Bitcoin (BTC) volatility is at multi-month highs, with the price action whiplashing futures traders on both sides, long and short alike. It comes amid geopolitical tension, which inspires an increase in safe-haven demand.

TradFi and crypto market participants should brace for impact as the world watches developments in the geopolitical space.

Bitcoin Bends To Geopolitical Tension

Bitcoin price volatility has been increasing, maintaining a steady climb since June 24. Data dashboard BiTBO shows that the last time volatility levels were this high was in early May. This metric indicates how rapidly the BTC price fluctuates within a certain period.

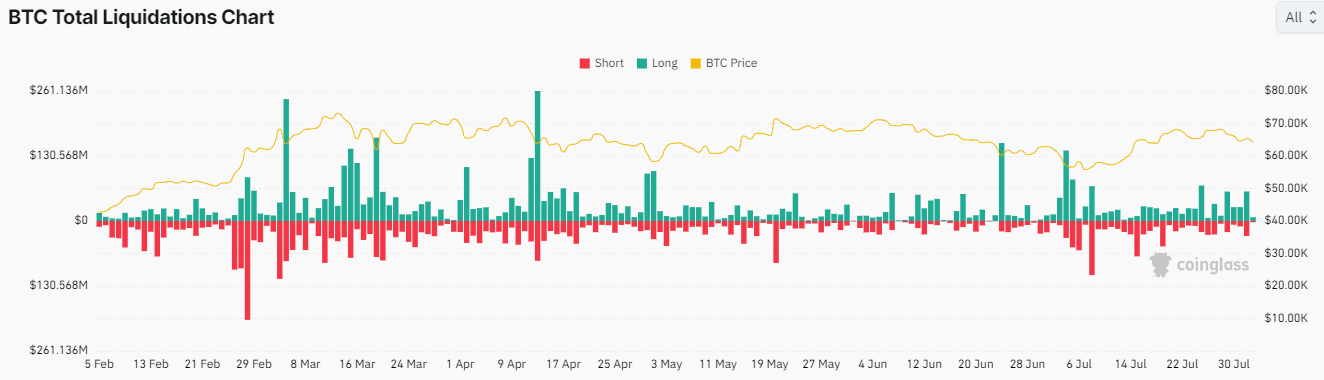

Coinglass data shows that volatility has led to the liquidation of over 90,000 traders, with total crypto market liquidations reaching $267.95 million. In the Bitcoin market, nearly $60 million in long positions were liquidated, compared to about $30 million in short positions.

Read more: How To Buy Bitcoin (BTC) and Everything You Need To Know

This comes amid ongoing turmoil between Israel and Hezbollah, creating a risk-off scenario. Recent reports indicate that Hezbollah fired a barrage of rockets into Israel’s Western Galilee late Thursday.

With major escalation and fears of a larger war, markets are experiencing growing uncertainty and soaring apprehension levels. A similar outlook occurred during the Russia-Ukraine conflict and the Iran-Israel saga. This demonstrates that financial markets, including crypto, are influenced by geopolitical tensions and conflicts that inspire fear and risk aversion.

“The magnitude of Iran’s attack on Israel will tell us how far the fall will go in Bitcoin and markets,” one analyst said.

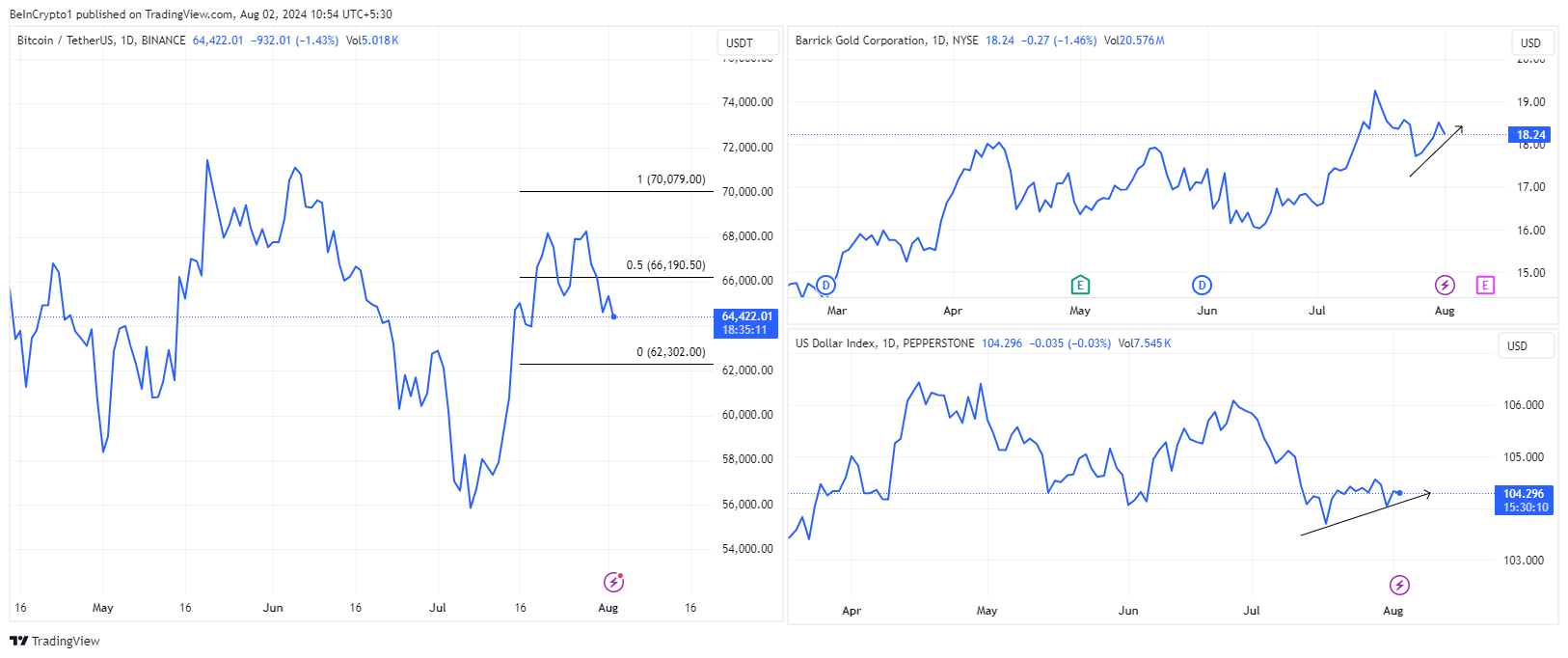

Meanwhile, the US Dollar Index and precious metals like gold are rising. The US Dollar Index, which measures the USD’s value against six foreign currencies, rose 0.54% in the last week. This caused Bitcoin to crash by 5% due to its inverse relationship with the USD. The general atmosphere of fear and risk aversion is affecting Bitcoin as investors seek to reduce risk and move towards traditional safe-haven assets like gold.

In the next few days, therefore, it would be critical to monitor the conflict’s severity. Global response, market sentiment, and investor behavior will also influence price action.

Nevertheless, geopolitical uncertainty or conflict may also favor alternative assets like Bitcoin. It could drive adoption, similar to what happened during the early months of the Russia-Ukraine conflict.

Investors may turn to alternative assets like Bitcoin as a haven to protect their wealth from traditional market volatility. This could drive up the demand for Bitcoin and crypto in general, effectively increasing their value.

Read more: Top 9 Crypto-Friendly Countries For Digital Assets Investors

According to Ryan Lee, Chief Analyst at Bitget Research, a few additional factors can influence Bitcoin’s performance in August. They include the macro liquidity environment, market capitalization of stablecoins, and BTC-related news ahead of the US presidential election.

“Based on the above points, it is estimated that BTC’s fluctuation range in August will be $62,000 to $73,000, and ETH’s range will be $3,000 to $4,200. One could look for trading opportunities in the potentially continuous rebound of the ETH/BTC exchange rate,” Lee told BeInCrypto.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.