iFinex Inc., the parent company of the Bitfinex crypto exchange and the stablecoin issuer Tether, is planning a $150 million stock buyback to help victims of the 2016 hack.

During the early days of crypto, Bitfinex users suffered a huge hack of 120,000 Bitcoin (BTC). The funds accounted for 36% of the users’ balance.

iFinex Wants to Buy Back 15 Million Shares at $10 per Share

According to Bloomberg, iFinex Inc. wants more control over the company’s dealings due to increasing scrutiny and regulatory challenges. Hence, it has proposed to buy back shares from the victim of the 2016 Bitfinex hack.

The company has a budget of $150 million for the buyback, and is proposing to offer $10 per share. This buyback gives iFinex a valuation of $1.7 billion.

The shareholders willing to sell the shares have a deadline of Oct. 24 to accept the offer.

Read more: The 7 Hottest Blockchain Stocks to Watch in 2023

When Bitfinex customers lost 120,000 Bitcoin to hackers in 2016, they were offered shares of iFinex Inc in compensation. After seven years, in August 2023, Heather Morgan and Ilya Lichtenstein, the couple responsible for the Bitfinex hack, pleaded guilty to laundering $4.5 billion.

At the time of the hack, the BTC was worth around $71 million. However, the valuation has risen to approximately $3.1 billion. When Bitcoin was at its all-time high, the amount lost to hack had a valuation of $8.2 billion.

Although by holding the shares instead of BTC, the investors missed out on the parabolic growth during the 2017 and 2021 bull run, they could still benefit from the increased valuation of iFinex. Moreover, they can now cash the amount from the “relatively illiquid assets.”

iFinex told BeInCrypto by email:

“iFinex is allowing its shareholders to participate in a share buyback, which was launched as a result of the positive performance of the iFinex platform over the last few years.”

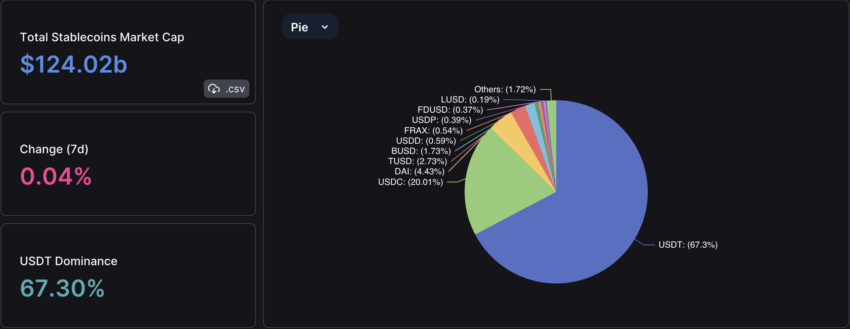

Over the years, Tether’s USDT has managed to become the most dominant stablecoin. The screenshot below shows that USDT has a market dominance of 67.3%.

Read more: What Is a Stablecoin? A Beginner’s Guide

Some community members alleged:

“Tether is going to print 150 million tethers out of thin air to buy back Bitfinex shares from themselves.”

However, Bitfinex, in a statement to BeInCrypto, clarified that:

“iFinex is a separate company from Tether, and is privately held. Funding for the proposed buyback will be resourced from its own undistributed profits.”

Read more: 8 Best Crypto Wallets to Store Tether (USDT)

Do you have anything to say about the iFinex buyback or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.