China is dedicated to becoming the first country to roll out a central bank digital currency (CBDC). Its Digital Currency Electronic Payment (DCEP) system aims to replace all physical currency in the country, including coinage.

The DCEP has been on trial for months, with thousands of government employees receiving it as part of their salaries. The People’s Bank of China (PBoC) envisions the DCEP as an opportunity to take on AliPay and WeChat Pay.

The two tech giants currently dominate in the digital payments arena. Why is China so interested in developing a digital currency? And will it potentially impact the dollar, bitcoin, and other cryptocurrencies?

The Biggest Market in the World

China has the biggest mobile payment market on the planet. Chinese citizens can do almost anything through their phones today. From government-related paperwork to bill payments or sending money to friends.

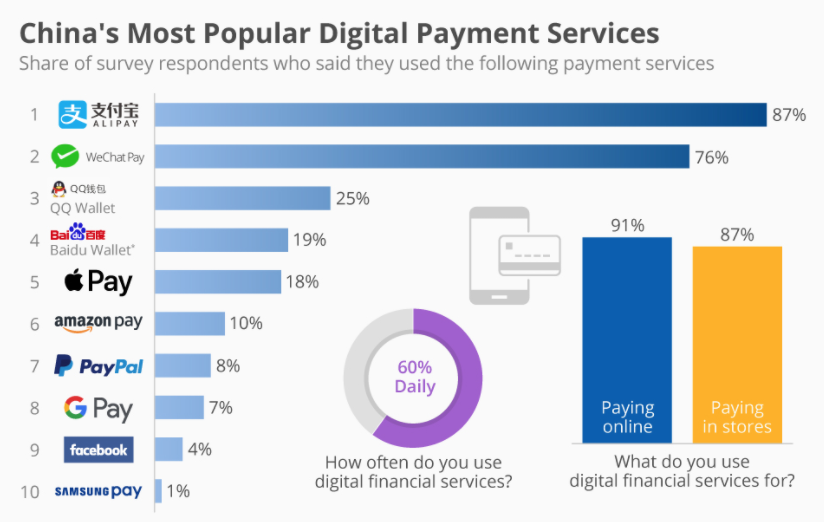

The Chinese also dominate in online shopping and pre-ordering for collection. An estimated 60% of the population uses digital payments on a daily basis.

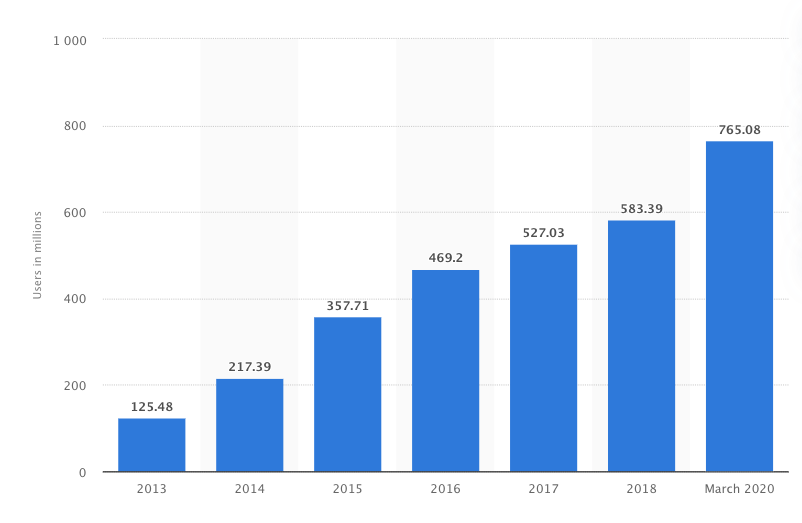

With 765 million Chinese consumers using mobile payments, it’s no surprise that the Chinese central bank wants a slice of the cake. The PBoC has partnered with four commercial banks to start issuing its digital currency replacement. But first, it needs to win the mobile market.

The Fight for Digital Payments

At the moment, Alibaba’s Alipay and Tencent’s WeChat Pay are leading the digital payment market, followed by the QQ and Baidu wallets. Almost all major Chinese internet players have launched their own payment services successfully.

Big Western names like Apple, Google, and Amazon appear to be falling behind their Chinese counterparts. Even Paypal, the online payment veteran, is having trouble competing.

Alipay had 55.4% of China’s mobile payment market during the first quarter of 2020. The development of the PBoC’s digital yuan comes at the same time as Ant’s dual listing request.

Ant, the company that controls Alipay applied for listings in both the Hong Kong and Shanghai stock markets. It’s unclear yet what support it will receive from China’s financial regulators. According to a senior executive at the Hong Kong Monetary Authority:

“It is about the role of a digital currency for domestic retail use… They want a more level playing field for the banks. Retail payments are so dominated by Alibaba and Tencent while banks are less active in electronic payments.”

The DCEP and the Big Picture

With growing competition from private Chinese firms, the PBoC will use its digital currency to reinforce China’s role as a rising superpower.

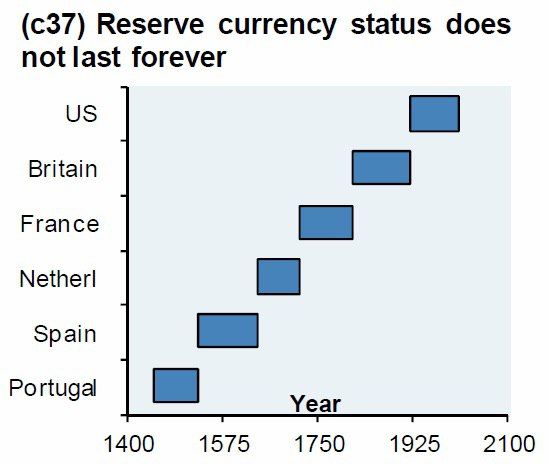

One of its aims is to elevate the status of the Chinese yuan as a reserve currency. The sterling pound was the world’s reserve currency during the British empire, and the American dollar took over after the Second World War.

Nowadays, a handful of currencies dominate, like the Japanese yen, the euro, and the Chinese yuan. However, only the American dollar holds the mantle as reserve currency.

China intends to expand the reputation of the yuan in the hopes that it will become the lifeblood of global trade. Its advanced mobile payment systems and a digital-savvy population make it well-positioned to take over in the 21st century.

The DCEP may become the system of choice for trade in a multipolar world. Huge infrastructure projects along the new Silk Road, known as the ‘One Belt, One Road’ initiative, may assist China in becoming a global lender.

If all its trading partners are forced to use the DCEP in order to buy and sell from the country, the dollar could be at risk.

Central Banking the Unbanked

It’ll take a few years for this digital currency to get a national rollout, though. A global release will take even longer. However, China’s moves also trigger concerns about American financial dominance.

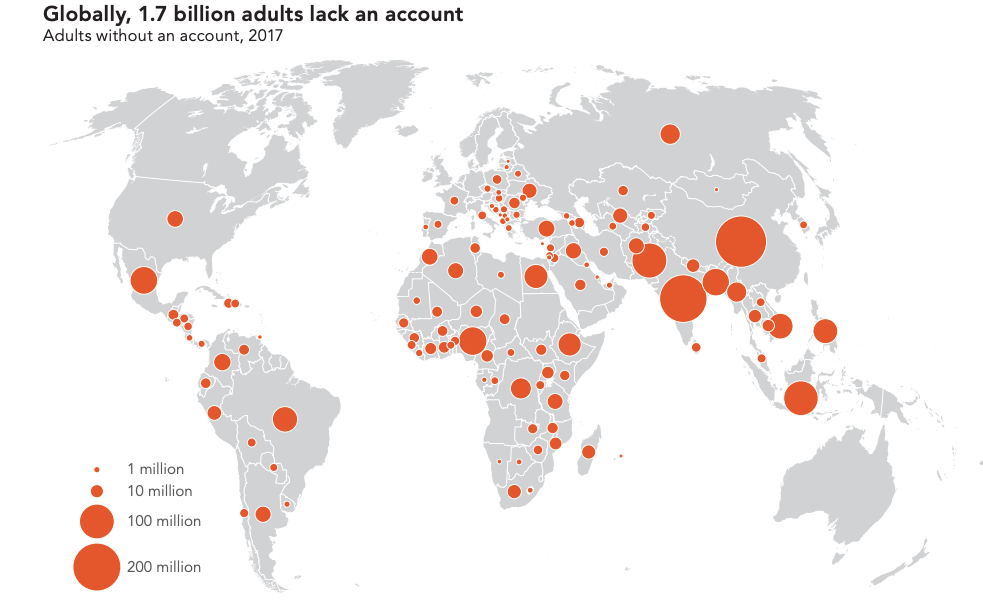

China not only wants to bypass global sanctions and Western-dominated payment systems, it also wants to avoid the current financial system altogether. Banking the unbanked is a major goal of the PBoC, aiming to avoid the need for bank accounts altogether.

Consumers will only have digital wallets, from where they will send and receive money. Those transactions will be closely monitored, of course, by Chinese authorities.

This centralized digital money opposes the vision of cryptocurrencies like Bitcoin. These cryptocurrencies intend to decentralize financial markets and disrupt predatory intermediaries.

The PBoC has indicated that transactions may be subject to limits, with users requiring permission for large transfers.

If the digital yuan takes off, China will likely tie it to its social-credit system. For many, this raises concerns, as the potential global expansion of the DCEP may come with social controls attached.

Is a Digital Yuan Good for Crypto?

Although some might think that China’s quest for a centralized digital currency will be bad for crypto, the opposite seems true. Decentralized crypto use cases may actually be strengthened by the DCEP.

China has had a love-hate relationship with crypto. It has swung from being a primary bitcoin trader to banning crypto. Even today, most bitcoin miners are based in the Asian giant.

If the DCEP grows dramatically with its rollout, bitcoin and other major cryptos may see a parallel rise in popularity. A superpower backing digital money could be a positive force for mainstream adoption.

Privacy-oriented cryptos like Monero may also see increased demand, as users likely move their assets away from the prying eyes of central banks.

The world may even see competing superpowers support bitcoin or ethereum as a way to stop the proliferation of the digital yuan.