Bitcoin’s (BTC) price recently experienced a sharp uptick, followed by a notable decline in late July and early August.

However, this drop doesn’t necessarily signal a bearish trend, as investor behavior shows signs that the market remains stable.

Bitcoin Investors Exhibit Conviction

Despite Bitcoin’s recent price drawdown, which brought it down from $68,000, the asset remains poised to continue its upward trend. This resilience is driven by consistently bullish investors who maintain confidence despite the volatility.

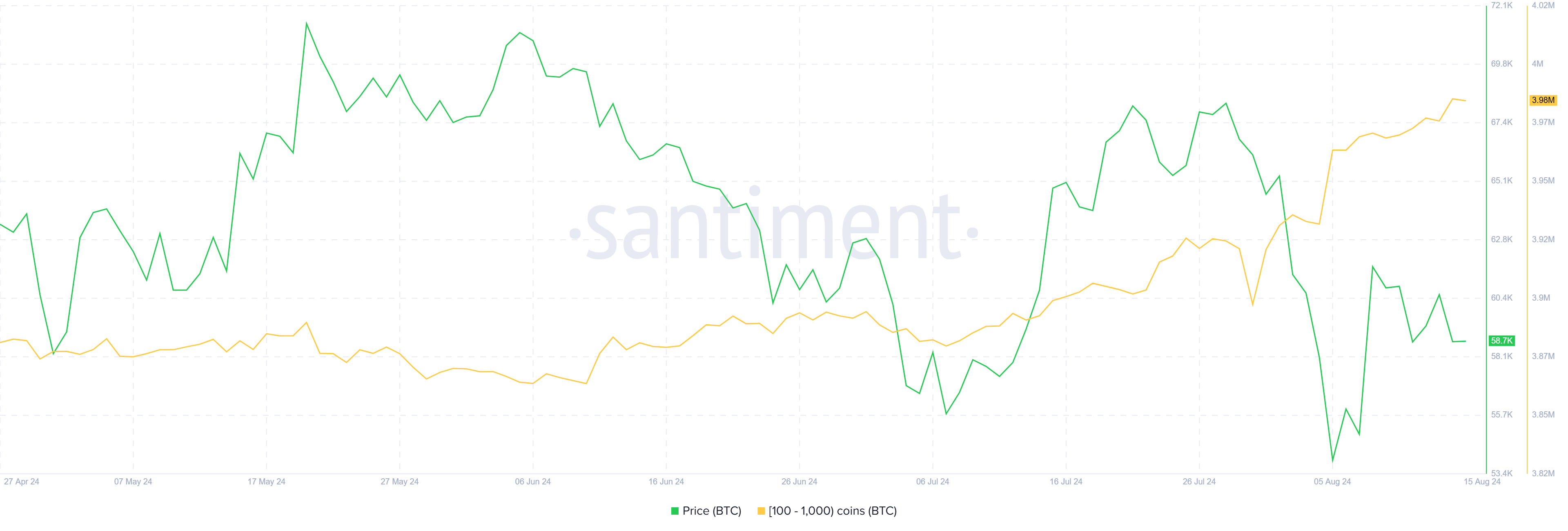

Among them are whale investors, who have held firm despite the recent dip. Addresses holding between 100 and 1,000 BTC show a steady increase, indicating ongoing accumulation.

hese investors hold substantial influence over Bitcoin’s price movements. Their accumulation often triggers rallies, while their selling can lead to sharp declines.

Read more: What Happened at the Last Bitcoin Halving? Predictions for 2024

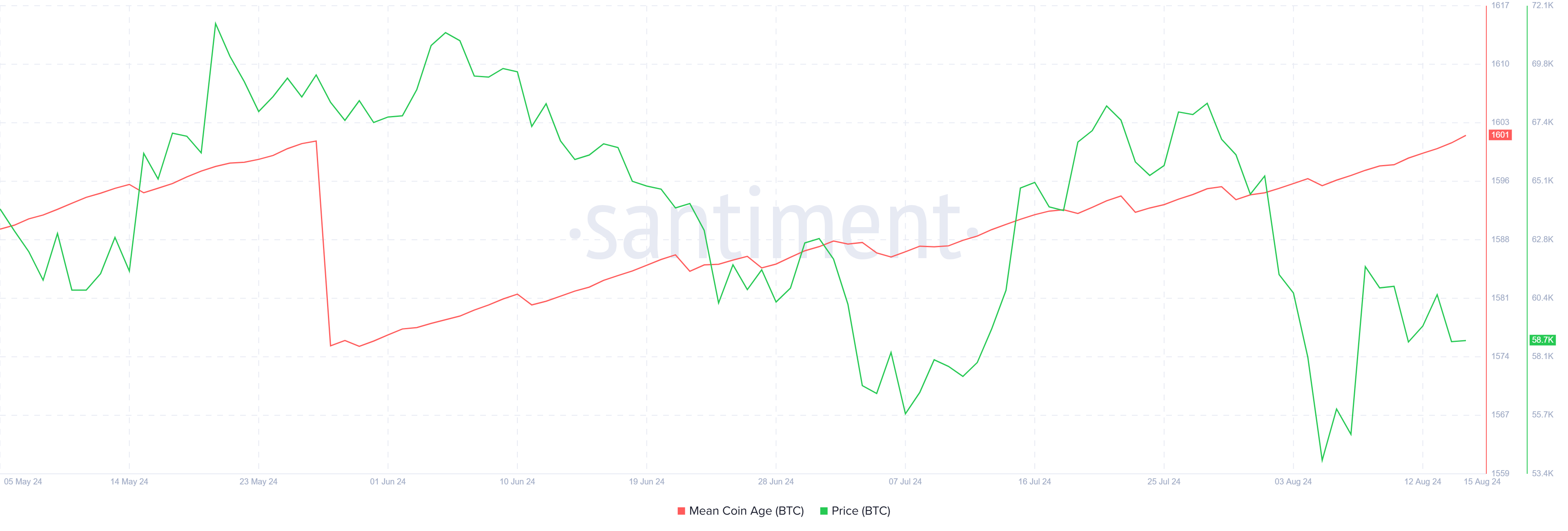

For a downtrend to sustain, market skepticism would typically be expected. However, this hasn’t been evident for some time. Since late May, Bitcoin’s Mean Coin Age (MCA) has consistently increased.

The MCA measures the average age of coins held in wallets or on the blockchain, indicating how long they’ve remained untouched. This metric helps gauge activity levels within a cryptocurrency’s network.

An upward trend suggests that investors are holding onto their coins (HODLing), while a decline indicates increased movement between addresses, signaling bearish sentiment. Currently, the continued incline points to investor confidence rather than bearishness.

BTC Price Prediction: Increase Ahead

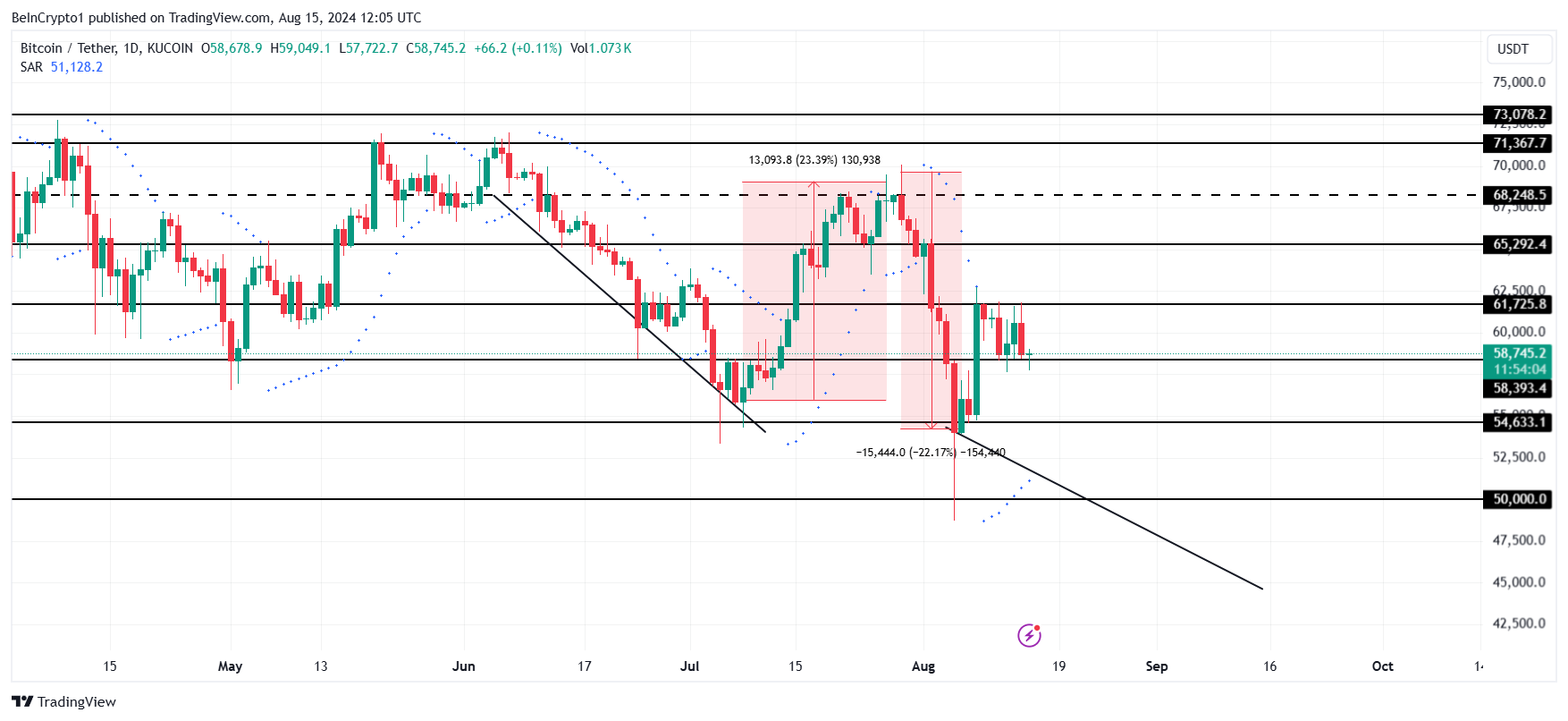

Considering these factors, Bitcoin’s price doesn’t appear to be forming a dead cat bounce. A consistent decline would be necessary to confirm such a scenario.

Currently, Bitcoin is trading at $58,740, holding above the critical support level of $58,390. This level has previously acted as support and could help sustain last week’s rally.

If Bitcoin maintains this support, it could aim to reclaim $61,000, setting the stage for a rise to $65,200. Breaking through that level would further solidify the uptrend.

Read more: Bitcoin Halving History: Everything You Need To Know

On the other hand, losing support at $58,390 would send BTC to $54,600. However, the bullish thesis would be invalidated only when the crypto asset drops to $50,000.