Leading crypto Bitcoin (BTC) shows signs of a potential surge as the market watches today’s Federal Reserve meeting. The Fed is expected to deliver its first rate cut since December 2024 today.

On-chain data signals that traders are positioning for a rally, as they anticipate that easing monetary policy could act as the catalyst for BTC to reclaim $120,000.

Bitcoin Set for Lift-Off as Fed Rate Cut Hopes Boost Investor Confidence

The two-day Fed meeting began on Tuesday and has heightened anticipation in the crypto market. Traders are betting that a reduction in interest rates will inject fresh capital into risk assets, pushing BTC’s value upward.

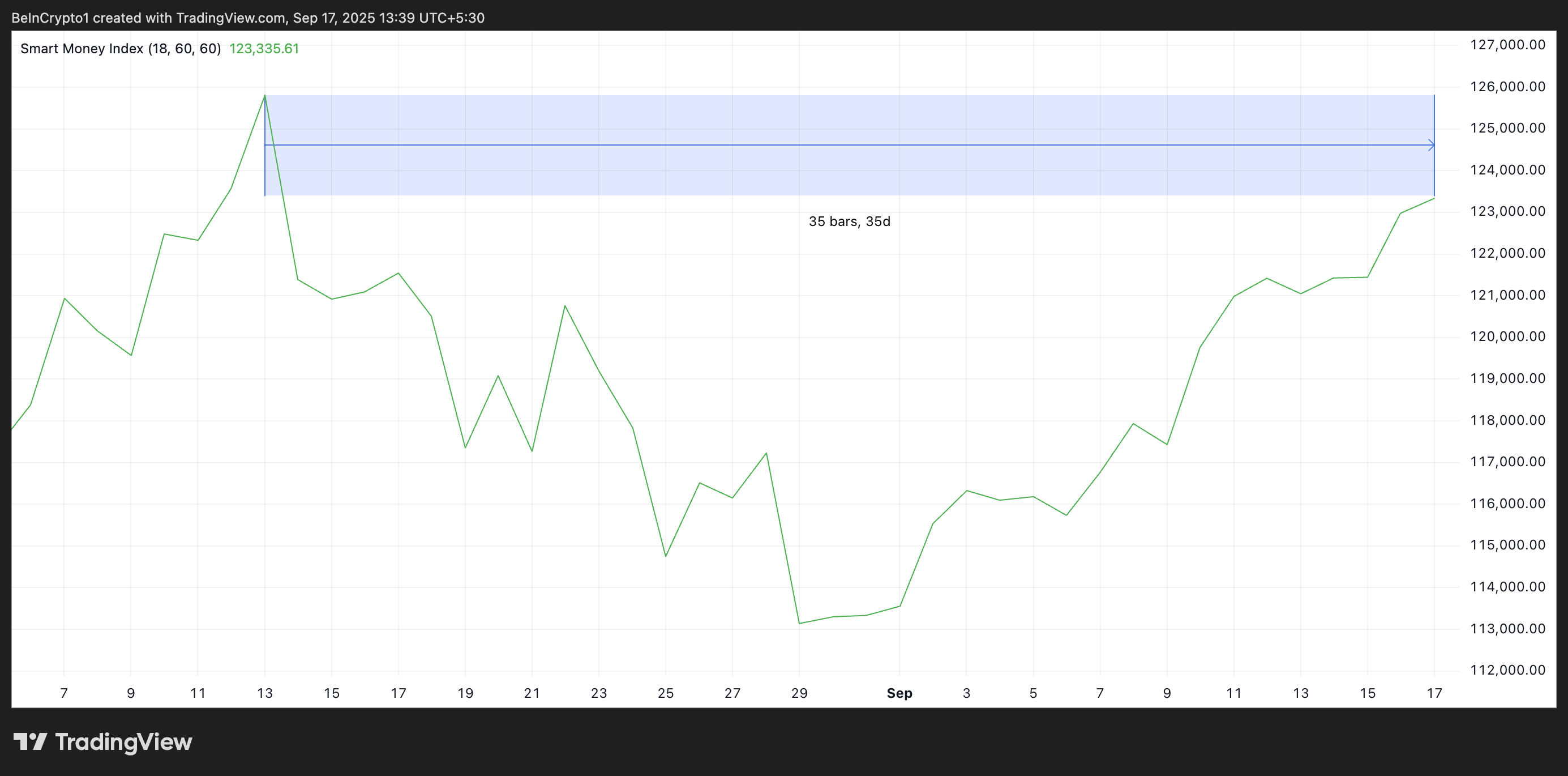

Readings from technical indicators support this bullish sentiment. For example, BTC’s Smart Money Index (SMI) is in an uptrend, signaling that key players are increasingly adding the digital asset to their holdings. As of this writing, the momentum indicator rests at a 35-day high of 123,400.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

The SMI indicator tracks institutional investor activity by analyzing price movements during specific times of the trading day, particularly end-of-day sessions.

A surge in the SMI signals growing confidence among institutional investors, pointing to a bullish market outlook. BTC’s rising SMI signals that major investors are accumulating ahead of the FOMC meeting, reflecting strong confidence in a sustained rally.

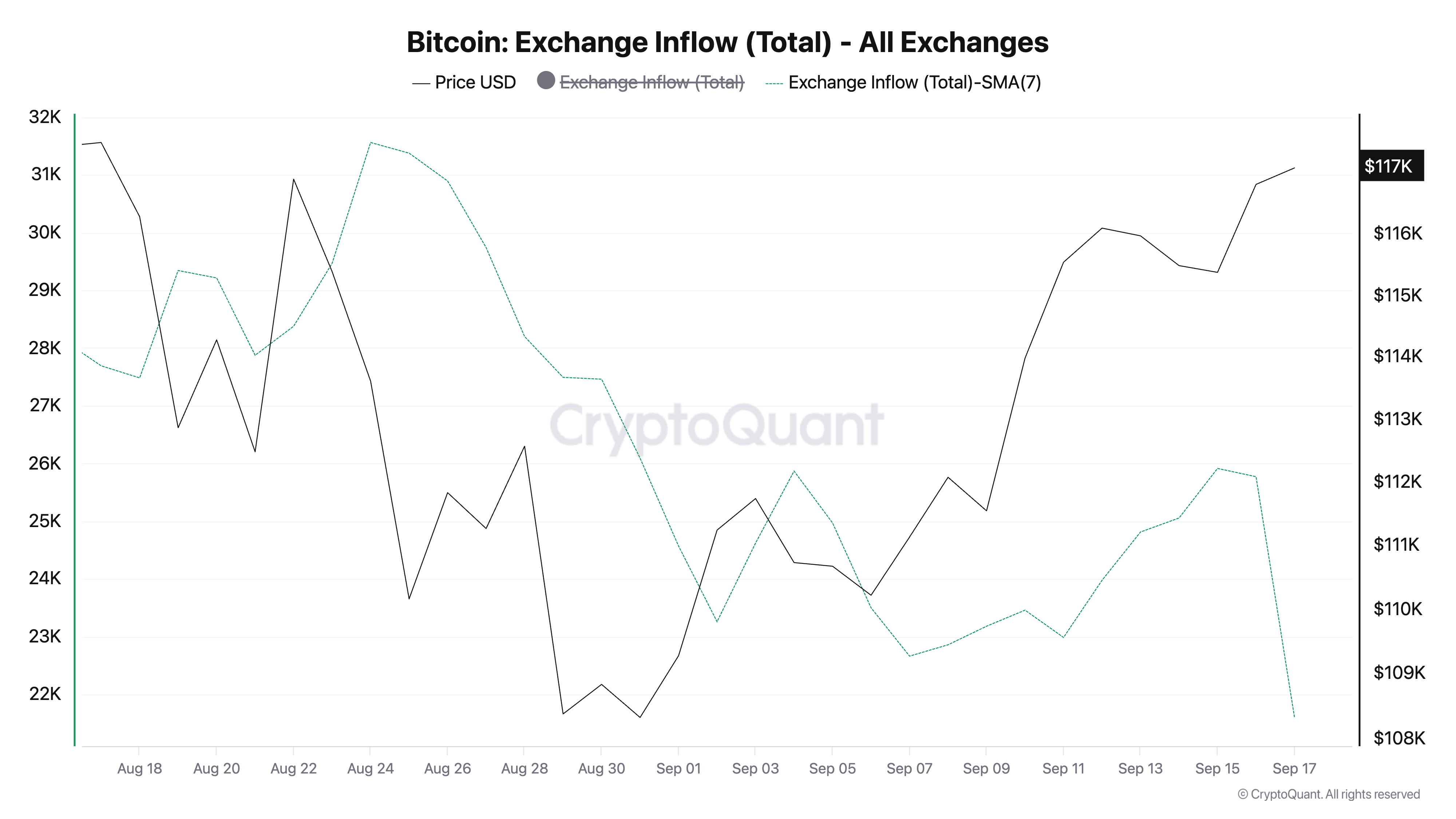

Additionally, BTC exchange inflows have dropped to their lowest levels in over 18 months, signaling a decline in broader market selloffs.

According to CryptoQuant’s data, the 7-day moving average of exchange inflows has fallen to 21,000 BTC, down sharply from 51,000 BTC in July.

The average BTC deposit per transaction has also halved, from 1.14 BTC in mid-July to 0.57 BTC in September. According to a new CryptoQuant report, this signals diminished selling pressure from larger holders.

These trends indicate that selling pressure across the market is easing, which could help stabilize the coin’s price and create conditions for a sustained upward move.

$120,000 Within Reach if Market Holds Key Support

With fewer coins entering exchanges and accumulation rising, the market is signaling growing confidence. It increases the likelihood of a rally toward $120,000 in the near term.

However, for this to happen, the king coin must first break above the barrier at $119,367 and flip it into a support floor. If successful, this could pave the way for a BTC price rally toward $122,190.

However, a shift in the hodling pattern toward distribution could prevent this. In that scenario, the coin’s value could dip toward support at $115,892.