Bitcoin’s price rise has stalled just under $120,000, moving sideways as the broader crypto market pivots to altcoins. This stagnation follows a recent rally that lifted BTC close to its all-time high.

However, saturated demand and increasing sell pressure are reducing Bitcoin’s momentum, raising concerns of a potential reversal.

Bitcoin Investors Beginning Profit Taking

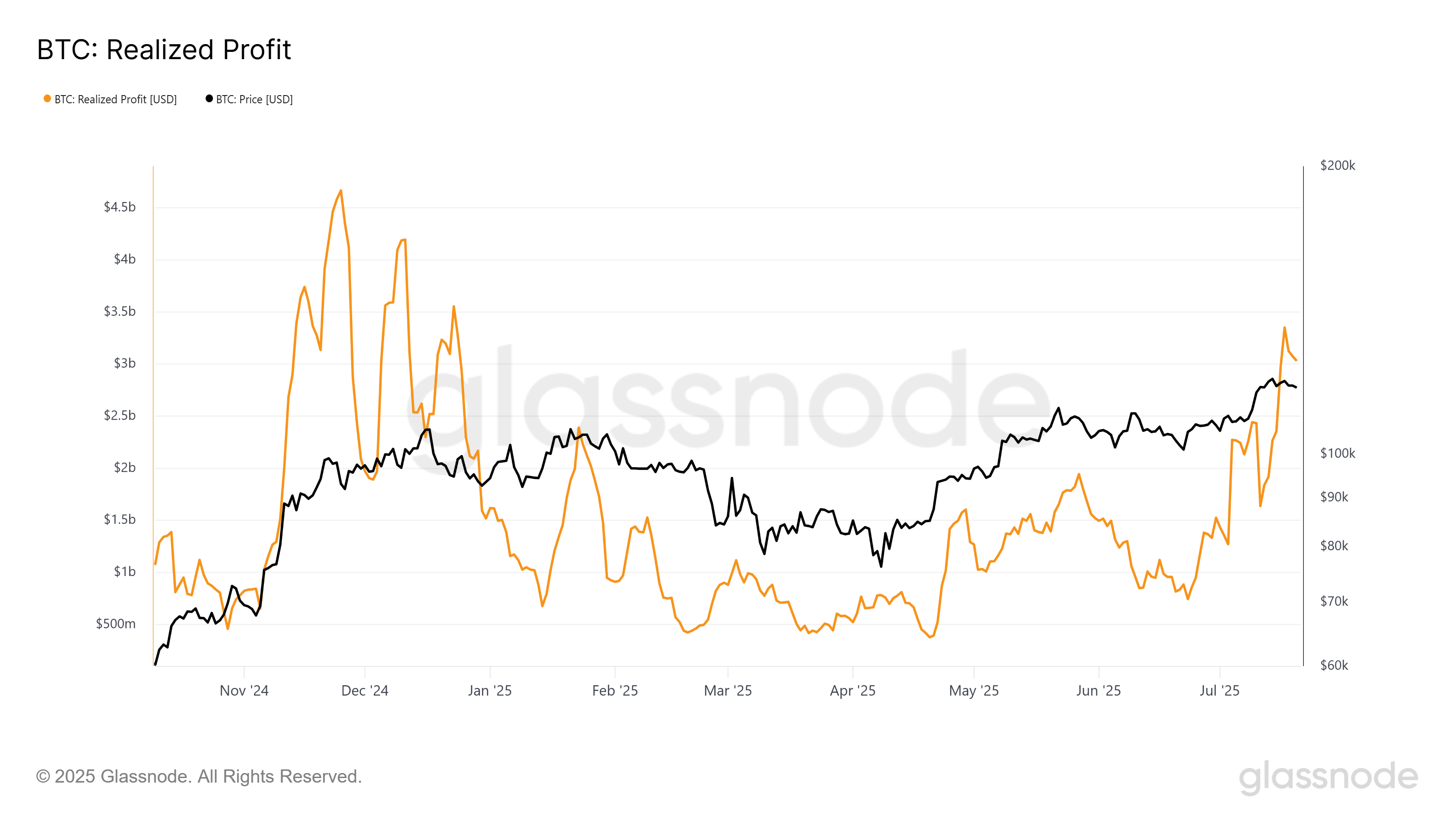

Realized profits for Bitcoin have surged to a 7-month high, signaling growing selling activity among investors. The spike indicates that holders are securing gains rather than betting on further upside. This behavior often emerges when investors lose confidence in continued bullish momentum, which appears to be happening now.

As profit-taking intensifies, investor sentiment has started shifting away from Bitcoin. This could limit the upside potential in the near term. When large numbers of investors exit at once, it typically places downward pressure on the price, reinforcing the likelihood of consolidation or a correction.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

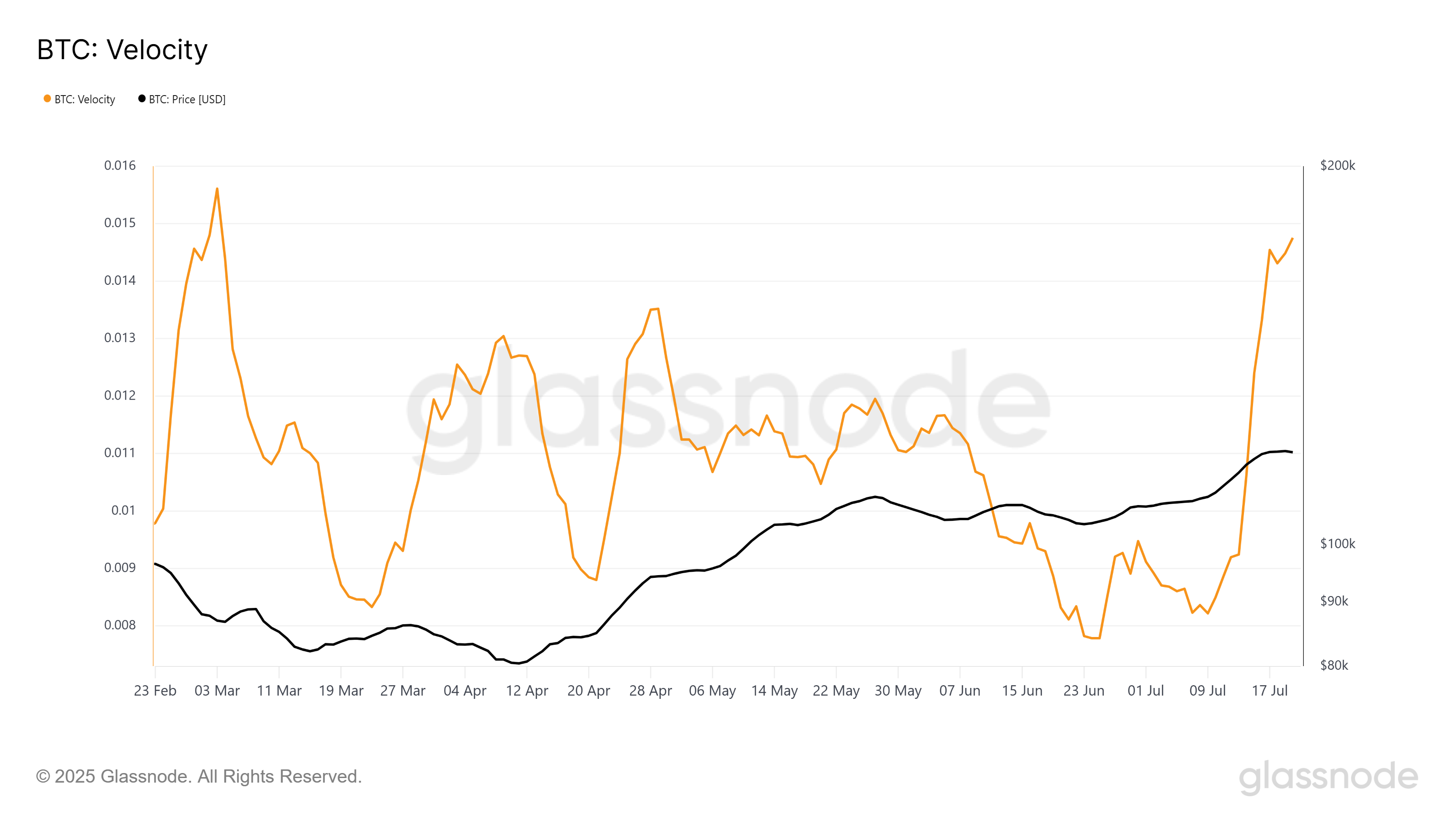

Velocity, another key indicator, is also spiking and currently sits at a 4-month high. This metric tracks the rate at which Bitcoin changes hands within the network. Higher velocity usually accompanies increased trading activity, reflecting investor attempts to capitalize on short-term movements.

This uptick in velocity shows that Bitcoin demand is still present, but it’s driven by quick trades rather than long-term accumulation. The conflicting signals of profit-taking and rising demand are keeping Bitcoin from making a sharp move in either direction. This tug-of-war is contributing to the ongoing price stagnation.

BTC Price Could Escape Consolidation, But For The Worse

At the time of writing, Bitcoin is priced at $119,366. The crypto giant is struggling to break past the $120,000 resistance level. Its fading dominance suggests capital is shifting to altcoins, decreasing the likelihood of a breakout above this barrier in the immediate future.

Bitcoin’s current indicators support a sideways price movement. If the market holds steady, BTC may continue to consolidate between $117,000 and $120,000. This range is likely to remain intact unless significant buying momentum returns.

On the downside, if selling pressure surpasses demand, Bitcoin could fall below $115,000. A stronger correction could push the price toward $110,000, invalidating the current bullish narrative and reinforcing concerns about near-term weakness.