Bitcoin’s implied volatility has fallen to its lowest level since 2023.

According to on-chain analysts in a Wednesday research report, the direction of Bitcoin’s price will now depend on the future accumulation of open interest.

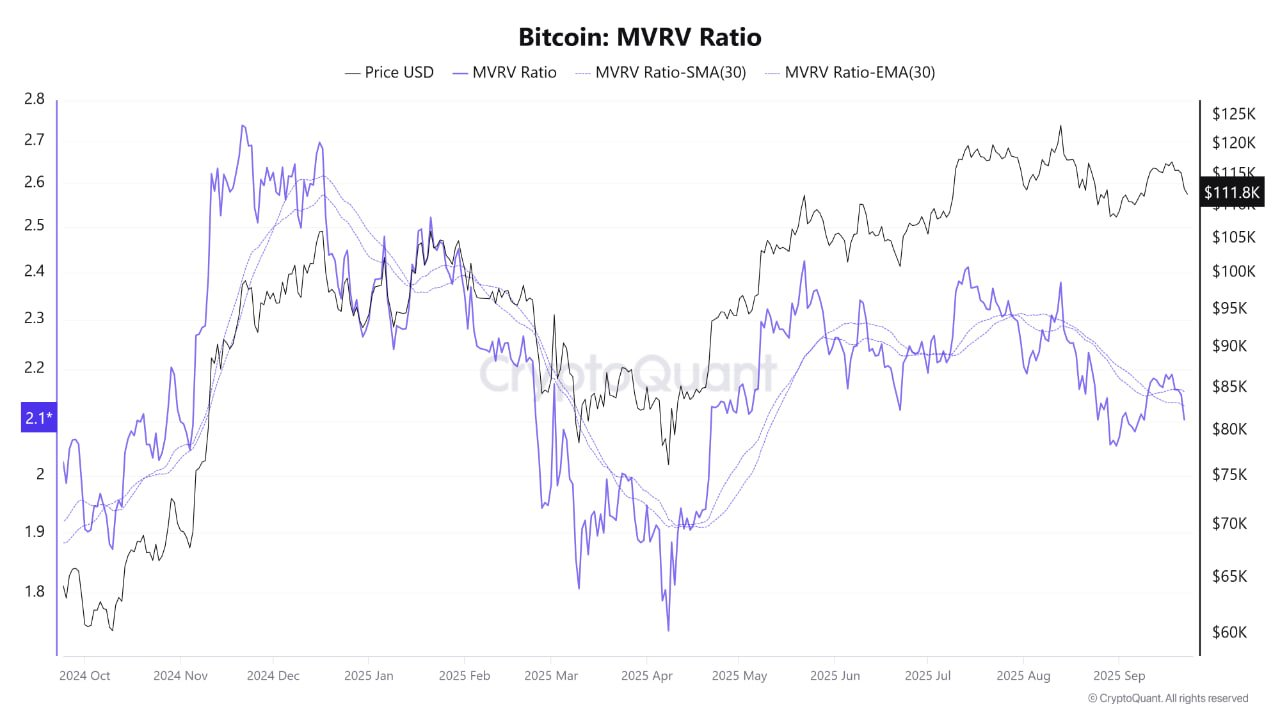

MVRV Ratio Suggests a ‘Wait-and-See’ Approach

Analyst ‘XWIN Research Japan’ pointed out that Bitcoin’s Market Value to Realized Value (MVRV) ratio is at a neutral position of around 2.1. An MVRV of 2.1 indicates that investors are neither seeing major losses nor excessive profits.

This price level is unlikely to trigger a wave of panic selling or natural profit-taking. The analyst explained that in such periods, a “wait-and-see” attitude tends to dominate the market.

This quiet sentiment is further supported by the continued decline in the total balance of Bitcoin held on exchanges, which suggests a weakening of selling pressure. Historically, a decrease in exchange holdings has been a prelude to a supply shortage when demand suddenly surges. XWIN Research Japan suggests that the market may now be experiencing the “calm before the storm.”

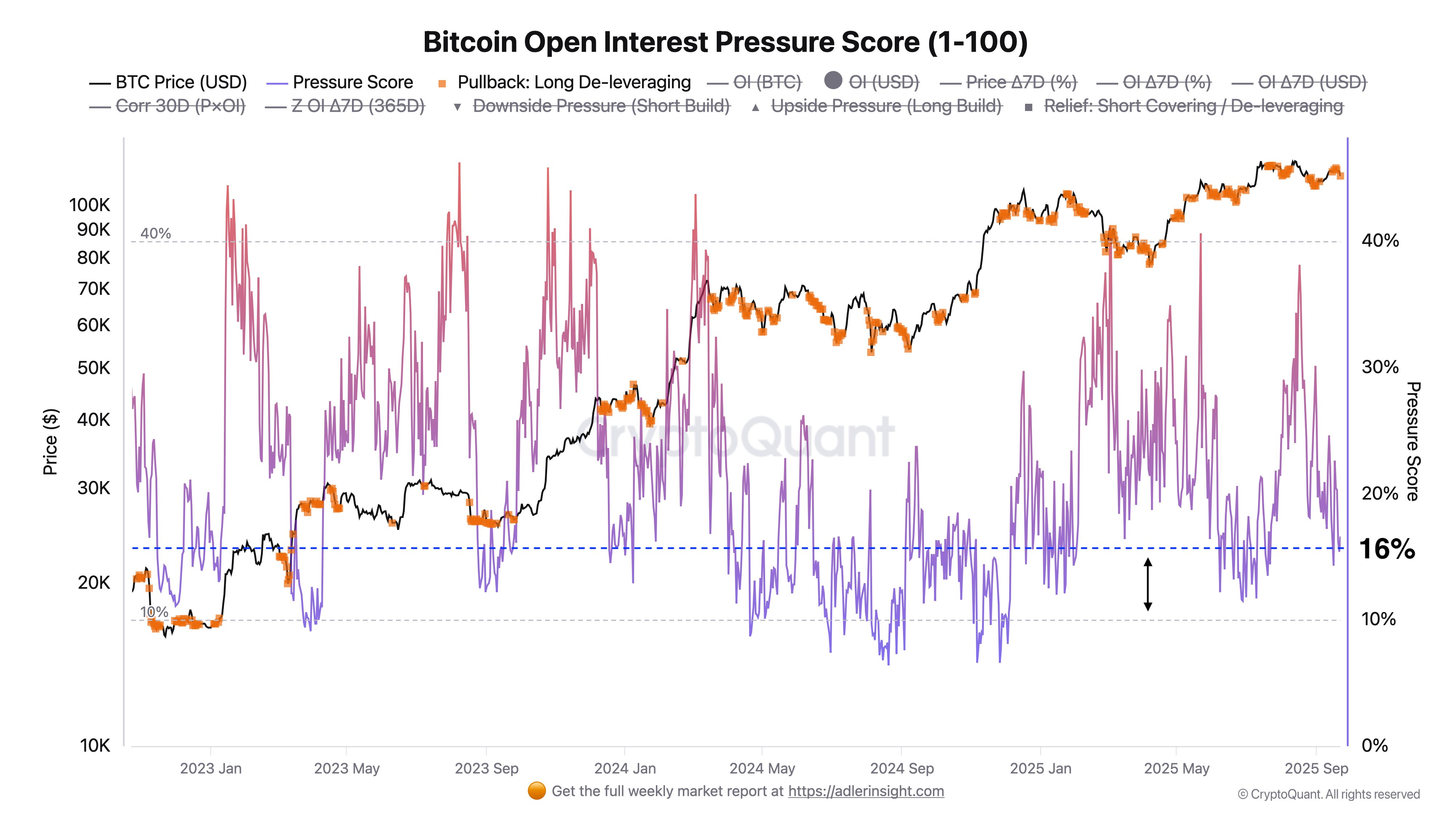

Open Interest: The Key to the Next Move

Another analyst, ‘Axel Adler Jr’, that the recent sharp price drop caused Bitcoin’s open interest to fall by 16%. This suggests that leverage is now at a low level following a recent deleveraging of long positions.

Axel Adler Jr argues that the future price path of Bitcoin depends on which direction open interest (OI) begins to accumulate. If long positions increase below a resistance level, the risk of another leverage-driven drop increases. Conversely, if short positions increase during a downturn, the probability of an upward move via a short squeeze rises.

The analyst believes a clear directional signal will emerge when the risk of leverage accumulation/pressure rises above 40% or when it drops to a 10% leverage depletion level, signaling a potential reversal.