In the first quarter of 2024, Cardano’s (ADA) price surged from $0.46 to $0.80 in under three months. This performance hinted at a run toward the $1 mark. However, since then, the altcoin has been in freefall, showing little to no signs of repeating that performance.

While broader market conditions contributed to Cardano’s decline, other factors have also affected its underperformance. This on-chain analysis highlights the key reasons ADA’s price has struggled to reach the point it last reached in 2022.

Supply Wall at $1.04 Poses Challenges for Cardano

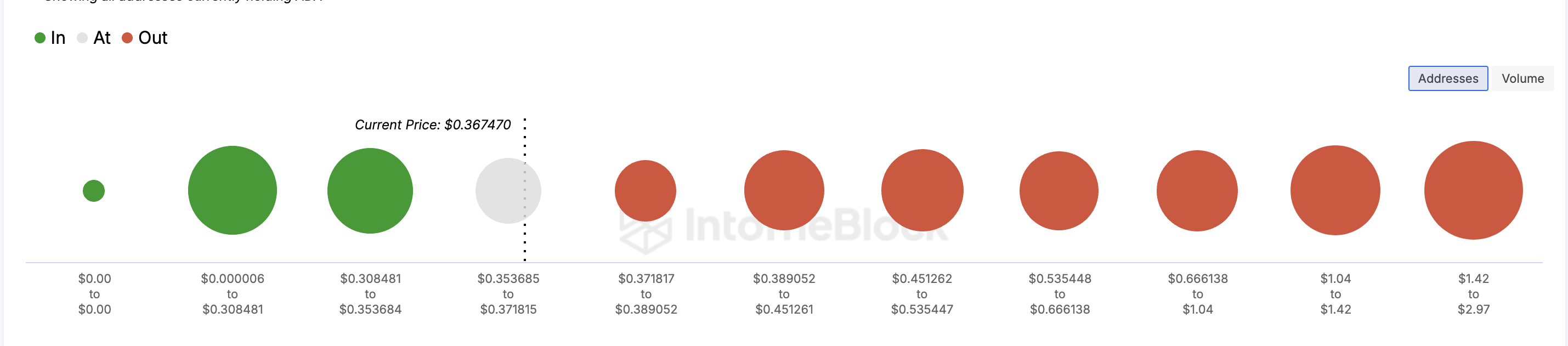

One key reason for Cardano’s price performance is the significant supply wall beginning at $1.04. According to the Global In/Out of Money (GIOM) metric, over 1 million addresses have accumulated more than 2 billion ADA at this level.

The GIOM classifies addresses based on their profit positions, those breaking even, and those out of money. From a price perspective, the larger the cluster of addresses or volume at a specific price range, the stronger the support or resistance.

The image below shows that the addresses and volume around $0.35 are higher than those at several price ranges up until $0.66. As such, Cardano’s price has the potential to reach that point. However, the supply wall at $1.04 creates significant resistance, which could make it difficult for the ADA to break past that level.

Read more: How to Stake Cardano (ADA)

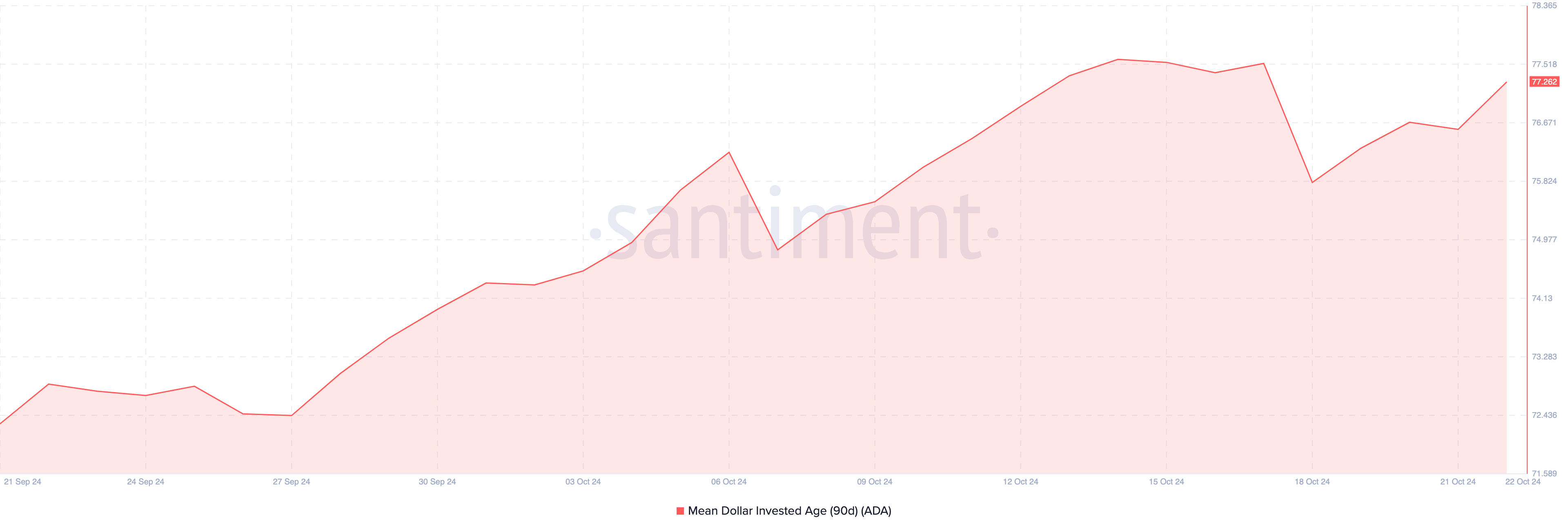

Another factor contributing to the bearish pressure on ADA is the state of the Mean Dollar Invested Age (MDIA). The MDIA represents the average age of every dollar invested in a cryptocurrency.

In bull markets, a declining MDIA suggests that whales are reactivating dormant coins and moving them back into circulation, which often boosts prices.

However, in ADA’s case, the 90-day MDIA has been steadily rising, indicating that long-term holders are not moving their assets. This trend signals that price growth may be difficult to achieve as investor activity remains stagnant.

ADA Price Prediction: At Risk of Hitting $0.32

On the daily chart, Cardano’s price is $0.37, but it is trading alongside a head-and-shoulders pattern. A head and shoulders pattern is a bullish to bearish reversal pattern that usually accelerates a downtrend.

Beyond that, ADA is facing notable resistance at the current level, indicating that it might be challenging for the token to trade higher. Should this remain the same, Cardano’s price might drop toward $0.32 in the short term.

Read more: 6 Best Cardano (ADA) Wallets You Should Consider in October 2024

However, the long-term outlook for the token could be bullish if the broader market conditions improve. Specifically, if Bitcoin (BTC) climbs above $70,000, ADA’s price might also begin to move upward. If BTC hits a new all-time high, the altcoin might hit $0.61 and possibly inch closer to $1.