Bitcoin’s price has experienced a modest 2% increase over the past 24 hours. This reflects the broader uptrend in the cryptocurrency market, which has also seen a 2% rise in capitalization.

On-chain data indicates that this bullish momentum could continue, paving the way for Bitcoin to approach the $67,000 mark. In this analysis, BeinCrypto explores the factors that could make this happen in the near term.

Bitcoin Registers Uptick in Accumulation

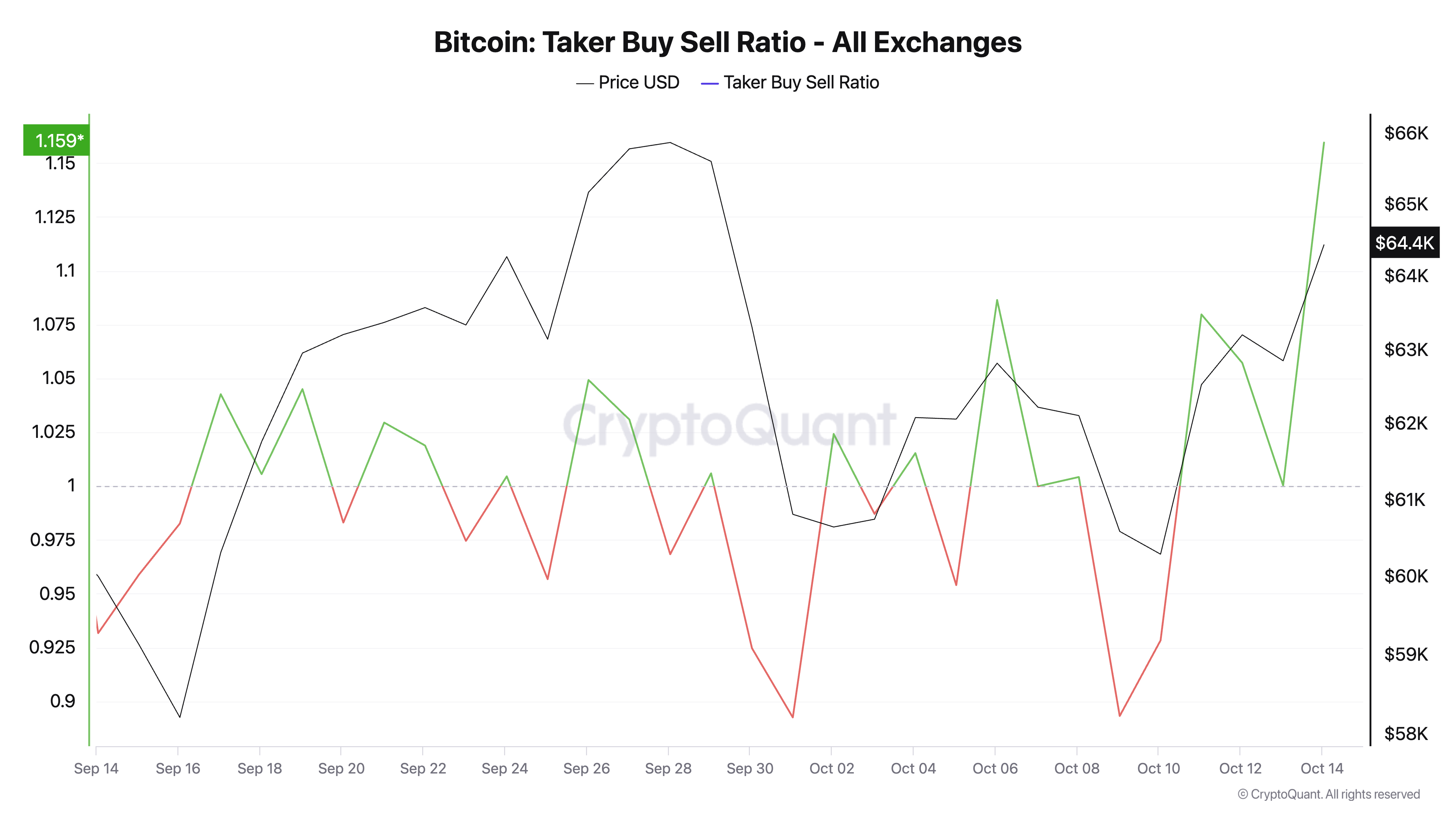

Bitcoin’s taker-buy-sell ratio has reached its highest level in the past month. Currently, this metric, which tracks the ratio of BTC’s buy-to-sell volumes in the futures market, stands at 1.19.

Read more: Top 7 Platforms To Earn Bitcoin Sign-Up Bonuses in 2024

A ratio greater than one means more buyers than sellers, indicating a bullish sentiment in the market. This suggests increasing demand for Bitcoin, hinting at a sustained upward trend.

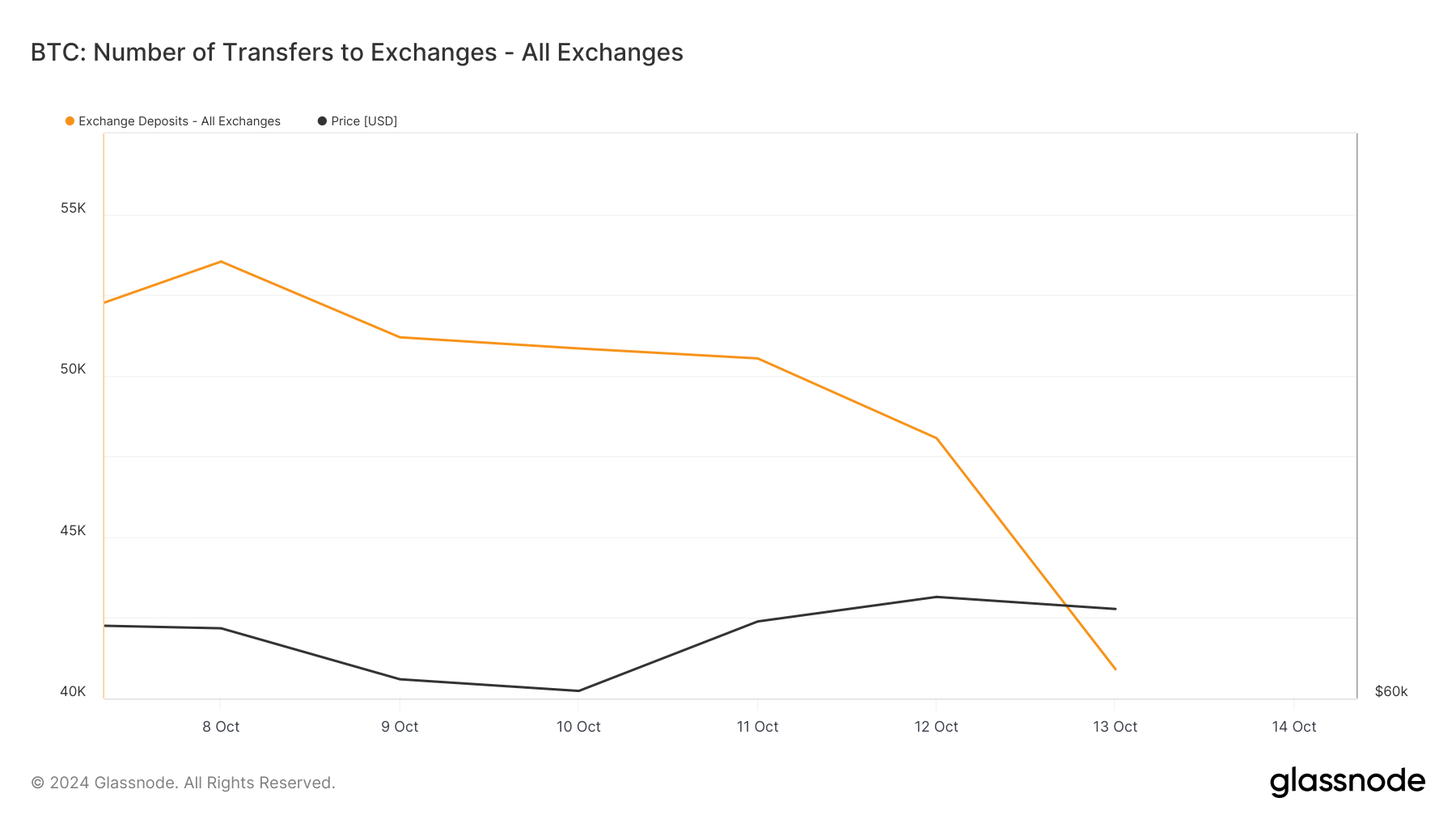

BeinCrypto’s assessment of the exchange activity supports this bullish outlook. Glassnode’s data reveals that the volume of BTC deposits to cryptocurrency exchanges fell to a weekly low of 40,908 coins on Sunday.

A reduction in deposits suggests that fewer investors are sending their assets to exchanges to sell. This reflects confidence in BTC’s long-term value, implying that holders expect its price to continue rising.

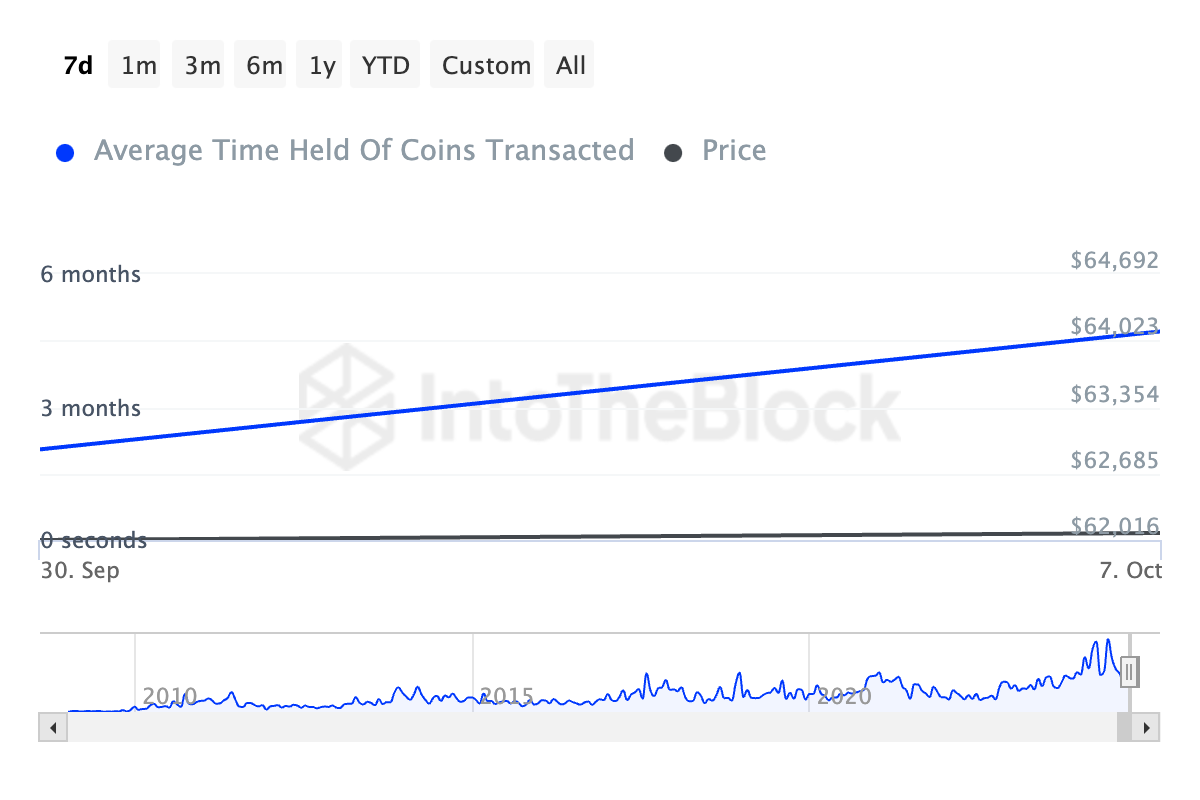

Moreover, BTC’s holding time has spiked by 301% over this past week, confirming that coins are being held for longer periods of time before being traded. This is a bullish signal indicating traders’ willingness to hold onto their coins for extended periods.

BTC Price Prediction: A Rally to a Five-Month High Is Possible

Bitcoin is currently trading at $64,315, just above the crucial resistance level of $63,289. If this upward trend persists, a retest of that resistance line will likely be successful, allowing BTC to continue its rally toward $67,078.

Should it clear this threshold, Bitcoin’s price could reclaim its five-month high of $71,906.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

However, this bullish outlook hinges on sustained buying momentum. If selling pressure increases, it may drive Bitcoin’s price down toward $60,627, invalidating the current bullish projection.