It’s been a little more than a year since Facebook’s Libra project first launched. While the project doesn’t look the same as it did when it made its debut in June 2019, its evolution has included the addition of blockchain pioneers who have their pulse on what Satoshi Nakamoto had in mind when he published the Bitcoin whitepaper nearly 12 years ago.

Most recently, Libra has tapped Blockchain Capital, a blockchain investment and advisory firm with more than $300 million in assets under management, to join its ranks. Blockchain Capital is now a member of the Libra Association, joining the likes of Coinbase, Xapo and Union Square Ventures as well as non-blockchain companies including Uber, Lyft and Spotify, to name a few.

We're honored to welcome Blockchain Capital LLC as the newest member of the Libra Association. @pbartstephens, @wbrads and the team have catalyzed and supported trailblazing firms in this sector. #Blockchain #DigitalCurrencyhttps://t.co/Wx4VaucOLw https://t.co/eY0fBzeA2J

— Dante Disparte (@ddisparte) September 18, 2020

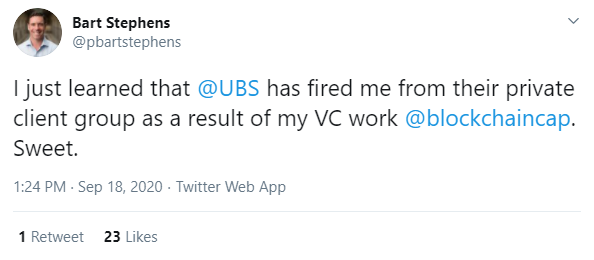

On the same day that Blockchain Capital joined Libra’s cohort, fate stepped in elsewhere. Bart Stephens, co-founder and managing partner of of Blockchain Capital, announced that Swiss bank UBS released him from its client group. He says it’s a direct consequence of his VC work at Blockchain Capital, which has backed more than 80 startups including the likes of Coinbase, BitGo, BitFury, Kraken, Ripple and more. Stephens doesn’t seem too broken up about it.

Libra’s Evolution

Libra updated its whitepaper in April 2020 after global regulators pushed back on the idea of a Facebook-controlled digital currency. In the new version, they decided to expand their portfolio to a group of single-currency stablecoins in addition to a multi-currency coin, or the LBR basket.

Libra is also a payment system, though the project abandoned plans to adopt a permissionless network in favor of a private blockchain. Another example of a private blockchain is JPMorgan’s Quorum, which was recently acquired by ConsenSys and which supports developers building on Ethereum.

If You Can’t Beat Them…

In addition to Blockchain Capital, Libra has also tapped a veteran banker for its association. James Emmett spent more than 25 years at HSBC, most recently at the helm of its European operations. Emmett reportedly retired amid an executive shakeup at the bank when Noel Quinn became CEO. Apparently he is coming out of retirement because on Sept. 17, Emmett was named managing director of Libra Networks, which is a subsidiary of The Libra Association. Emmett said in a statement,

“As someone who is passionate about the opportunities for financial services and technology to make a real difference, I am delighted to be joining Libra Networks with a mission to enhance financial innovation and inclusion and to deliver the operationalization of the network.”

According to his LinkedIn profile, Emmett begins in his new role at Libra on Oct. 1.

The Libra Association declined to comment for this story.