Zebec Network (ZBCN), Zora (ZORA), and Jupiter (JUP) are three of CoinGecko’s top-performing altcoins of the day. ZBCN is up over 420% in the past 30 days, with strong momentum behind its real-time payment and payroll tools.

ZORA has gained traction through the growing “Content Coins” narrative, while Jupiter has rallied following major product rollouts and platform upgrades. All three are posting double-digit gains in the last 24 hours, with key resistance and support levels now in focus.

Zebec Network (ZBCN)

Zebec Network is a decentralized infrastructure protocol that enables real-time, programmable money flows across borders. Through products such as Zebec Silver, Carbon, and Black, it provides solutions like continuous payroll streaming, on-chain remittances, and crypto-enabled payment cards.

The platform claims to serve over 50,000 monthly users across 138 countries, with enterprise-level payroll support already handling $1 billion in volume.

Zebec also powers WageLink, a Web3 payroll app offering features like USDC-based payments, early wage access, and cross-border transfers—designed to bridge the gap between traditional finance and blockchain utility in everyday life.

Zebec’s native token, ZBCN, has surged over 25% in the last 24 hours, extending its rally to 170.6% over the past week and 420% over the past month.

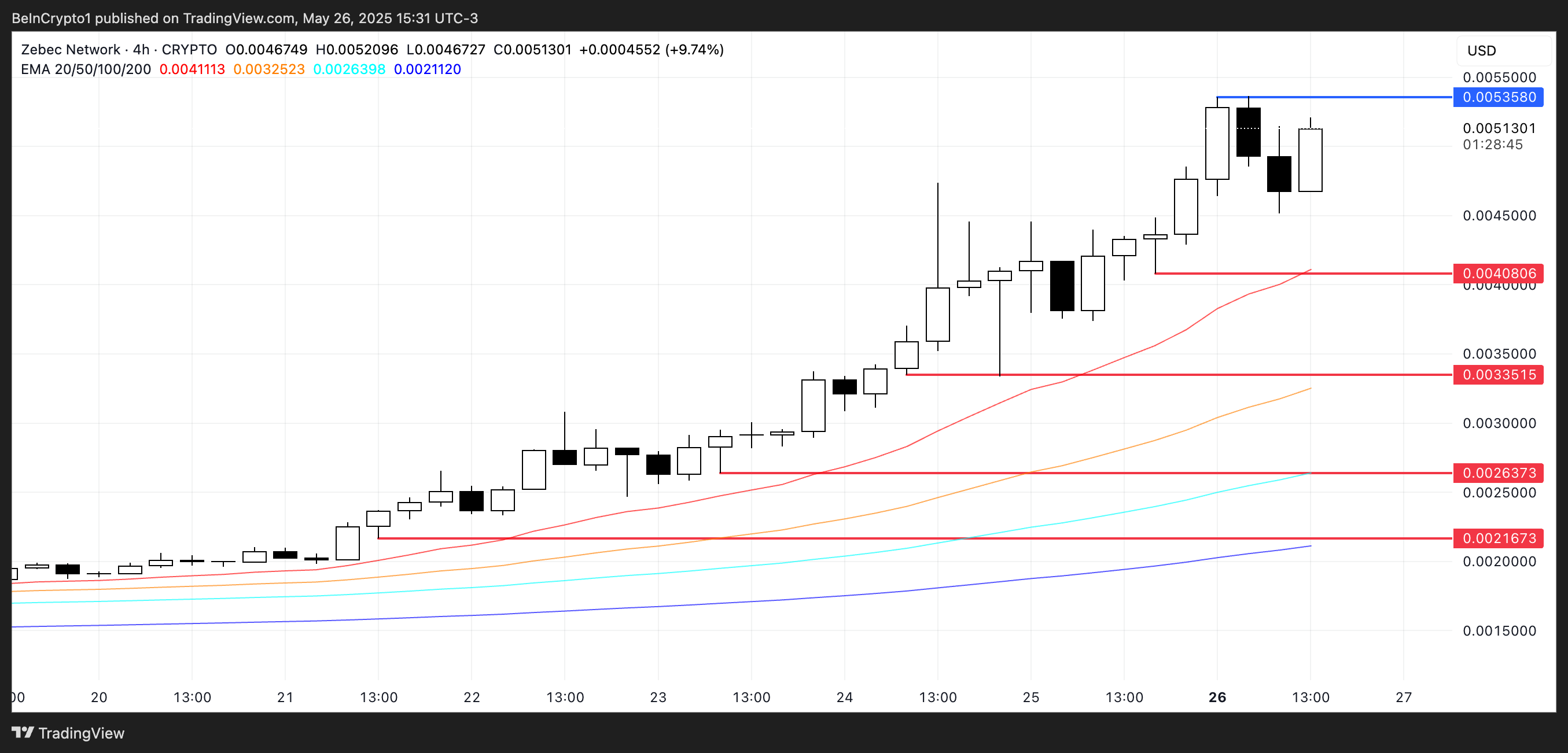

Its market cap now stands at $405 million, with daily volume up 32.7% to $166 million—reflecting strong trader interest. If the uptrend holds, ZBCN could break resistance at $0.0053 and climb above $0.0060.

However, if momentum fades, it may retest support levels at $0.0040 and $0.00335, with deeper corrections possible down to $0.00263 or even $0.00216 in a more aggressive selloff.

Zora (ZORA)

ZORA has gained significant attention recently as Base and the Zora protocol work to develop the emerging narrative of “Content Coins”—a category centered around on-chain media, creators, and decentralized publishing.

So far, over 922,200 tokens have been created on Zora, generating a total trading volume of $283 million and engaging more than 2.75 million unique traders.

ZORA has increased more than 21% in the past 24 hours, bringing its market cap to $40 million, and trading volume soared nearly 300% to $63.5 million.

If bullish momentum holds, ZORA could move toward the resistance at $0.0132 and potentially break through to $0.0147. On the downside, if sentiment shifts, the token may retest support at $0.0108, and a further drop could bring it down to $0.0090.

Jupiter (JUP)

Jupiter is up 17% in the last 24 hours, fueled by a wave of recent product announcements aimed at expanding its ecosystem.

The revamped Jupiter Onboard now allows users to buy crypto with fiat, transfer from exchanges, and bridge assets via integrations with deBridgeFinance and Circle. Additionally, the platform launched Jupiter Lend and introduced upgrades to its mobile app.

Technically, Jupiter’s EMA lines remain bullish, suggesting the uptrend could continue. If momentum holds, JUP may break the resistance at $0.6331 and potentially climb to $0.671, with stronger moves targeting $0.77 and $0.839.

However, if sentiment shifts and support at $0.605 is lost, the token could retrace to $0.521 or even $0.465 under heavier selling pressure.