The bitcoin (BTC) price has been increasing in what looks like a bullish impulse since the beginning of March.

The price is likely in the fifth and final wave of the impulse and should reach a top in the near future, if it has not already done so.

In this article, waves will be labeled as follows:

- Cycle Wave – White

- Wave – Orange

- Sub-wave – Blue

- Minor sub-wave – black

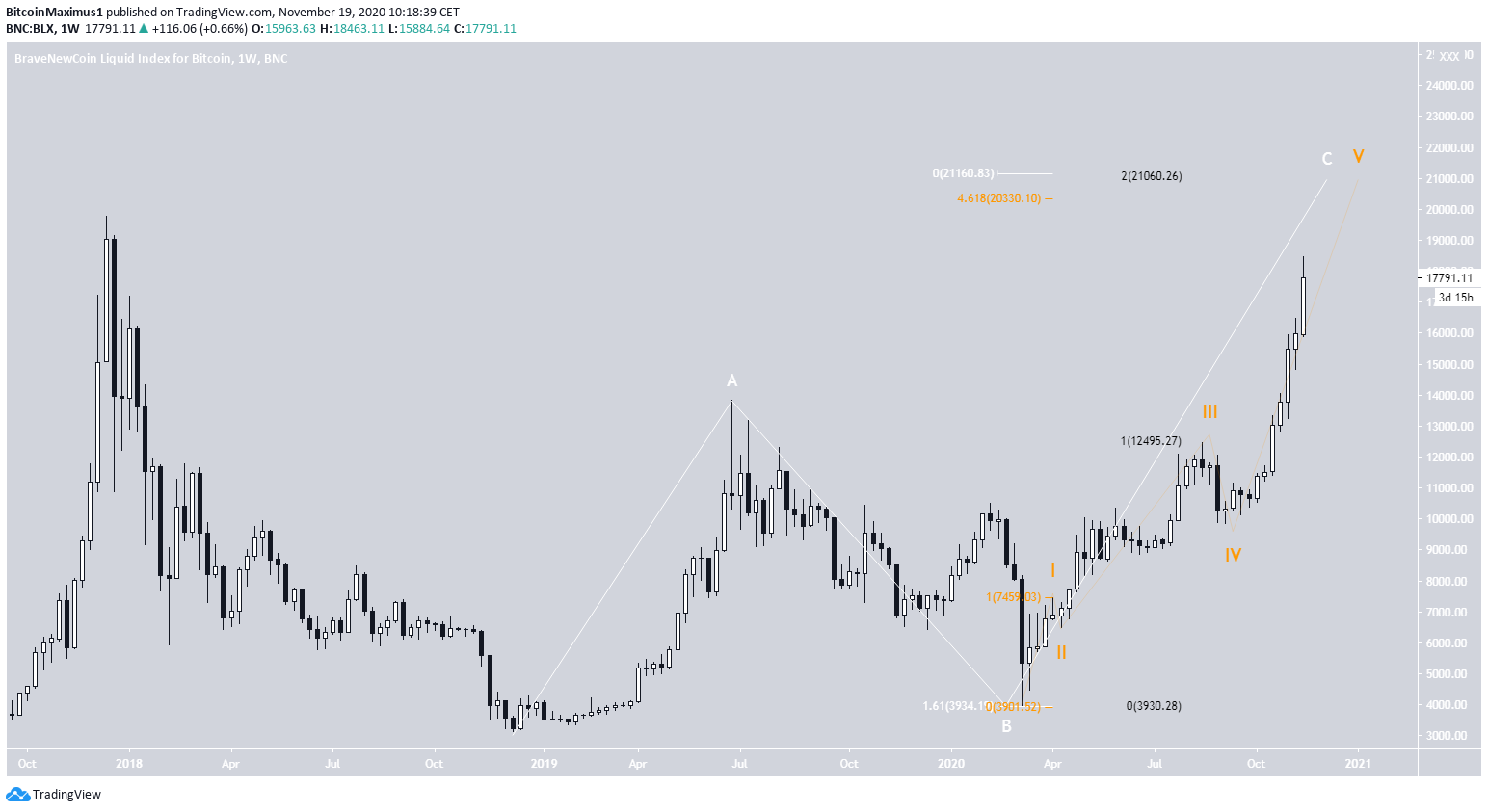

Bitcoin’s Long-Term Count

The bitcoin (BTC) price likely began a bullish five-wave formation (orange) once it reached a low on March 13. The price could be in the fifth and final wave of the impulse, which is a part of a longer-term C cycle wave (white). Notice the parabolic rate of increase since the wave began in September. If the count is correct, the most likely target for the top of the move would be between $20,330 and 21,168. The target is found by:- Projecting the 1.61 length of cycle wave A (white)

- The 4.61 Fib extension of wave 1 (orange)

- External Fib retracement of waves 1-3 (black)

- The 0.9 Fib retracement level of the entire decline from the ATH (white)

- The length of waves 1-3, projected to wave 4 (orange)

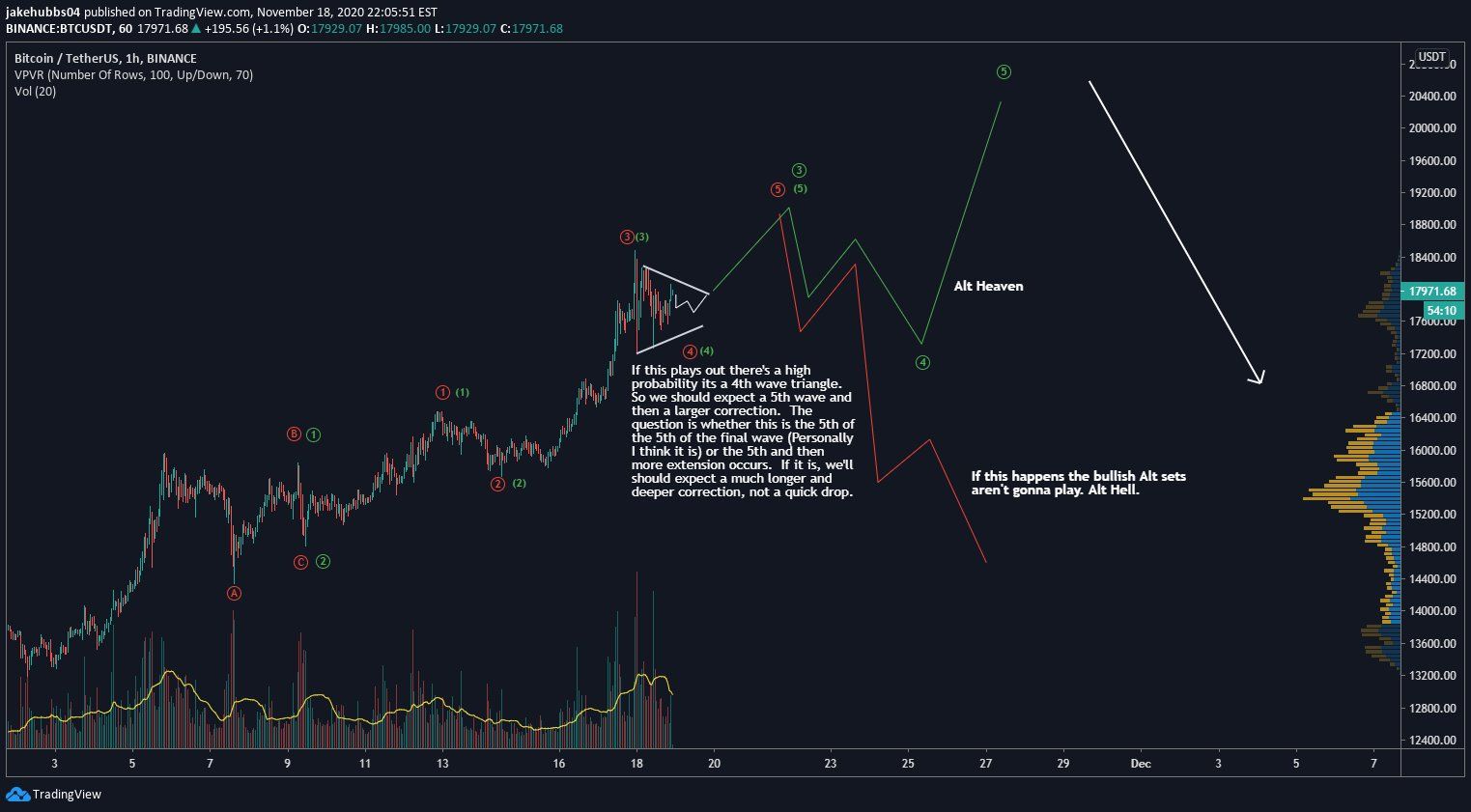

Short-Term Bitcoin Counts

Cryptocurrency trader @Thetradinghubb tweeted a wave count for BTC, outlining two possibilities for the future move. Interestingly, both of them predict an upward move towards $19,200 before a potential decline.

Short-Term Bullish Count

Since the price is trading inside a symmetrical triangle, it’s likely that this is wave four of some degree. The main count suggests that it is the minor sub-wave 4 (black), after which there is a final rally that completed the entire bullish formation. If correct, the next rally could take the price towards $20,000, as outlined in the first section. A decline below $17,283 (red line) would invalidate this possibility.

Short-Term “Bearish” Count

The second possibility suggests that the price is in a wave four, but of one lower degree. If correct, the ensuing rally would be much smaller, after which the price would undergo a correction. This possibility would fit with the second outline in the first section, which suggests that the price has reached a high. Same as the previous chart, a decline below $17,283 (red line) would invalidate this possibility.

Conclusion

To conclude, while it is likely that BTC has either reached or will soon reach a top, the exact high cannot be accurately determined yet. A breakdown from the current symmetrical triangle would indicate that the price is already correcting and will head lower. For BeInCrypto’s previous Bitcoin analysis, click here! Disclaimer: Cryptocurrency trading carries a high level of risk and may not be suitable for all investors. The views expressed in this article do not reflect those of BeInCryptoDisclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Valdrin Tahiri

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

READ FULL BIO

Sponsored

Sponsored