Blockchain analytics firm, Crystal Blockchain, has analyzed cryptocurrency flows in and out of the darknet, revealing that transfers (measured in $) are peaking.

Altcoins also appear to be growing in use. Transactions largely involve exchanges without KYC requirements. The report, published on July 14, shows that Bitcoin and altcoin use on the darknet has increased, at least in dollar terms for Q1 2020.

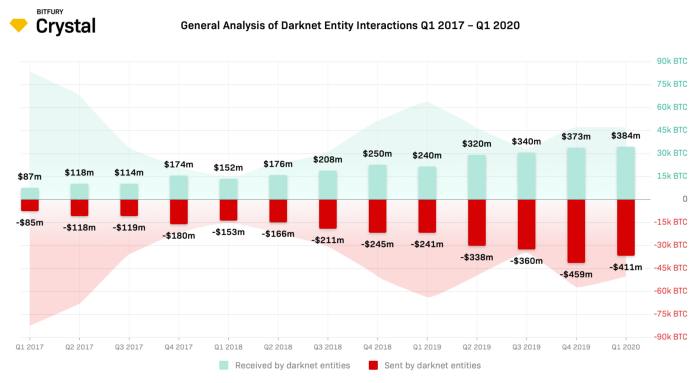

The report compared the Bitcoin darknet flows to previous quarters. While the amount of Bitcoin notably declined, the higher price of the alpha-crypto led to a 65% increase in USD terms. Both this and growing altcoin use have contributed to the reduction in the amount of Bitcoin transferred.

In BTC terms, Q1 2020 saw a 22% and 26% drop in received and sent Bitcoin compared with Q1 2017. Compared to Q1 2019, outflows dropped from 64,000 to 47,000 BTC while inflows dropped from 64,000 to 50,000 BTC.

Nevertheless, since Bitcoin’s dollar value has notably increased, the overall USD amount is the highest it’s ever been for Q1. Outflows and inflows measured $384 million and $411 million, respectively.

Loose Exchanges the Main Culprits

Crystal Blockchain also examined the types of entities that were at the sending and receiving ends of the transactions. Most of these entities were exchanges that had loose identity verification requirements.

Exchanges accounted for 45% and 48% of the entities sending and receiving funds. Given the nature of the darknet, this makes sense. Mixers have also grown in popularity, though they stand at only 1% of all transactions.

Legitimate Mixers hide the source of transactions, making it near impossible to track.

Bitcoin Still a Popular Darknet Choice

Bitcoin gained notoriety in the darknets early years, most notably on the Silk Road marketplace. It continues to be a popular choice for transactions on similar marketplaces. Darknet activity too remains a much talked about topic with notable research from Messari and CipherTrace in recent times.

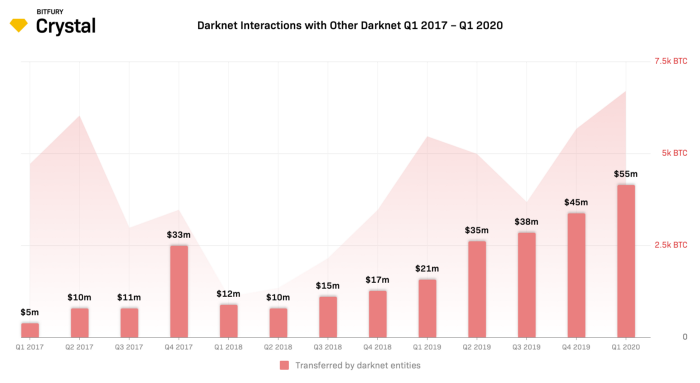

Crystal Blockchain offers tangible evidence that shows it remains popular. $55 million worth of Bitcoin was transferred between darknet entities, the highest it has ever been.

Most notably, the report highlights an increase in internal cooperation. It reads:

“The share of bitcoin sent from one darknet entity to another (i.e., all transactions between different darknet entities) also grew from 10% in Q1 2019 to 19% in Q1 2020 — indicating overall growth in darknet revenue and cooperation.”

The statement infers that darknet users may be hiding Bitcoin flows within the darknet to avoid tracing. The report concludes by saying that darknet entities will likely evolve to combat the Financial Actions Task Force (FATF) and European Union (EU) regulations.