South Korea’s cryptocurrency exchange Bithumb faced a major operational mishap on February 6, 2026, which quickly sent the BTC/KRW trading pair down by double digits.

It brings to mind past controversies about the exchange, including incidents of partial liability in data leaks.

Bithumb’s Accidental 2,000 BTC Airdrop Sparks 10% Bitcoin Crash on Exchange

Reportedly, a staff member accidentally sent 2,000 Bitcoin (BTC) to hundreds of users instead of the intended 2,000 Korean Won (KRW) reward.

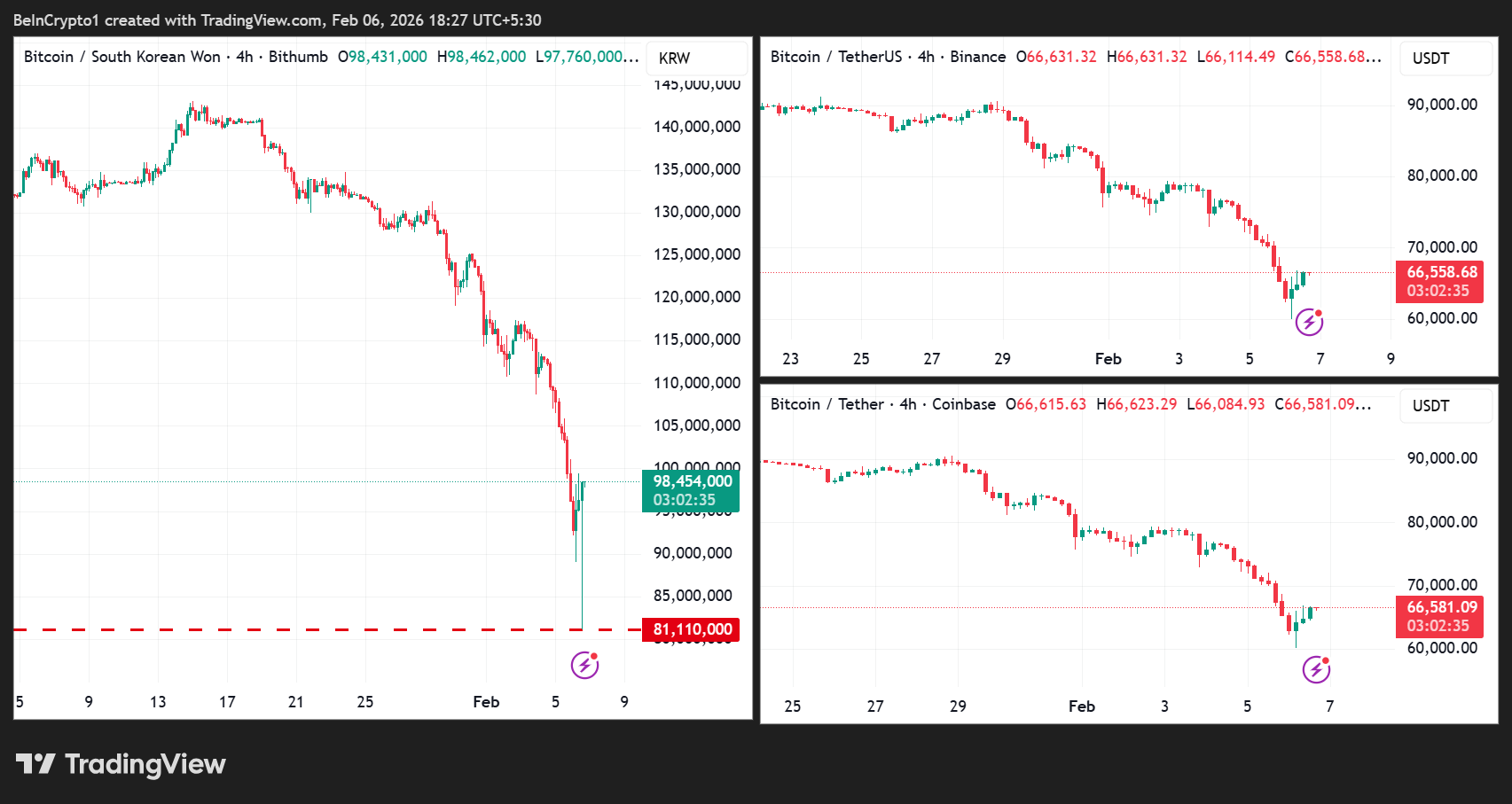

The error triggered an immediate wave of sell-offs, sending Bitcoin’s price on the exchange more than 10% below global market rates.

Dumpster DAO core member Definalist first reported the incident, citing a routine airdrop meant as a small incentive for platform users.

Amidst the chaos, some users reportedly benefited significantly from the mistake, selling their unexpected Bitcoin windfall at market prices.

The accidental BTC distribution has raised questions about internal controls and risk management at crypto exchanges, particularly those handling high-value digital assets.

“Crazy to think that exchanges can still do paper trading like this, even in 2026 lmao,” remarked Definalist.

Notably, however, the Bitcoin price crash was largely confined to Bithumb due to the exchange’s isolated order book. Users sold massive amounts of BTC directly on Bithumb, overwhelming its liquidity and causing a 10% local drop.

Other exchanges remained unaffected because the selling pressure didn’t enter their markets, and global arbitrage mechanisms hadn’t yet adjusted the discrepancy, keeping the impact largely contained.

Notwithstanding, the incident highlights the operational risks that can persist even in major exchanges, despite years of industry maturation. It also shows how a simple input error can cascade into substantial market disruption.

Bithumb did not immediately respond to BeInCrypto’s request for comment and has not yet released an official public statement on corrective measures.

Still, the event could influence market confidence in the short term, particularly on exchanges where operational errors have immediate price consequences.

Bithumb’s Operational History and Corporate Changes Highlight Ongoing Risks

Bithumb itself has a checkered history with security and operational issues. In 2017, a data breach exposed customer information, and in a 2020 ruling, local media reported that the exchange was found partially liable in one case in which a user lost $27,200.

The court ruled that, although Bithumb’s database had been accessed, the claimants should have recognized the scam attempts and awarded only $5,000 in damages.

Other claims were dismissed because the court found the private information could have been obtained elsewhere.

Bithumb has also undergone significant corporate changes in recent years. In 2018, the exchange sold a 50% stake to BK Global Consortium, a group led by startup investor Kim Byung-gun, who was already the company’s fifth-largest shareholder.

This acquisition came amid a broader contraction in the crypto sector investment. According to FinTech Global research, global crypto investments peaked at $7.62 billion in 2018 before falling to $3.11 billion in 2019. In the first half of 2020 alone, the sector raised just $578.2 million.

This latest mishap adds to Bithumb’s long history of operational challenges, reinforcing the view that while crypto adoption is growing, the sector remains vulnerable to human and technical errors, even in leading exchanges.