Bitcoin whales continue to accumulate the crypto, while exchanges see an increase in deposits, potentially signaling bearish selling pressure.

Bitcoin has hit a new monthly low of $31,000 for July. However, according to on-chain analysis firm Santiment, large bitcoin addresses continue to accumulate as the price declines.

Santiment stated that the ‘millionaire tier’ of addresses that hold between 100 and 10,000 BTC continues to climb. “The cumulative amount of holdings for these whales has increased by 100,000 BTC since May 21,” Santiment stated.

BTC continues to look bearish

While it may appear that bitcoin whales are accumulating BTC on the dips, CryptoQuant has previously stated that the bitcoin bear market was confirmed on June 21. The on-chain analysis company reiterated that “too many whales are sending BTC to exchanges.”

CEO of CryptoQuant, Ki Young Ju recently tweeted that “BTC selling pressure seems to be high.” According to Ju, the indicator shows that the exchange whale ratio is over 85%. “When this indicator constantly keeps above 85%, the market has usually been bearish.”

BTC volume surges

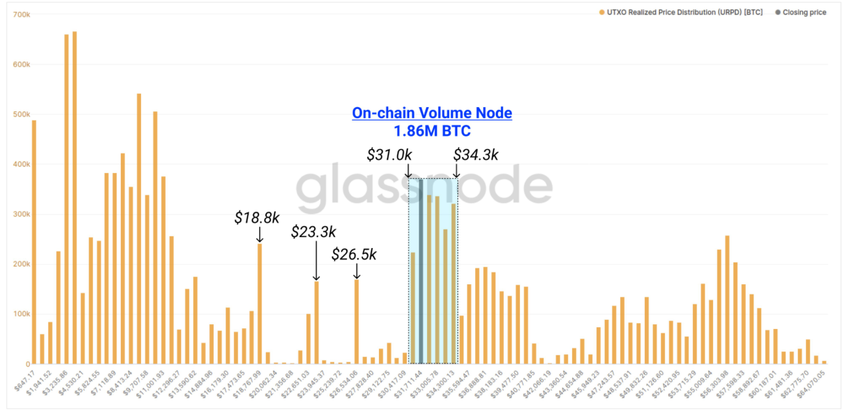

On-chain analysis from Glassnode also indicates some interesting facts. The company indicates that bitcoin is trading near the lows of a significant on-chain volume node.

Bitcoin has seen over 1.86 million bitcoin transacted on-chain, between the $31,000 and $34,300 price range. This equates to 9.93% of the circulating supply. “This is now convincingly the largest realised volume cluster since $12k,” Glassnode stated.

Bitcoin is currently priced at $31,800. Down almost 10% for the month of July, while being down a hefty 51% since the all-time high of $64,000 set in April.