A crypto whale who recently pocketed over $197 million during the October market crash has doubled down, building a massive short bet against Bitcoin (BTC).

This move comes amid Bitcoin’s turbulent recovery from its mid-October crash, which continues to test investor resolve. The cryptocurrency is exhibiting flashes of resilience amid persistent volatility.

The Comeback Short: BitcoinOG Reloads With Massive Bet Against BTC

BeInCrypto previously reported that a whale held massive short positions on both Bitcoin and Ethereum (ETH) amid the October downturn, earning substantial profits during the market panic. Within just 30 hours, the investor gained over $160 million.

Lookonchain reported that on October 15, this Bitcoin OG had completely closed all short positions on Hyperliquid, securing more than $197 million across two wallets. Despite these massive gains, the trader was back just days later.

According to data from the blockchain analytics firm, the whale through the wallet (0xb317) transferred $30 million in USDC to Hyperliquid earlier this week and opened a 10x leveraged short position on 700 Bitcoin, valued at about $75.5 million. The investor has since expanded this position, signaling a renewed bet against the market.

“The $10B Hyperunit Whale who made $200M shorting the China Tariff Crash just DOUBLED DOWN on his BTC short position,” Arkham posted.

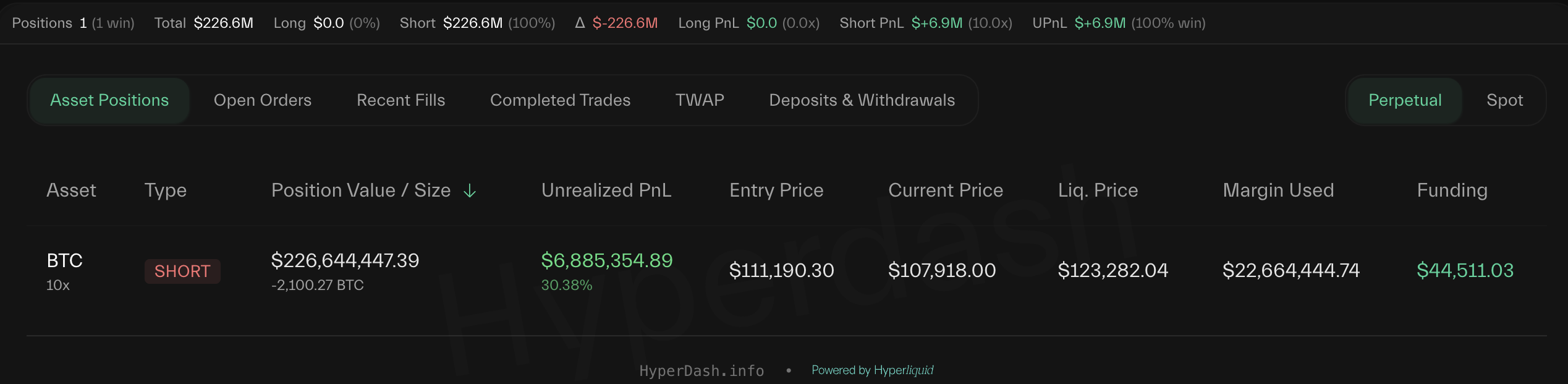

According to the latest data from Hyperdash, the BitcoinOG’s active 10x leveraged short position on Bitcoin is worth $226.6 million. The liquidation price is set at $123,282. Furthermore, the position is currently showing an unrealized profit of around $6.8 million.

In addition to the leveraged bets, Lookonchain highlighted that the trader has also been offloading Bitcoin,

“Since the 1011 market crash, he has deposited 5,252 BTC($587.88 million) into Binance, Coinbase, and Hyperliquid,” the firm noted.

Bulls vs. Bears: Who Will Win as Bitcoin Eyes Its Next Move?

However, not all traders are convinced by the bearish outlook. Yesterday, the largest cryptocurrency rebounded slightly to over $114,000 as gold dipped before settling near $108,000 at press time. Technical signals and possible capital rotation have fueled optimism among analysts, who now project that BTC and altcoins could rally soon.

This positive outlook is also evident in several traders’ bullish moves. Lookonchain highlighted four investors who have recently gone long on the market.

- 0x89AB moved $9.6 million USDC to Hyperliquid, purchased 80.47 BTC (around $8.7 million), and opened a 6x leveraged long worth 133.86 BTC (about $14.47 million).

- 0x3fce added $1.5 million USDC, expanding their Bitcoin long to 459.82 BTC (roughly $49.7 million).

- 0x8Ae4 deposited $4 million USDC to open long positions across Bitcoin, Ethereum, and Solana.

- 0xd8ef transferred $5.44 million USDC and went long on Ethereum.

As investors take opposing positions, the days ahead will determine who called it right — the whale wagering on another slide or the traders betting on the market’s comeback.