The US Federal Reserve (Fed) announced an interest rate hike of 50 basis points. The price of Bitcoin plummets following the announcement.

After four consecutive 75 basis point hikes, the Fed slowed down its monetary tightening policy in the last FOMC meeting of the year. With the 50 basis points hike, the Fed interest rate now stands at 4.5%.

The Fed interest rates stood at 0% in Jan. 2022, but by the year-end, it is now the highest since late 2007.

The market expected a 50 basis point hike since the announcement of lower-than-expected year-on-year Consumer Price Index (CPI) rates. On Tuesday, the CPI was announced at 7.1%, lower than the estimated CPI of 7.3%

Market Participants Sold the News.

There was a significant pump in crypto and stock markets in anticipation of the 50 basis point hike. But the markets behaved in the opposite direction upon the announcement.

The S&P 500 fell by 1.5%, while the Nasdaq fell by 1.8%. The crypto market also saw the negative impact of the interest rate hike, with Bitcoin plummeting by nearly 3.5% and Ethereum by almost 3%. The BeInCrypto trading community believes that the market participants bought the rumor of the 50 basis points hike and sold the news.

$18 Million Liquidated in 1 Hour

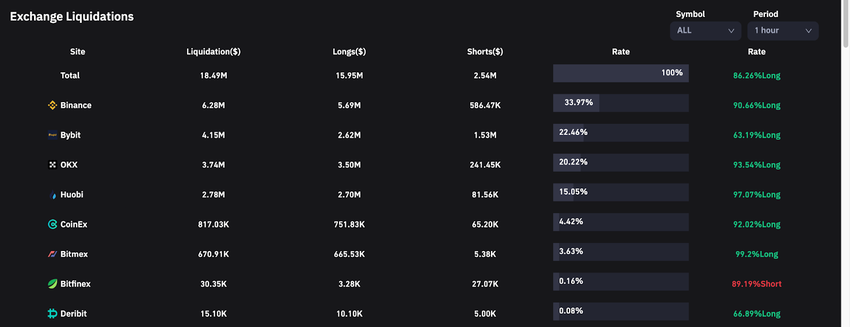

According to data from Coinglass, over $18 million worth of trades were liquidated from crypto exchanges in 1 hour after the announcement of 50 basis points interest rate hike.

The crypto traders who had bets on the bullish market momentum suffered liquidations. Amongst all the trades, 86.26% of longs worth $15.95 Million got liquidated.

Recession to Amplify in 2023?

The Fed chairman Jerome Powell’s speech suggested that the Fed will likely continue the interest rate hike in 2023. He stated that “Historical experience cautions strongly against prematurely loosening policy. I wouldn’t see us considering rate cuts until the committee is confident that inflation is moving down to 2% in a sustained way.”

The community is disappointed and believes the Fed is committed to put the US economy in a high unemployment recession. In contrast, others favor the interest rate hike stating that there is no other solution.

Elon Musk predicted earlier this month that the recession would be greatly amplified if the Fed raises the interest rates again. What are your thoughts on this, now that the Fed has again raised the interest rates?

Got something to say about the 50 Basis Points interest rate hike or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on Tik Tok, Facebook, or Twitter.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here