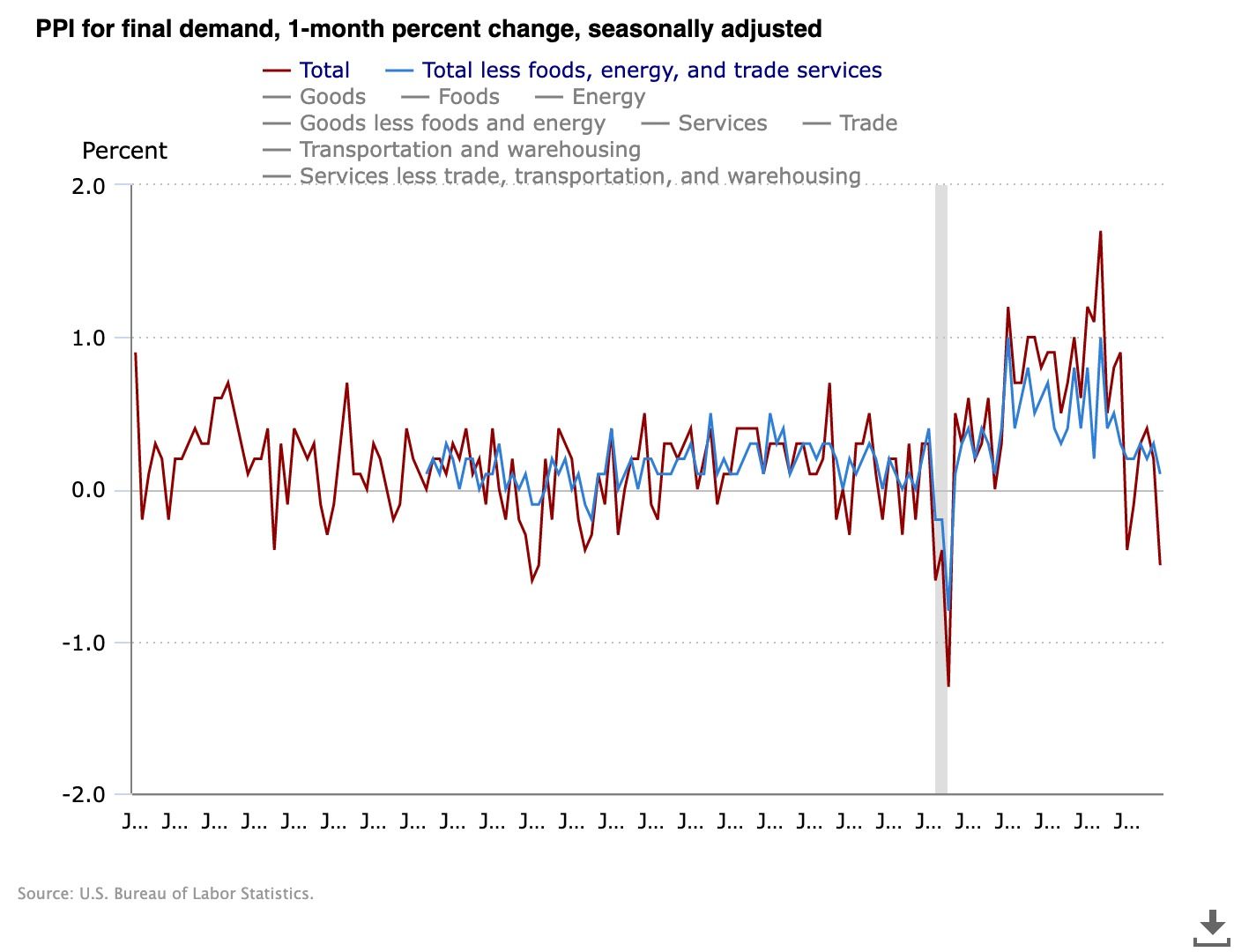

In addition to the CPI, Wall Street will also have an opportunity to gauge inflation at the wholesale level with the release of the Producer Price Index (PPI) on Thursday. The government’s retail sales report, due on Wednesday, is expected to show continued strength in consumer spending.

The PPI is forecasted to have risen 0.4% over the prior month, a bounce back from December’s decline of 0.5%. On an annual basis, economists expect the PPI to have fallen to 5.4% from 6.2% in December.

Retail sales are expected to have rebounded in January, rising 1.9% over the prior month following a 1.1% decline in December.

Despite a strong start to 2023, US stocks and Bitcoin experienced their worst week of the year last week. The S&P 500 closed down 1.1%, the Dow Jones Industrial 0.2%, the Nasdaq Composite 2.4%, and Bitcoin 5.05%.

Analysts at Bespoke Investment Group noted:

“Given the strong rally to start the year, the market was due for a cool-off period, and we got that this week.”

Investors have seen equity markets rebound sharply since December on the anticipation that the Federal Reserve may pause rate hikes sooner than expected. However, officials and strategists continue to assert that excitement around a potential pivot is premature.

Investors will also be closely watching the January CPI data, as it will give them an insight into the economy’s direction. If the data comes in lower than expected, it could indicate that the economy is slowing down, which could be a negative for stocks and cryptos. On the other hand, if the data comes in higher than expected, it could signal that the economy is gaining momentum, which would be positive for stocks and cryptos.