Coinbase Exchange CEO Brian Armstrong remarked on the launch of spot Ethereum ETFs. He sees it as ETH’s vindication from the security label imposed by the US Securities and Exchange Commission (SEC).

The landmark development on Monday makes Ethereum accessible to institutions, as it did for Bitcoin (BTC) in January.

Coinbase CEO Echoes Ethereum Is Not A Security

Armstrong echoed what crypto proponents have been advocating for years: Ethereum is not a security. He says the regulator’s decision makes this stance official, with the largest US-based trading platform providing custody services for eight of the nine newly approved financial instruments.

“Another huge step forward for regulatory clarity: ETH is not a security! We have been saying it for years and today the SEC finally made it official. Coinbase is proud to be the trusted partner and custodian powering 8 of the 9 newly approved ETH ETFs,” Armstrong noted.

Read more: Ethereum ETF Explained: What It Is and How It Works

In May, the US SEC suggested that ETH could be classified as a security. The development threatened spot Ethereum ETF approval odds at the time as the regulator sought public input on Ethereum’s classification. In April, blockchain software company Consensys gave four compelling reasons why Ethereum should not be deemed a security.

“We anticipate significant positive effects from ETH ETFs on both Ethereum and the broader crypto market. Drawing from the experience of Bitcoin ETFs, we foresee substantial institutional demand for Ethereum, leading to increased attention and capital inflows into the larger ecosystem. Ethereum stands to benefit as an attractive diversification option alongside Bitcoin within institutional portfolios. If interest correlates to that we’ve seen with Bitcoin ETFs, we could witness increased institutional engagement with Ethereum, driven by its distinct value proposition,” LightLink CEO & Co-founder Roy Hui told BeInCrypto.

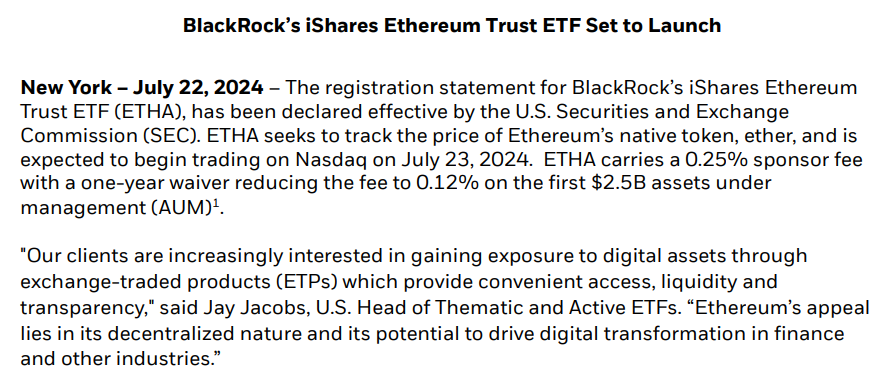

Ethereum ETF issuers that utilize Coinbase’s services include BlackRock, Franklin Templeton, Grayscale, Bitwise, 21Shares, Invesco, and Grayscale. Coinbase also provides custody services for multiple spot Bitcoin ETF issuers. Coinbase custody services are crucial as they ensure the secure preservation of tokens for investors.

With this development, Coinbase operates a substantial part of the US-based spot trading platform for Bitcoin and Ethereum. As the largest US-based crypto trading platform, it represents a significant portion of US-based and USD-denominated BBTC and ETH trading. Its collaboration with the Chicago Board Options Exchange (Cboe) started on June 21, 2023, as the Bitcoin spot ETF campaign ramped up.

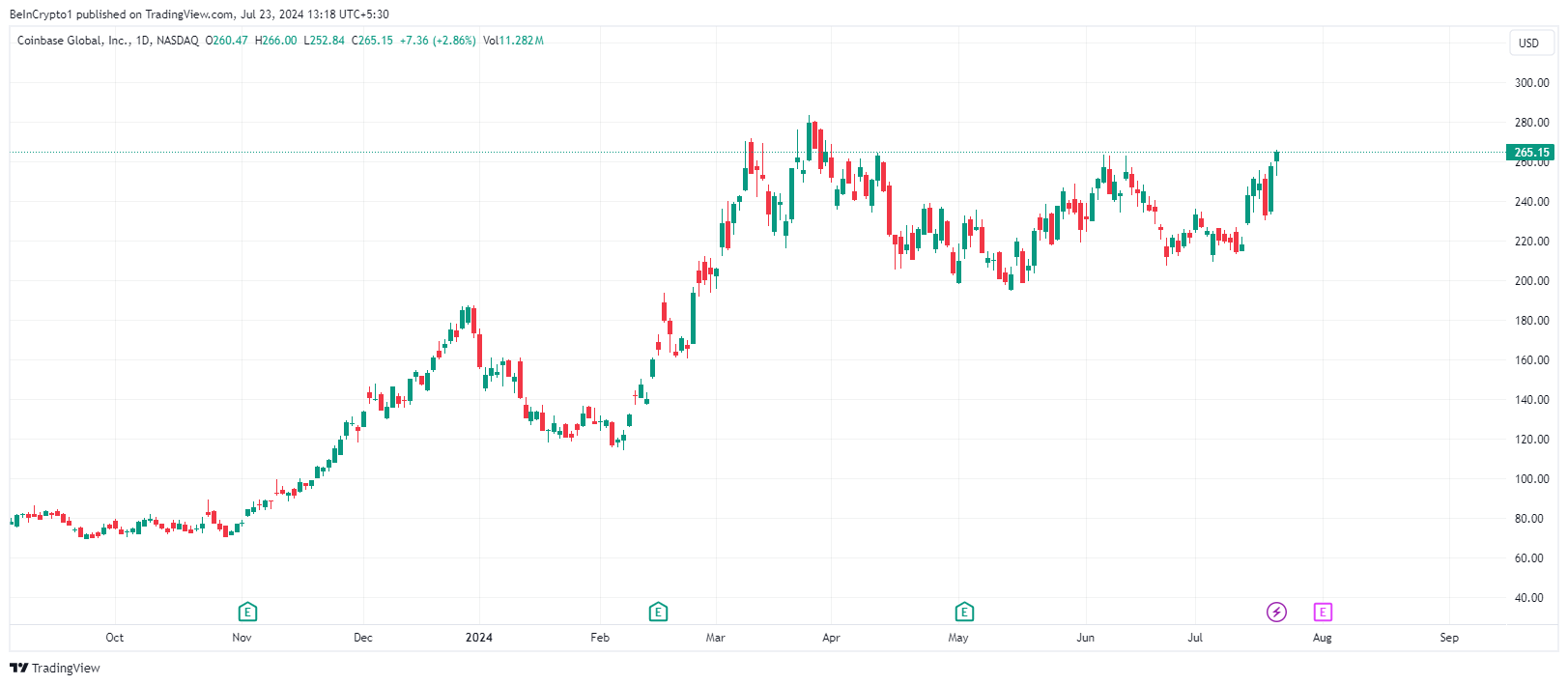

Following this development, Coinbase stock, COIN, is up nearly 10% to trade for $265.15 as of press time.

BlackRock and Bitwise Comment on Ethereum ETF Launch

In a statement, BlackRock, one of the ETH ETF issuers, said, “Ethereum’s appeal lies in its decentralized nature and potential to drive digital transformation in finance and other industries. With this launch, institutional players can now enjoy direct access to Ethereum.

Elsewhere, another Ethereum ETF issuer, Bitwise, has committed to donate 10% of the Bitwise Ethereum ETF (ETHW) profits to Ethereum open-source protocol development.

“Bitwise will donate 10% of the profits of the Bitwise Ethereum ETF (ETHW) to Ethereum open-source protocol development. Recipient orgs: – ProtocolGuild and PBS Foundation. We cannot take Ethereum and its core protocol properties for granted. We are excited for ETHW to support the work of those who tend to the Ethereum protocol. These unsung heroes work tirelessly every day to improve Ethereum’s security, scalability, and usability. Donations will be made annually for at least the next 10 years. Recipient organizations are subject to change based on annual review,” the announcement read as Bitwise Ethereum ETF went live.

Bitwise has been vocal on Ethereum ETFs, posting a bold ad campaign in June mocking limitations in TradFi. Recently, the firm predicted the Ethereum price could rally past $5,000 post-ETH ETF launch.

Read more: How to Invest in Ethereum ETFs?

While the announcement did not catalyze a rally in ETH price, the approval conditions and subsequent launch show how crypto assets can transition over time. It also indicates a maturing regulatory environment in the US, highlighting the ongoing innovation within the cryptocurrency industry.