September saw heightened activity across Perpetual DEX platforms. Leading projects like Hyperliquid (HYPE) and Aster are setting the pace. In this context, lower-cap tokens with the same theme, such as Bluefin (BLUE), may attract increasing attention.

What advantages does BLUE have in attracting attention at this time? The following article will show in detail.

What Gives BLUE an Edge in the Fierce Perp DEX Competition?

Bluefin currently stands as the leading perpetuals platform on Sui. In September, Bluefin reached several impressive milestones.

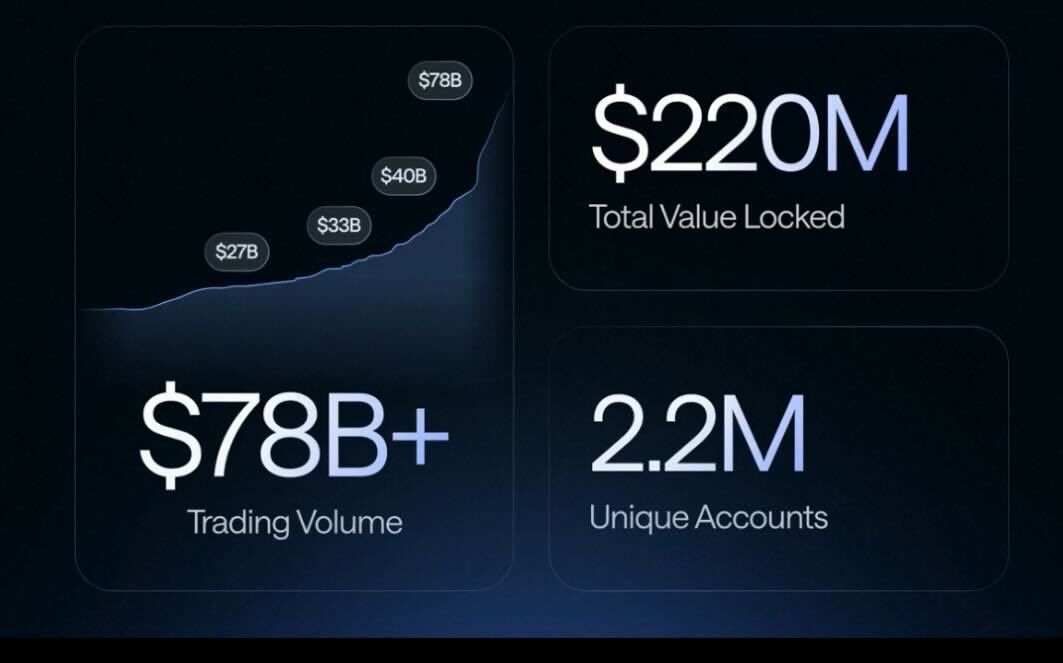

The Total Value Locked (TVL) climbed to $220 million before adjusting to $180 million. The platform also recorded 2.2 million accounts, while trading volume surpassed $78 billion.

Thanks to Bluefin’s contribution, weekly and monthly Perps volumes on Sui hit new highs not seen since the start of the year. This trend signals a potential upcoming surge in trading activity.

“SUI saw its highest monthly perp volume since January. Why? Bluefin is why,” analyst Kyle Chassé explained.

Bluefin’s TVL, measured in SUI tokens locked in the protocol, has also grown significantly. It rose from 20 million SUI at the start of the year to more than 50 million. The higher the locked amount, the stronger the investor confidence in the project.

As a result, BLUE’s price doubled in September. According to BeInCrypto data, the token started the month at $0.064 and has since reached $0.135.

The combination of rising token prices and positive on-chain data has led analysts to predict that BLUE could become investors’ next focus.

“The Perp DEX meta is heating up more than ever, fueled by explosive growth from ASTER and APEX. A project with 10x growth potential is Bluefin. It’s not just a perp platform; it’s a native DeFi hub offering a full suite of services, including spot swaps, perpetuals, lending, and vaults,” investor Bellstoshi predicted.

BLUE has already appeared on the Binance Alpha list, though it has not yet received an official Binance spot listing. These achievements raise expectations that Binance may soon consider listing BLUE, sparking a new wave of FOMO around the token.

Additionally, the Bluefin governance team has proposed a quarterly BLUE token buyback program. The plan could begin on October 1, 2025, with 25% of protocol revenue allocated to repurchase BLUE.

According to Kaleo, founder, LedgArt, the market will soon recognize BLUE’s fundamentals. Prices could return to the late-2024 peak. However, the path may not be quick or easy, as BLUE would still need to rise sixfold to revisit its all-time high of $0.8.