B Strategy, a digital asset firm founded by former Bitmain executives, said in a Monday press release that it will launch a Nasdaq-listed BNB treasury company targeting a $1 billion raise.‹

Backed by YZi Labs—the family office of Binance co-founder Changpeng Zhao—the initiative seeks to create a regulated vehicle for institutional exposure to BNB, Binance’s native token.

CZ Backs B Strategy’s Capital Raise

B Strategy’s structure will resemble 10X Capital, which raised $250 million last July with YZi Labs’ support to purchase and hold BNB as a reserve asset. According to the company, the new entity will collaborate with a US-listed partner through private placements, channeling capital directly into BNB holdings.

“The goal is to maximize BNB per share and provide full transparency to investors,” said Leon Lu, B Strategy’s co-founder and former Bitmain fund manager.

Fellow co-founder Max Hua, Bitmain’s ex-CFO, added that the firm will maintain independent audits and risk controls while complying with US market regulations.

Zhao clarified on X that YZi Labs is a supporter but not the lead sponsor, calling the project “another B Strategy” capital raise.

Why BNB Is Gaining Momentum

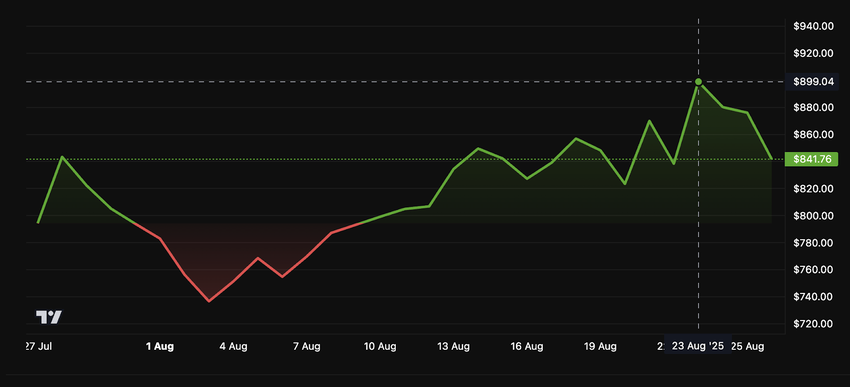

BNB ranks as the world’s fourth-largest cryptocurrency, with a market capitalization of about $121.9 billion. Prices recently hit record highs, climbing nearly 40% in six months despite short-term fluctuations.

Ella Zhang, head of YZi Labs, said, “BNB is central to stablecoins, real-world assets, and the future of financial systems. This treasury initiative will help push its mainstream adoption.”

Companies adopting BNB treasuries have seen dramatic market reactions. Formerly a vaping products firm, CEA Industries pivoted into a BNB-focused treasury company, and its shares surged 550% after unveiling the plan.

Meanwhile, BNB Network oversubscribed its $500 million fundraising round. Still, risks exist: Windtree Therapeutics was delisted from Nasdaq after holding BNB in its reserves, a precedent B Strategy insists it will avoid through stronger governance.

Connecting Asia and Wall Street

B Strategy is positioning itself as a bridge between Asian capital and US markets, with several Asia-based family offices already joining as anchor investors. The company expects to complete its $1 billion fundraising in the coming weeks.

Beyond accumulating BNB, the treasury firm also plans to invest in technology, provide grants for blockchain projects, and support community initiatives within the Binance ecosystem.

On the day, BNB traded at $846, down 3.5% from 24 hours earlier, while Bitcoin slipped 3.2% over the same period, going below $110,000.