Bitcoin (BTC) has surged beyond $125,000, setting a new all-time high and cementing its dominance as the world’s leading cryptocurrency. The sharp rally, which pushed BTC to $125,708 during intraday trading, was not a random market event.

Instead, it reflects a pattern of constructive accumulation seen in previous cycles, driven by investor confidence and structural demand.

Bitcoin Investors Are Optimistic

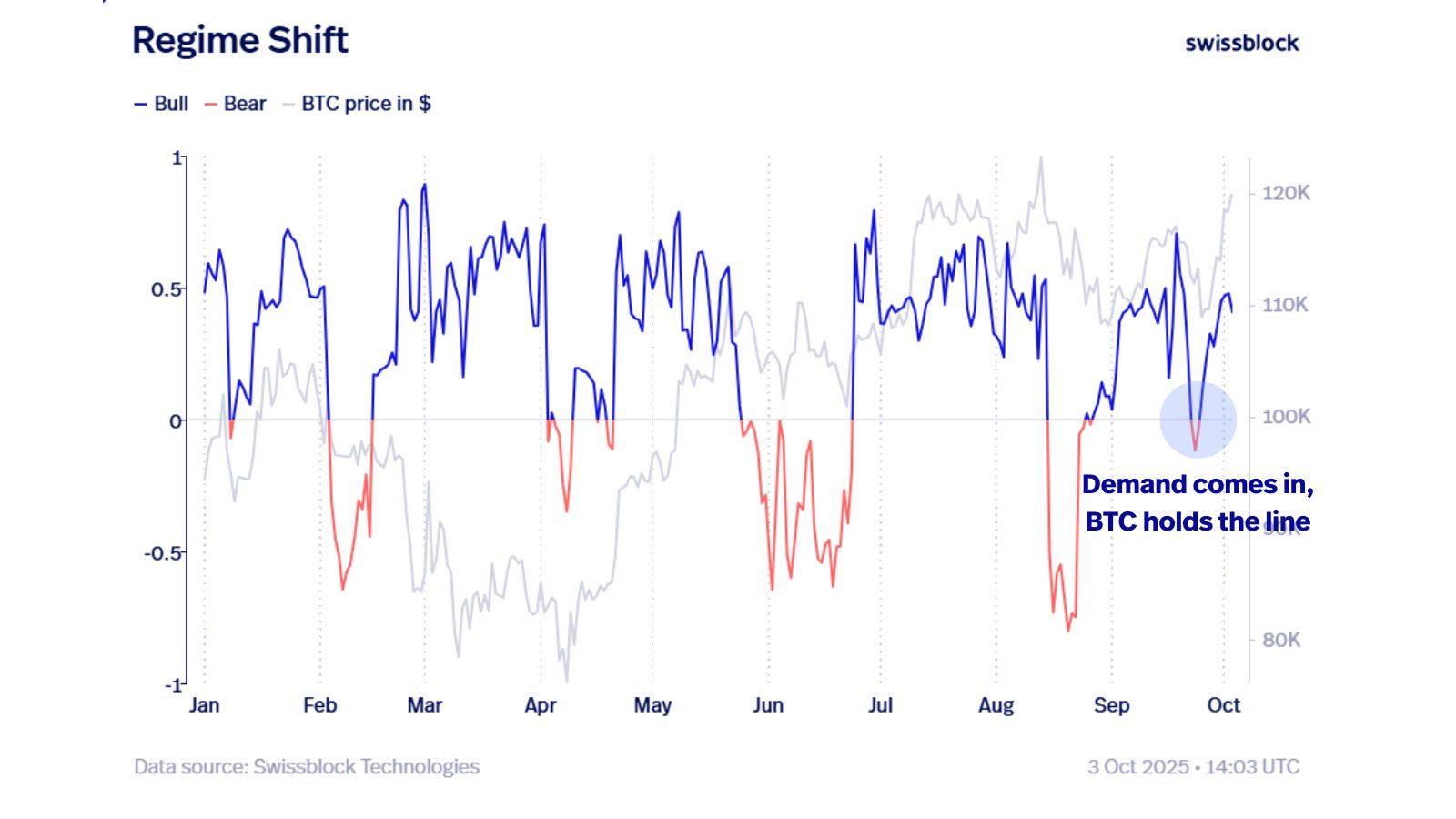

According to analysis from Swissblock, the Bull Bear Indicator reveals that Bitcoin’s recent rally was fueled by genuine demand rather than speculative excess.

Even as the market corrected briefly before this surge, demand continued to absorb supply. The Structure Shift remained on an upward trend throughout the dip, highlighting investor conviction.

This sustained demand points to a healthy market reset instead of fragility. Institutional interest, combined with growing retail participation, has created a steady flow of capital into Bitcoin.

Such resilience highlights a constructive phase where market participants view pullbacks as buying opportunities rather than exit signals.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

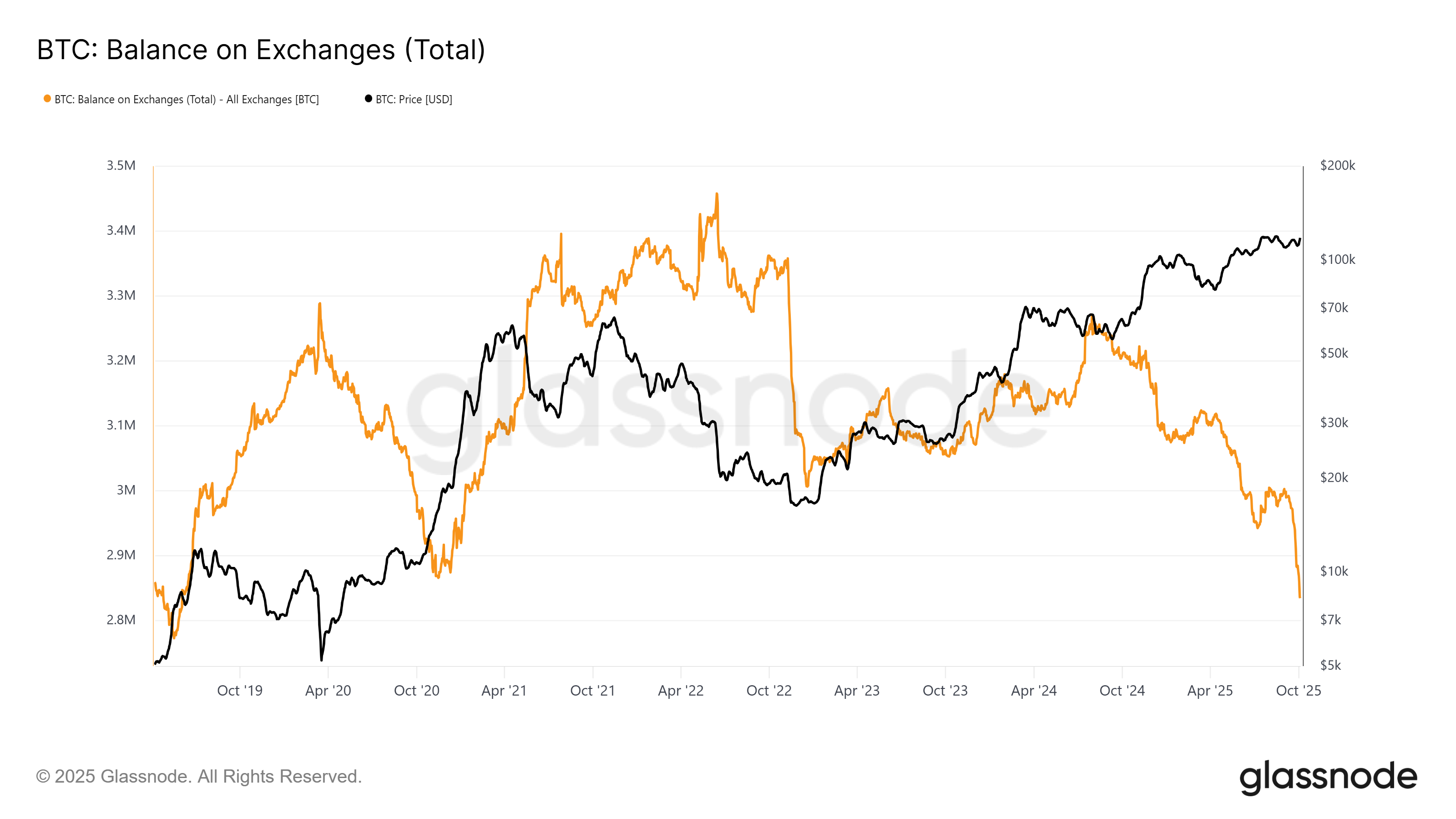

The macro picture for Bitcoin remains bullish. Exchange data shows that the BTC supply is sitting at a six-year low, with only 2.83 million coins now available on exchanges. This reflects extensive accumulation by investors over the past month, signaling strong long-term confidence in the asset.

Lower exchange supply typically indicates reduced selling pressure, which is a historically bullish sign. This accumulation trend confirms that market participants interpreted the recent correction not as weakness, but as an opportunity to acquire more BTC.

BTC Price Forms New ATH

Bitcoin’s price hit a new all-time high at $125,708 before consolidating near $122,963. This retracement appears healthy given the scale of recent gains. Holding above $122,000 remains crucial for sustaining momentum.

The combination of demand strength, accumulation, and limited supply could help Bitcoin form another all-time high in the coming days. Continued inflows from institutional investors may further support this trajectory.

However, if profit-taking intensifies, Bitcoin could lose the $122,000 support and decline toward $120,000 or lower. Such a move would signal a temporary cooldown, potentially delaying the next leg of its rally.