A dormant Bitcoin whale has reemerged with a decisive shift toward Ethereum, locking in more than $100 million in unrealized profits as ETH prices surge.

On August 22, blockchain tracker Lookonchain flagged the wallet after it began loading up on ETH through both spot purchases and leveraged trades.

The Bitcoin Whale’s Ethereum Position is Worth Over $850 Million

The whale, which received over 100,000 BTC nearly seven years ago, executed its first major Ethereum buys, which included a $270 million purchase of 62,914 ETH and a much larger $580 million derivatives long position worth 135,265 ETH.

These transactions signaled an intentional reallocation of holdings from a significant Bitcin holder of that scale.

On August 23, the whale also sent 300 BTC in two separate transactions to the derivatives platform Hyperliquid, suggesting a deliberate plan to expand their Ethereum exposure rather than a one-off allocation.

At current market prices, these trades have already paid off.

Lookonchain estimates the derivatives position is up around $58 million, while the spot purchase has added roughly $42 million in paper gains. Combined, the wallet now sits on more than $100 million in profit from this pivot alone.

Beyond the profits, the whale’s shift points to a broader market trend showing that Ethereum is steadily pulling more liquidity and market interest.

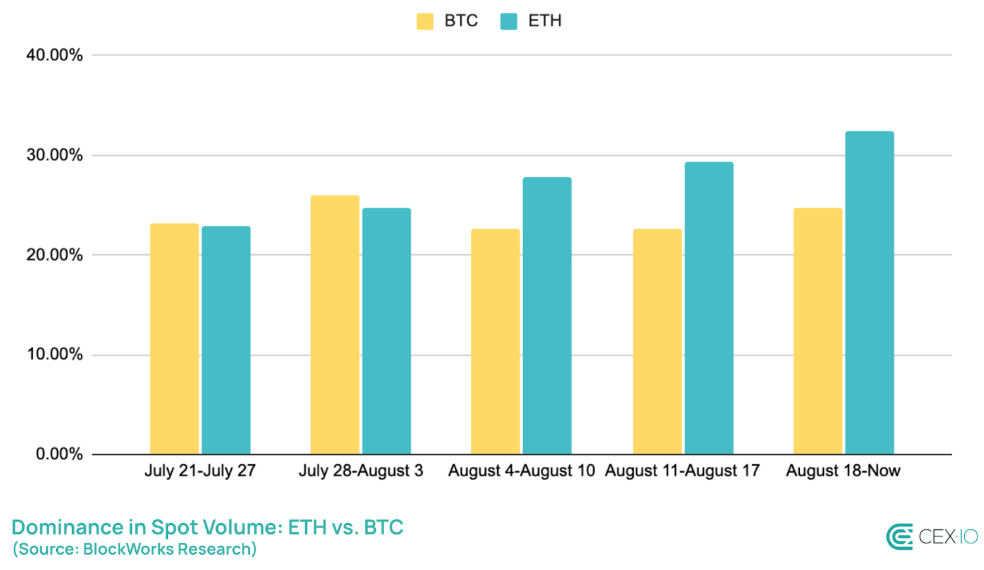

A CEXIO report shows Ethereum’s share of spot trading on major centralized platforms climbed above 32% in August, its highest level since 2017.

According to the firm, that shift has been partly driven by retail investors, who increased participation in sub-$3,000 order sizes, and institutions following with larger trades.

Apart from that, CEX.io pointed out that capital net position data shows that Ethereum rose 23% in August, while Bitcoin dropped by 43%. That dynamic highlights how capital rotation has tilted toward ETH, reflecting shifting confidence among traders.

So, it is unsurprising that Ethereum rose to a new all-time high after risk appetite improved across the crypto market following Federal Reserve Chair Jerome Powell’s Jackson Hole remarks.