Be[in]Crypto takes a look at on-chain indicators for Bitcoin (BTC), more specifically the exchange balances and Accumulation Trend Score.

Accumulation Trend Score

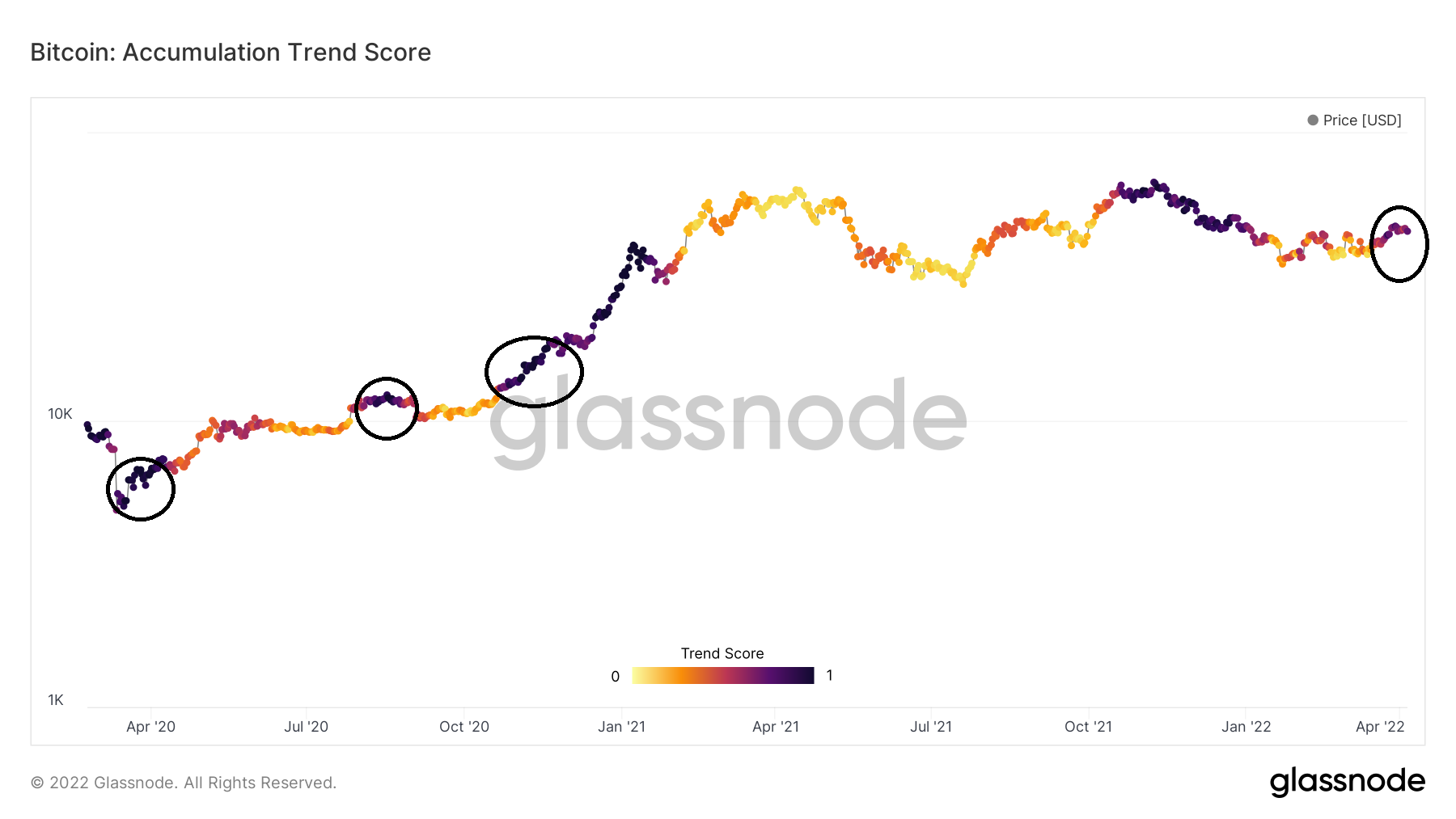

The Accumulation Trend Score is an indicator used to reflect the size of entities that are participating in BTC transactions.

The indicator shows both the size of these entities and the number of new coins that they have gained/lost. The former is done by dividing their holdings over the total supply, while the latter is done by their relative balance change.

Values close to 1 (purple) suggest that large entities are accumulating, while those close to 0 (yellow) suggest that they are distributing instead.

Historically, values close to 0 (black circle) are reached in the first bounces after a bear market begins.

The reason for this is that large holders are offloading their positions in anticipation of a long-term downtrend. This is also evident when looking at the HODL wave.

Currently, the indicator shows a value of 0.78, which means that large holders are dominating current transactions.

With the exception of the period between Oct 2021 and Jan 2022, such values have been seen prior to significant upwards price swings (black circles). It remains to be seen if the same will occur this time around.

Bitcoin (BTC) exchange balance

The amount of BTC that is held on exchanges has been decreasing since 3,118,057 coins were held in exchange addresses. The value is an all-time high.

BTC held on exchange wallets has been falling since March 2020 (black circle), when a total of 3,118,057 coins were held in exchange addresses. This value still stands at an all-time high.

In the period between April 2021 and March 2022, the balance hovered between 2,500,000 and 2,700,000. This potentially resembled a period of accumulation prior to another increase.

However, another sharp fall ensued at the end of March (red arrow) and the number of BTC on exchange addresses is currently at 2,473,758. This is the lowest value since Sept 2018.

As seen in the first section, it is likely that these BTC are moving into the cold storage of large holders.

For Be[in]Crypto’s latest Bitcoin (BTC) analysis, click here

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.