The Bitcoin price is trading above most daily and weekly moving averages. The previous time this occurred, the BTC price was engulfed in a solid upward trend.

Bitcoin Highlights

- The Bitcoin price is likely in a bullish trend.

- It is trading above significant daily & weekly moving averages.

- Numerous moving averages have made bullish crosses.

Has this ever occurred prior to today? What does this mean for the future price movement? Continue reading below if you want to find out.#Bitcoin Is trading above all MAs worth looking at on the Daily and Weekly TFs. pic.twitter.com/FBQGDyyNcK

— f i l ₿ f i l ₿ (@filbfilb) February 10, 2020

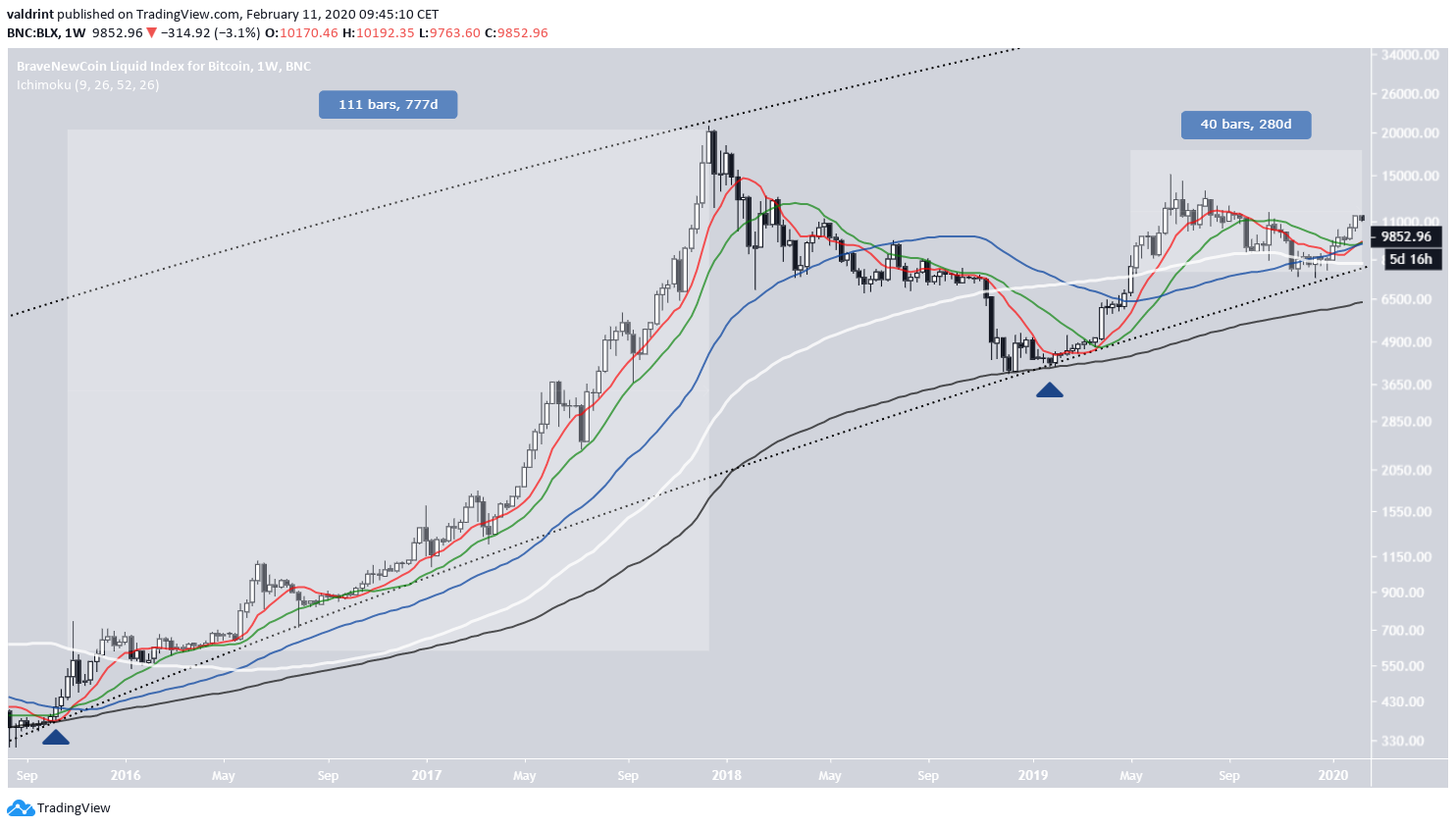

Weekly Bitcoin Moving Averages

For the weekly chart, we are going to use the following MAs:- 10-week (red)

- 20-week (green)

- 50-week (blue)

- 100-week (white)

- 200-week (black)

An almost identical scenario can be observed in 2012-2014.

The price bounced on the logarithmic growth curve in May 2012 and began an almost two-year-long upward trend, in which the price traded above these MAs — with the exclusion of the 200-week MA, which had yet to be plotted due to the lack of data points.

An almost identical scenario can be observed in 2012-2014.

The price bounced on the logarithmic growth curve in May 2012 and began an almost two-year-long upward trend, in which the price traded above these MAs — with the exclusion of the 200-week MA, which had yet to be plotted due to the lack of data points.

Also, there have only been two times when the 50-week MA made a bullish cross with the 100-week one, in May 2016 and December 2019. Both times, the bullish market cycle began shortly after — which was noted by the 50-week MA being above the 100-week one. This last characteristic occurred for around 1000 days in both prior bullish cycles but lagged slightly, meaning that it gave the signal for the beginning and end of the market a few months after the market reversed.

Currently, the 50-week MA is above the 100-week one and has been so for 70 days.

Also, there have only been two times when the 50-week MA made a bullish cross with the 100-week one, in May 2016 and December 2019. Both times, the bullish market cycle began shortly after — which was noted by the 50-week MA being above the 100-week one. This last characteristic occurred for around 1000 days in both prior bullish cycles but lagged slightly, meaning that it gave the signal for the beginning and end of the market a few months after the market reversed.

Currently, the 50-week MA is above the 100-week one and has been so for 70 days.

Going just by the historic relationship of the price and its weekly MAs and the MAs with each other, we can make the claim that the Bitcoin price is in a bullish trend.

Going just by the historic relationship of the price and its weekly MAs and the MAs with each other, we can make the claim that the Bitcoin price is in a bullish trend.

Daily Moving Averages

For the daily chart, we are using the same period moving averages. The Bitcoin price has not respected them as much as the weekly ones, especially the short-term 10-, 20- and 50-day MAs. However, the 100-day MA has been a good predictor of the direction of the trend, since during the times the price has been above it the trend has been bullish and vice versa. In addition, it has intermittently offered support/resistance to the price. A more interesting relationship is that between the 50- and 200-day moving averages.

These MAs first made a bearish cross (a death cross) on April 2018, signaling that the Bitcoin price is in a downward trend and preceding a decrease from $9900 to $3100.

Afterward, a bullish cross between the same MAs (golden cross) transpired in April 2019, preceding a price increase from $5000 to $13,600.

Currently, the MAs are very close to making a bullish cross, and judging by the slope of the 50-day MA, it is almost a certainty that the cross will transpire soon, confirming that the price is in a bullish trend.

A more interesting relationship is that between the 50- and 200-day moving averages.

These MAs first made a bearish cross (a death cross) on April 2018, signaling that the Bitcoin price is in a downward trend and preceding a decrease from $9900 to $3100.

Afterward, a bullish cross between the same MAs (golden cross) transpired in April 2019, preceding a price increase from $5000 to $13,600.

Currently, the MAs are very close to making a bullish cross, and judging by the slope of the 50-day MA, it is almost a certainty that the cross will transpire soon, confirming that the price is in a bullish trend.

Conclusion

Conclusion

The relationship of the Bitcoin price to its daily and weekly MAs has been historically relevant in determining the direction of the trend, especially when combined with the relationship of the MAs to itself.

Analyzing the current price and MAs, we can make the claim that the Bitcoin price is in the initial stages of a long-term upward trend, which could continue for two more years.

Top crypto projects in the US | April 2024

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Valdrin Tahiri

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

READ FULL BIO

Sponsored

Sponsored

Conclusion

Conclusion