Popular altcoin Solana has shed nearly 10% of its value over the past week, and the bearish pressure does not appear to be letting up. The token dropped to $129 today, as geopolitical tensions between the US and Iran escalate.

As the second quarter of 2025 draws to a close, mounting selloffs have placed Solana’s price at risk of breaking below the crucial $130 support level. This analysis explains how.

SOL Slips as Key Indicators Remain Bearish

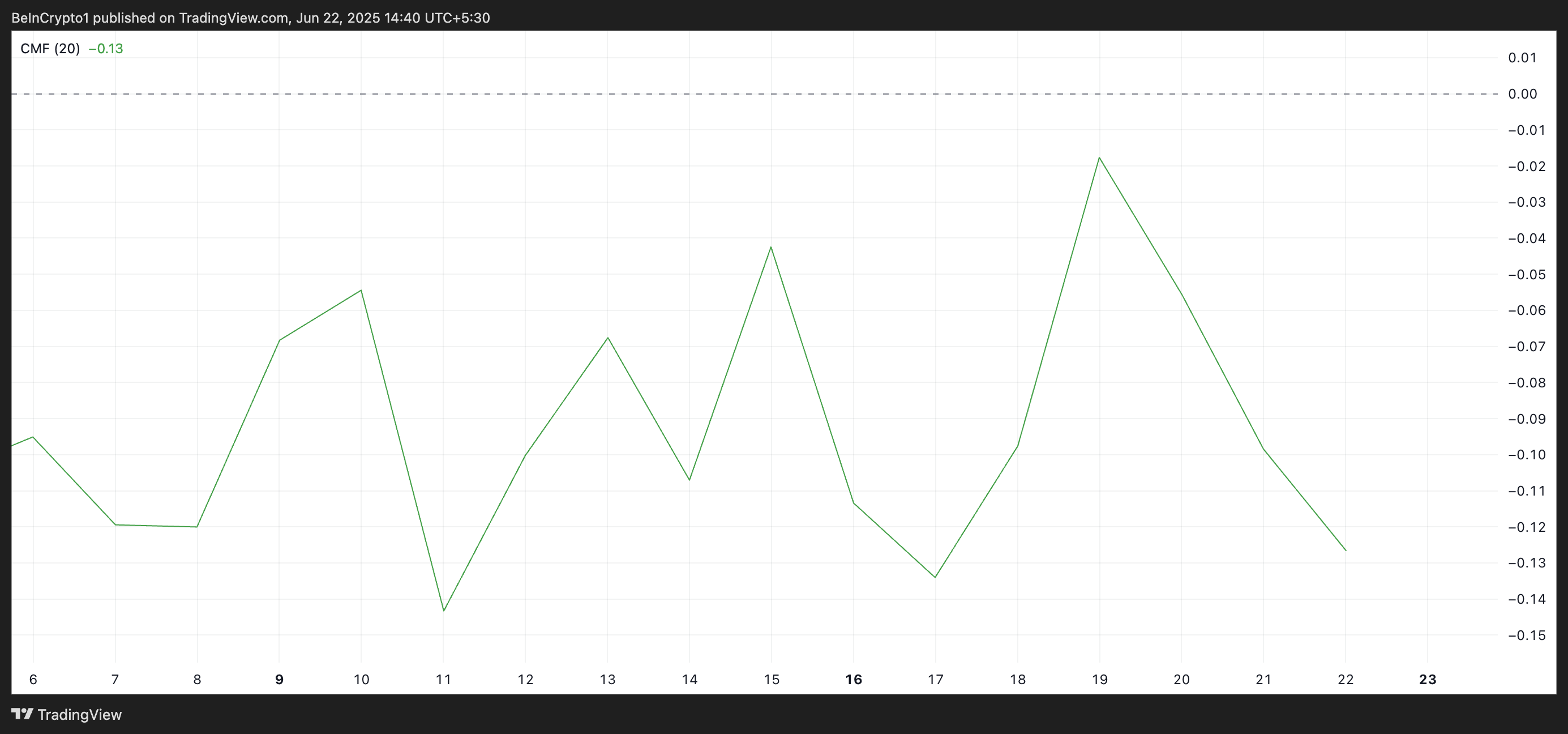

Over the past seven days, SOL’s price has steadily declined. This has been accompanied by a dip in the coin’s Chaikin Money Flow (CMF), which has fallen deeper into negative territory. As of this writing, SOL’s CMF is at -0.13.

The CMF measures the flow of money into and out of an asset over a specific period, typically 20 or 21 days. It combines price and volume data to assess buying and selling pressure. When an asset’s CMF is positive, buying volume is dominant and capital is flowing into the asset, indicating potential bullish sentiment.

Conversely, when the CMF turns negative, selling volume outweighs buying volume, meaning money flows out. This signals weakening demand for SOL, especially if the negative reading deepens while price declines.

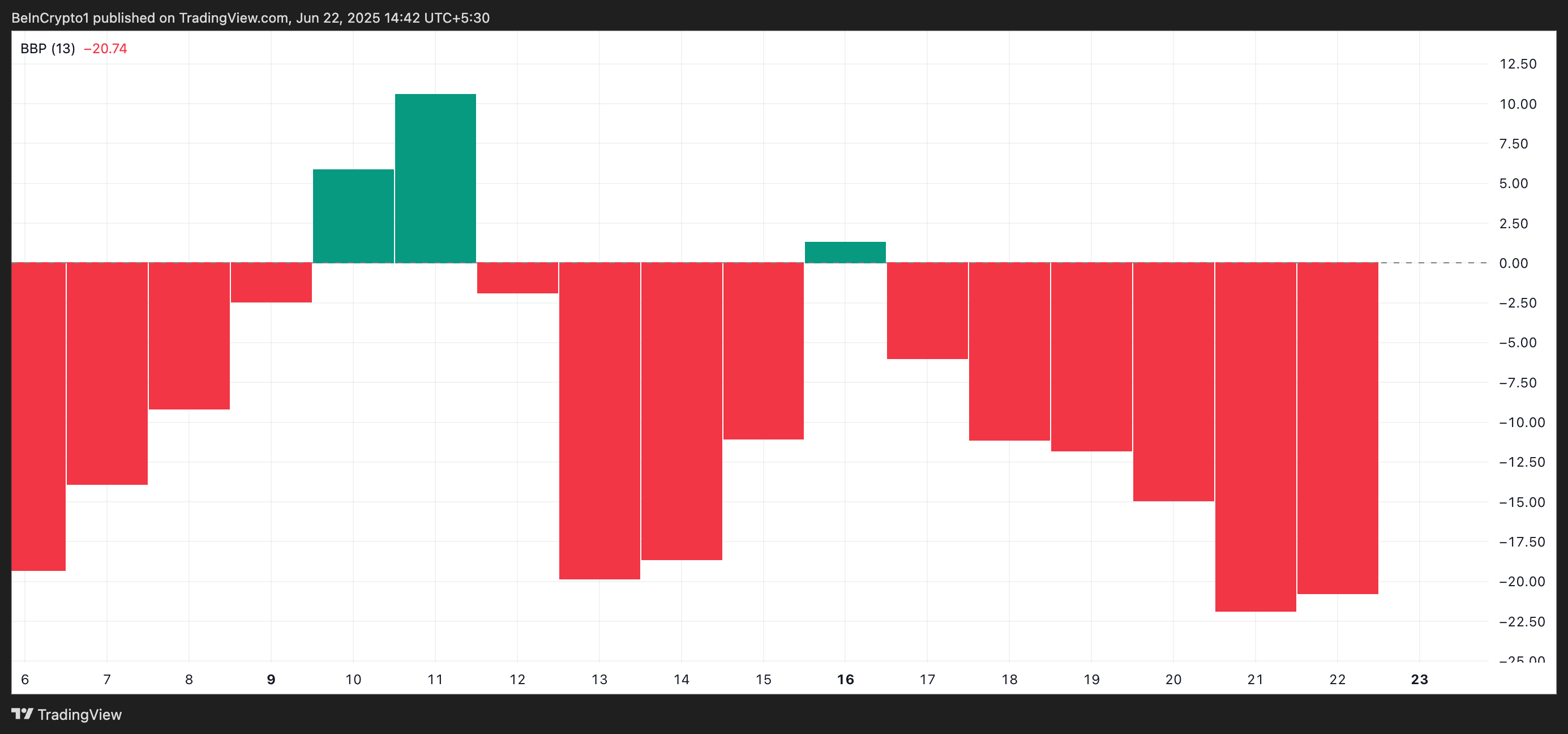

Moreover, the coin’s Elder-Ray Index, which gauges the balance between buyers and sellers, is at -20.74, signifying that sellers are firmly in control.

This indicator measures the strength of bulls and bears in the market by analyzing the difference between an asset’s price and a moving average. When it is negative, bears dominate, as prices consistently fall below the average, suggesting selling pressure outweighs buying interest.

Will SOL Recover Above $130 or Is a Drop to $123 Looming?

This bear dominance reflects the growing conviction that SOL’s price could decline further, particularly if $134 fails to hold as a support floor.

Meanwhile, a breakdown below this level could open the door for deeper losses, potentially dragging SOL toward $123.49.

However, if bulls manage to regain control, they could push Solana’s price upward to $142.59.