Solana-based meme coin BONK is today’s top gainer, surging 22% in the past 24 hours. The rally comes as crypto markets bounce back more broadly.

Still, BONK’s gains are mostly driven by renewed investor interest ahead of the possible launch of a leveraged exchange-traded fund (ETF) tied to the asset.

Traders Bet Big on BONK as Potential ETF Launch Nears

Tuttle Capital recently submitted a post-effective amendment to the US Securities and Exchange Commission (SEC) for its proposed suite of leveraged ETFs, including a 2x Long BONK ETF. The filing indicates the product could go live as early as July 16.

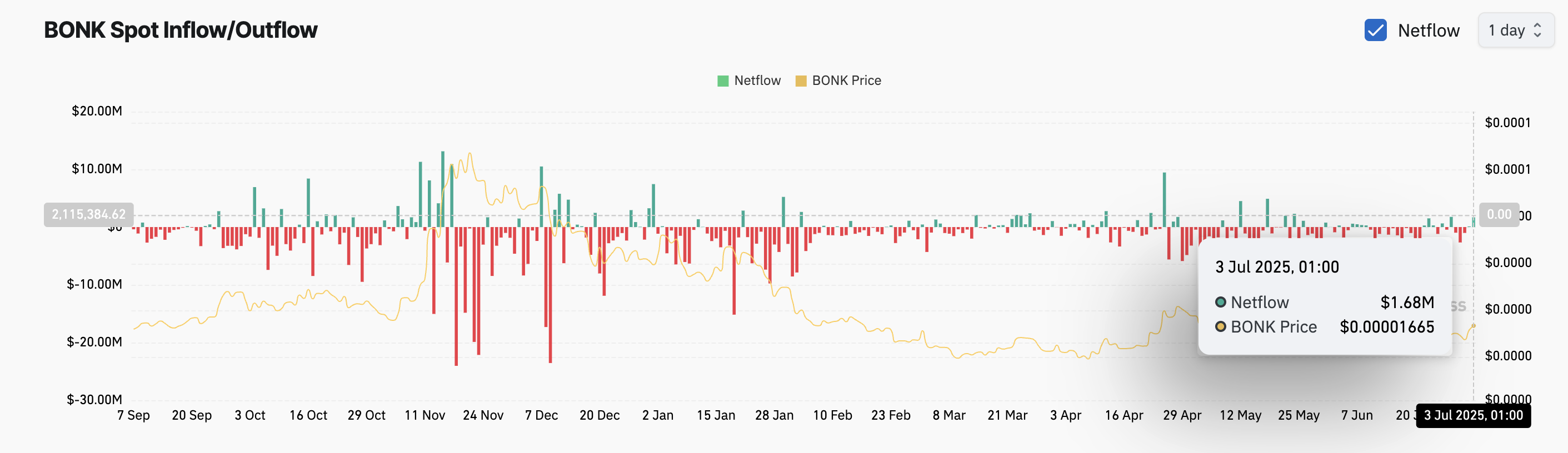

This has reignited enthusiasm around BONK, with traders piling in on speculation that the ETF could attract further inflows and institutional attention. The interest is evident in the token’s rising spot net inflow. As of this writing, netflow totals $1.68 million, climbing over 100% over the past day.

Spot net inflow tracks the capital entering an asset through direct purchases, indicating growing investor interest and demand. When an asset’s spot net inflows climb, it signals a bullish sentiment in the market.

BONK’s rising net inflow reflects growing investor confidence in the asset, and it could contribute to its upward price pressure as more capital flows into the market.

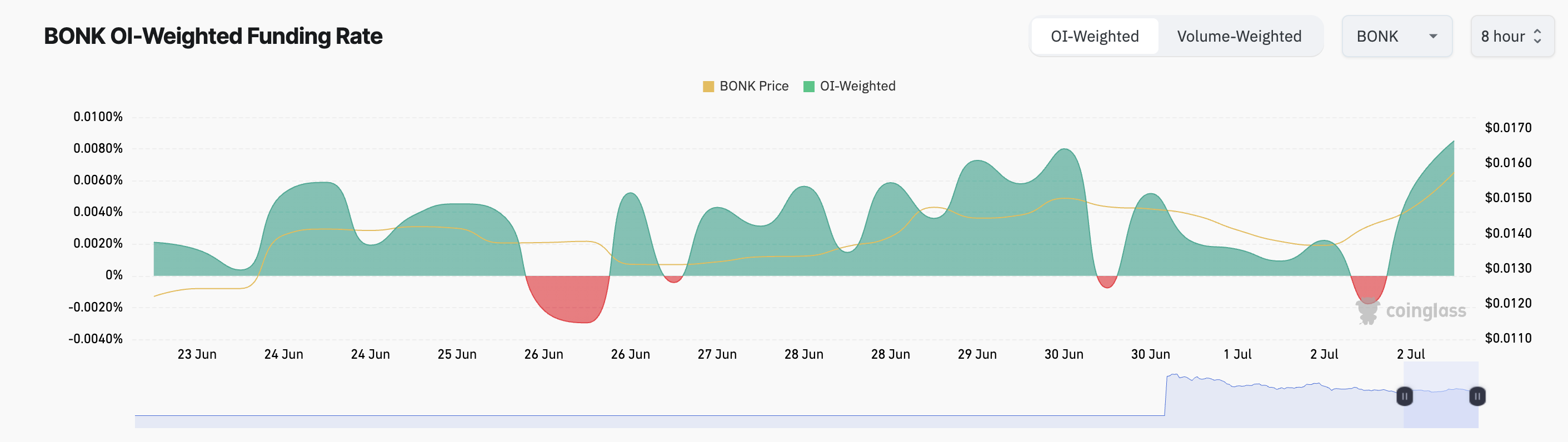

Moreover, the meme coin’s positive funding rate confirms this bullish outlook. As of this writing, it is 0.0085%, signalling a preference for BONK longs over shorts among futures market participants.

The funding rate is a periodic payment between traders in perpetual futures contracts to keep the contract price aligned with the spot price. When the funding rate is positive, there is a higher demand for long positions.

This means that more traders are betting on BONK’s price extending its gains in the short term.

BONK Breaks Above 20-Day EMA, Signals Fresh Bullish Momentum

The spike in BONK’s price has pushed it above its 20-day exponential moving average (EMA), which now forms dynamic support below it at $0.000014.

The 20-day EMA measures an asset’s average price over the past 20 trading days, giving more weight to recent prices. When an asset’s price trades above its 20-day EMA, it signals short-term bullish momentum and potential continued upside.

If the bulls retain control, they could drive BONK’s price toward $0.000018.

Conversely, if demand plunges, the altcoin’s price could break below $0.000016, falling to $0.000012.