Breakdown time: Olga Ortega, the co-founder and CPO of the real-time DeFi explorer AnalytEx by HashEx explains some of the concepts in decentralized protocols.

There are countless decentralized protocols and opportunities to use them. In AnalytEx, we know that more than a thousand smart contracts with the signature of MasterChef are created monthly, which are usually called farms. In addition to farms, many people know about the existence of pools. There are several commonly known kinds of pools, like liquidity pools, syrup pools or staking pools, but how do they really differ?

Even experienced investors find it difficult to understand the terminology used in protocols as it varies. Let’s take a closer look at the details, using the top decentralized protocols by TVL, according to AnalytEx, such as Pancakeswap, Apeswap, Uniswap and Sushiswap.

What is a Liquidity Pool?

A liquidity pool is a trading pair of tokens with locked funds of liquidity providers. When investors put two tokens into a liquidity pool, they create an LP token and receive income from all swaps made between these two tokens on a specific protocol. The only risk they agree to by creating an LP token is the so-called “impermanent loss”.

What is Impermanent Loss?

The crypto market is well-known for its volatility. When the price of tokens changes its value. In this regard, liquidity providers may incur an impermanent loss when two tokens in the liquidity pool move in price differently (a negative correlation), which subsequently leads to a change in the ratio of tokens in the pool. This happens to stabilize the overall value of the pool.

For example, an investor deposits 310 BUSD and 1 BNB into the liquidity pool by creating an LP token. In addition to this investor, there are 9 other investors who contributed the same amount to the same pool. It turns out that the total value of the pool is 10 BNB and 3100 BUSD, for a total of $6200. So each investor owns 10% of the pool and they would all get back 1 BNB and 310 BUSD upon withdrawal.

But what happens if the price of BNB goes down? The pool will have more BNB, but less BUSD. Thus, investors will still have 10% of the pool, but now in USD. This amount will be less than the original amount because BNB has fallen in price relative to BUSD. This is called impermanent loss.

It is impermanent since it is implemented only when liquidity is withdrawn from the pool. If the investor does not touch the funds in the pool, the liquidity value may return to its original levels. We should also not forget that investors receive income from the liquidity providing, which can compensate for impermanent losses.

Liquidity pools consisting of pairs of stablecoins or pairs of tokens with a positive correlation (when two tokens in the liquidity pool move in price together) are considered to be the safest, but always make sure to DYOR.

Breakdown: What is a farm?

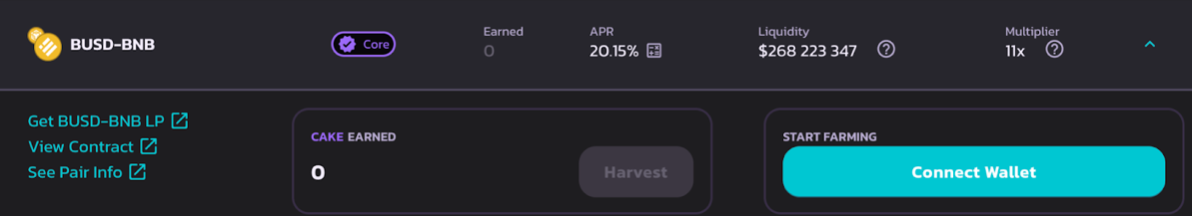

A farm is a smart contract in which you can place LP tokens in order to receive additional income in the tokens of the protocol that you use. For example, if you put your LP token, consisting of BNB and BUZD pairs, in Pancakeswap, you will receive a token of this protocol called CAKE (which, at the time of writing, has an APR of 20.15%). At the same time, the investor will receive a double reward, for staking the LP token, and for providing liquidity in the BUSD-BNB pair.

Very often, a farm is simply called a decentralized protocol that has the possibility of farming, for example, the Pancakeswap Farm – this is not entirely true.

In fact, it is correct to call a farm a MasterChef contract, which allows you to receive income in protocol tokens, regardless of whether an investor puts an LP token (a pair of tokens) or a regular token into it. All of this belongs to the MasterChef contract and should be called a farm.

Breakdown time: Pancake interface

Let’s consider the Pancakeswap interface.

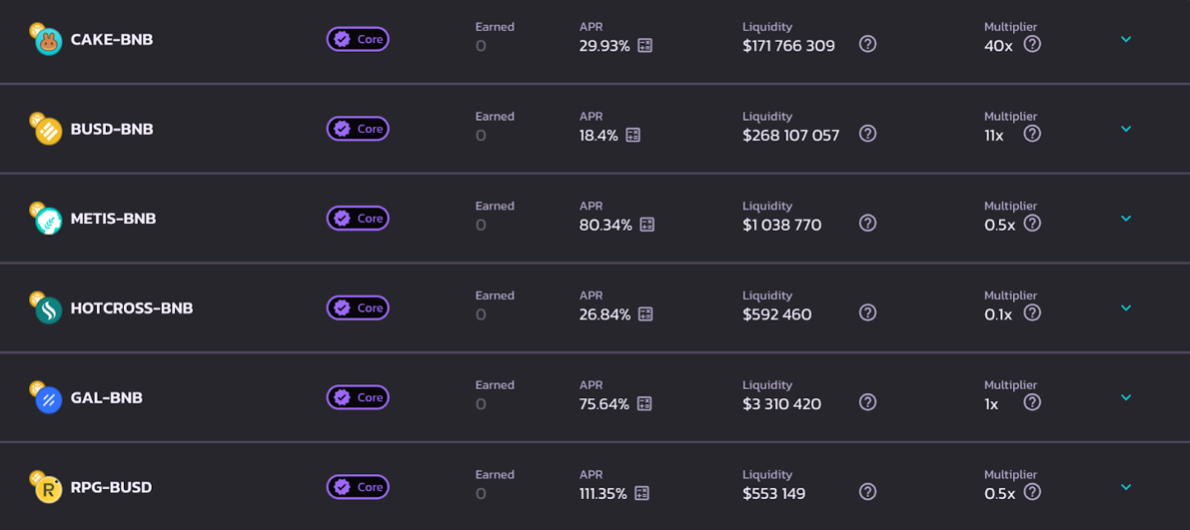

According to Pancakeswap, the FARMS tab contains farms where an investor can stake their LP tokens and earn a CAKE token.

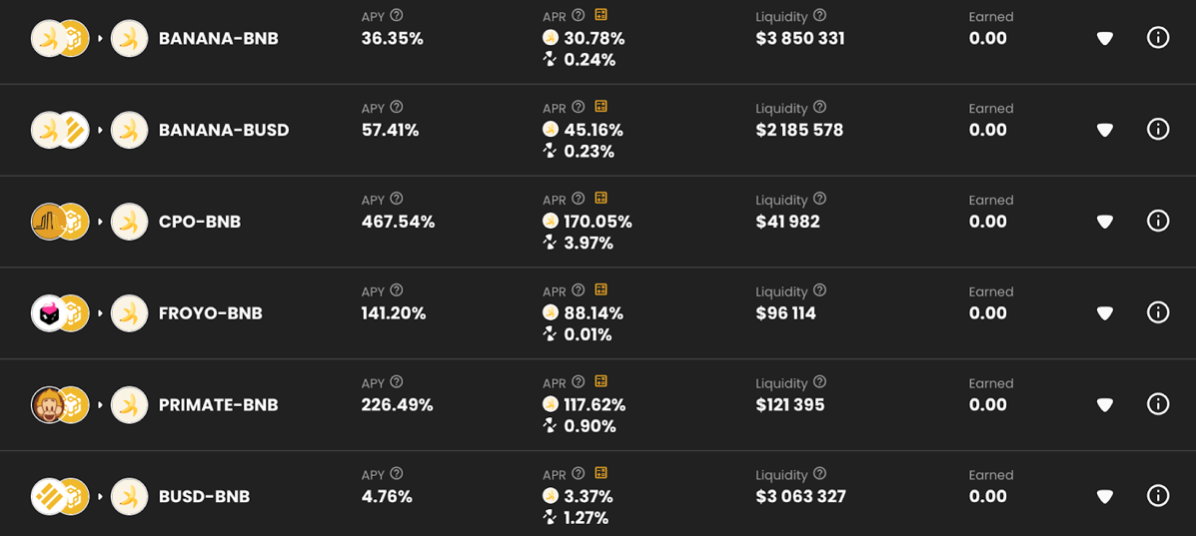

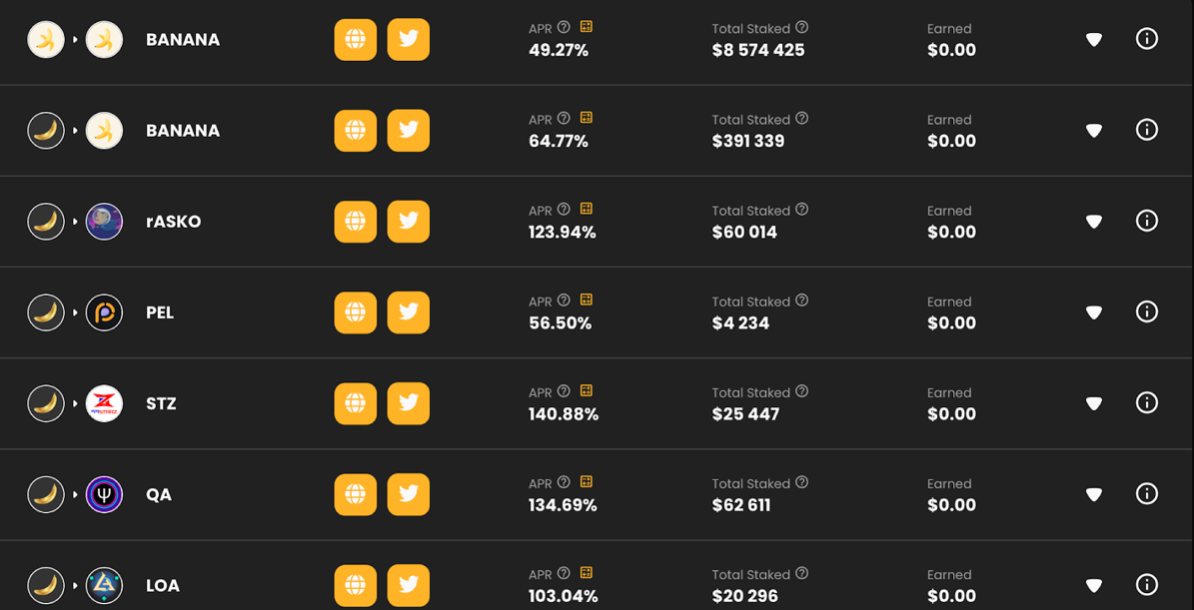

We observe the same situation on other protocols, for example, Apeswap. We can stake the LP token and get BANANA – the token of this protocol.

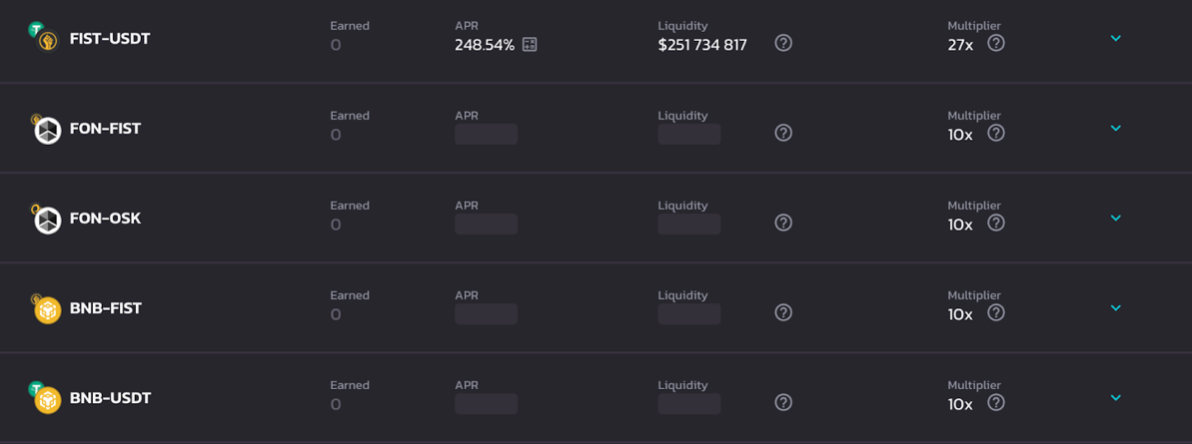

A similar picture can be seen in the new rapidly evolving FstSwap protocol, which was recently auto-detected on AnalytEx Farm Aggregator. You can stake your LP tokens to earn FIST tokens.

All of these farms are under the MasterChef contracts of the above protocols.

However, there are also Staking or Syrup pools. These are two names of the same thing. Different protocols call these pools differently. They have nothing to do with liquidity pools, which we talked about at the beginning of the article.

Breakdown: What are Staking/Syrup Pools?

Staking or syrup pools are the kind where you can stake a regular token (usually a protocol token) into a smart contract to earn other tokens. It is done on proof-of-stake blockchains, where a user is paid interest to pledge their tokens to the network to provide security.

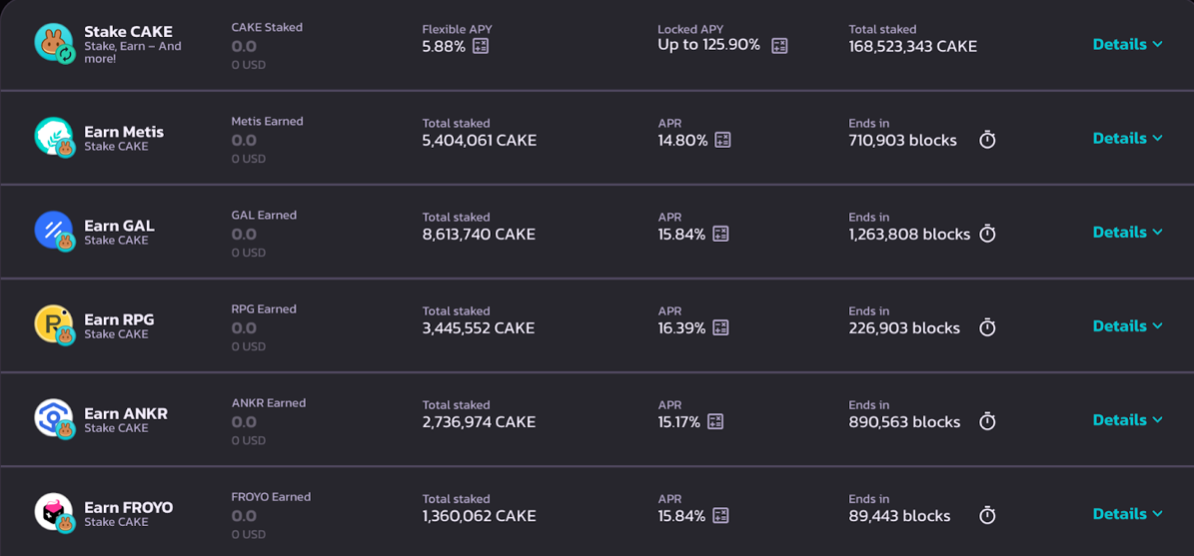

For example, on Pancakeswap, you can stake CAKE tokens to earn various tokens.

We can see the same situation on Apeswap.

Pay attention to the top lines in the “POOLS” tabs of both protocols. There are “Stake CAKE to earn CAKE” and “Stake BANANA to earn BANANA” pools. Only a few people know that these pools actually refer to the MasterChef smart contract like a farm, unlike all other pools, which belong to completely different smart contracts. This results in a confusion of terminology.

If an investor places an LP token or a regular token and earns protocol tokens (in the case of Pancakeswap it would be CAKE), they use the MasterChef contract. We can call such pools “farm pools.”

But as a rule, most known protocols do not explain this difference and divide farming opportunities according to the criterion of tokens placed in a smart contract. If we are talking about LP tokens, the commonly applied term is “farms.” But if it is about ordinary tokens, it gets called “(staking/syrup) pools.”

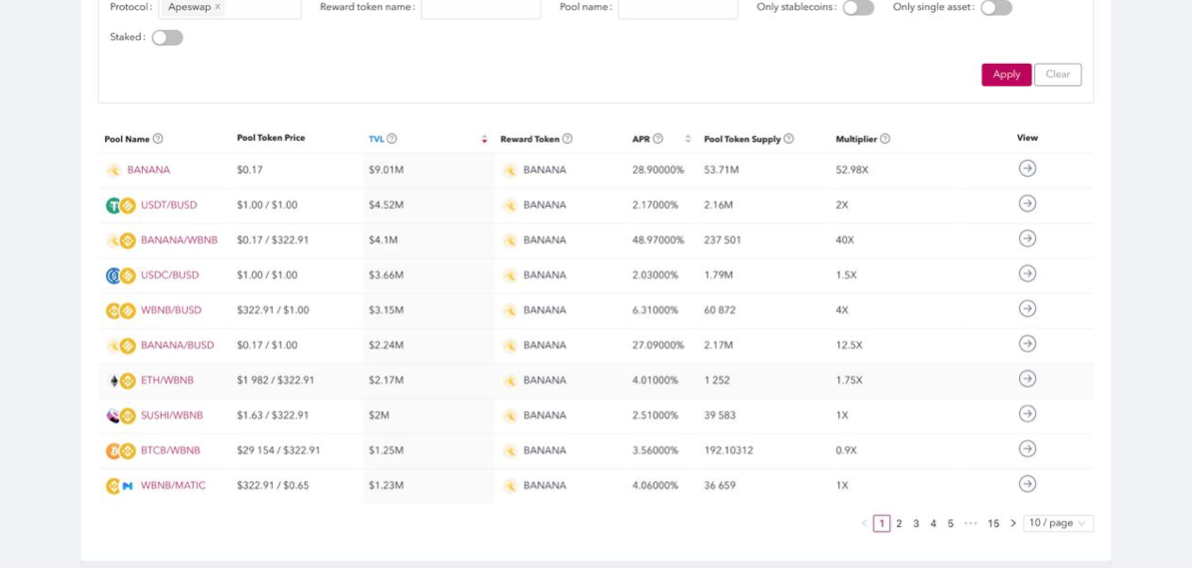

In AnalytEx, we show all the pools that belong to the MasterChef contract in one place, regardless of whether it is an LP token or a single one. Here is the Apeswap protocol shown on the AnalytEx website.

Final Breakdown

From everything we covered above, it can be concluded that, regardless of the interface and terminology in various decentralized protocols, if you receive income in tokens of the protocol that you use, you are accessing the MasterChef contract of this protocol. This is regardless of whether you use LP tokens or regular ones for staking.

If you use ordinary tokens and receive a reward in some other tokens, you use third-party smart contracts, but all these farming opportunities are called pools.

In order to completely understand what is happening in the DeFi space and properly make data-driven decisions, it is necessary to understand the basic terminology and its differences.

About the author

Olga Ortega is the chief product officer and co-founder of the real-time DeFi explorer AnalytEx by HashEx. She is an accomplished expert in the field of IT, with over 12 years in development and implementation of large-scale data systems. Over the years Olga held managerial positions in multiple global organizations, such as IT giants Google and Facebook. She led the creation and implementation of scalable data solutions, analytics software, web and mobile applications. Olga also established business intelligence practices to improve decision-making processes for companies. At AnalytEx, she is responsible for driving the project’s development.

Got something to say about this terminology breakdown or anything else? Write to us or join the discussion in our Telegram channel. You can also catch us on Tik Tok, Facebook, or Twitter.