Cardano has trended downward since it climbed to a year-to-date peak of $0.77 on March 11. Exchanging hands at $0.41 at press time, the altcoin’s value has since dropped by 48%.

Despite this decline, on-chain data reveals that ADA holders have significantly reduced their selling activity over.

Cardano Holders Sit on Coins for Long-Term Gains

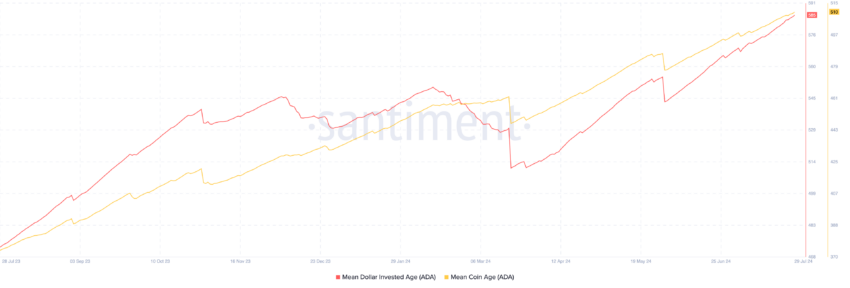

The decline in ADA’s distribution is evident from its rising Mean Coin Age and Mean Dollar Invested Age. Since initiating their uptrend on May 30, these on-chain metrics have increased by 7%. According to Santiment’s data, ADA’s Mean Coin Age is 510 days at press time, while its Mean Dollar Invested Age is 585 days, both at their yearly highs.

An asset’s Mean Coin Age tracks the average age of all its coins or tokens in circulation. It measures how long coins have been held by investors on average. On the other hand, the Mean Dollar Invested age measures the average age of every dollar invested into the market capitalization of a coin.

Generally, the spike in ADA’s mean coin age and mean dollar invested age in the past two months is a bullish sign. It signals that its investors are holding on to their coins, reducing selling pressure.

This can also be confirmed by the surge in ADA’s large holders’ inflow, which has risen by over 20,000% in the past 90 days, according to IntoTheBlock’s data.

Read More: 6 Best Cardano (ADA) Wallets You Should Consider in July 2024

Large holders refer to addresses that hold over 0.1% of an asset’s circulating supply. Large holders inflow tracks the amount of assets flowing into addresses belonging to this cohort of investors. When it spikes, it signals a surge in buying pressure.

ADA Price Prediction: Brace For Short-Term Price Decline

A combined reading of the on-chain metrics above suggests that ADA holders have bought more coins and sold fewer coins in the past few months.

However, this merely points to investors’ belief in the altcoin’s long-term potential. In the near term, ADA is poised to decline.

At press time, the ADA’s Moving Average Convergence/Divergence (MACD) indicator is set up to confirm the bearish bias that currently trails it. Its MACD line (blue) currently rests below its signal line (orange).

The MACD indicator tracks an asset’s price strength and direction. When the MACD line is below the Signal line, it is a bearish signal. It signals that the asset’s short-term trend is weaker than its longer-term trend. Traders interpret it as a sign to take short positions, hinting at a continued price decline.

If the downtrend persists, ADA risks falling to $0.31, marking the second time it has traded at that low since October 31, 2023.

However, if buying momentum spikes and ADA trends upward, it may rally to $0.43.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.