What do you do when you don’t know something? Google it, of course — which is what a lot of people did at the height of the recent Bitcoin bubble.

The problem is: not so many people are Googling it now.

According to research from Dutch National Bank policy advisor Joost van der Burgt, there exists an almost-perfect correlation between the first and foremost cryptocurrency’s price movements and Google searches for Bitcoin — at least, until the bubble burst.

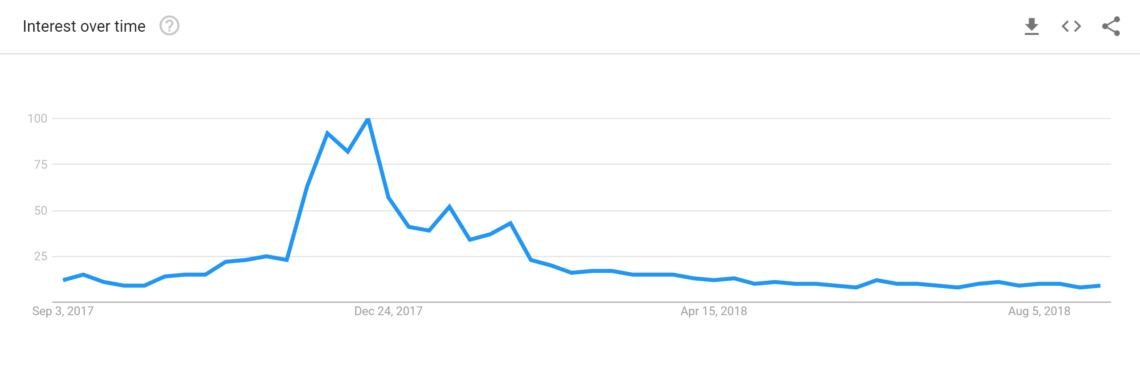

Below is the chart of Bitcoin’s interest over time, courtesy of Google Trends:

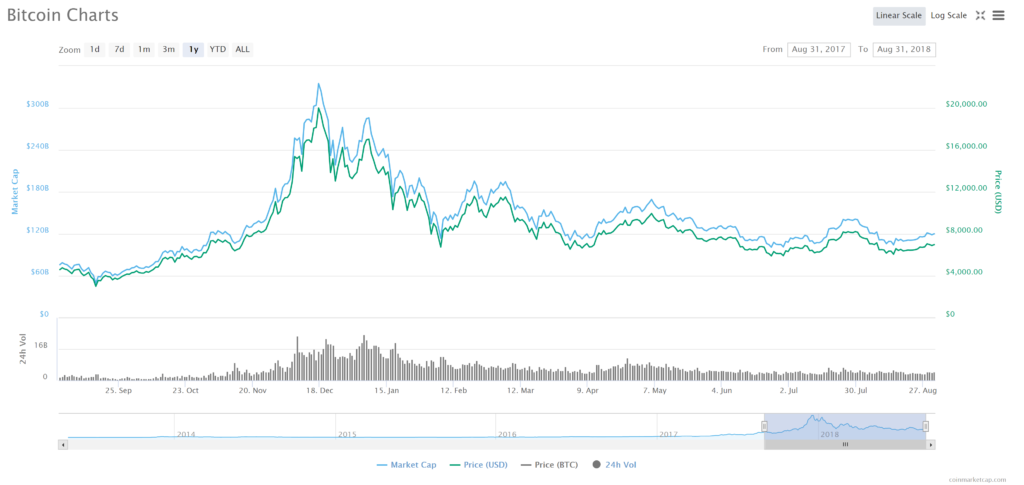

Now, compare that to Bitcoin’s price chart over the same time period:

Now, compare that to Bitcoin’s price chart over the same time period:

As you can see, there is an obvious correlation between the two.

However, Google searches have not kept up with Bitcoin’s price — with the latter experiencing various rallies throughout the year.

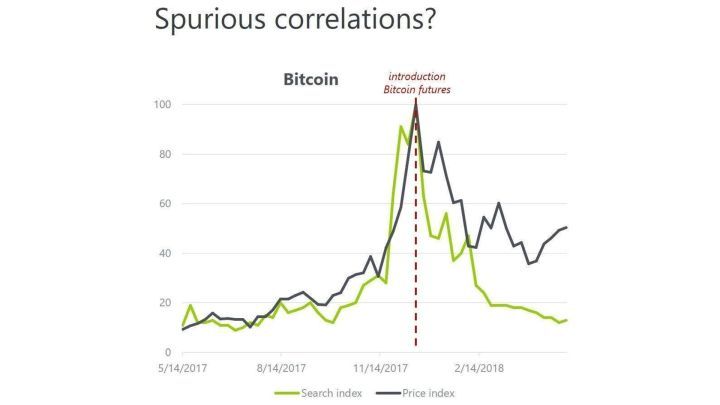

Van der Burgt’s correlation, as published on CBNC, illustrates this exact point:

As you can see, there is an obvious correlation between the two.

However, Google searches have not kept up with Bitcoin’s price — with the latter experiencing various rallies throughout the year.

Van der Burgt’s correlation, as published on CBNC, illustrates this exact point:

Hype Driven

The apparent lack of Google searches for Bitcoin stems from the significant decrease in the mainstream attention.

Blame the Futures

This correlation all but ceased, however, when the market took a turn for the worse. Specifically, Van der Burgt blames the introduction of bitcoin futures contracts.

Keep Calm

Bitcoin’s bear market in 2018 has been undeniably brutal. Still, the Dutchman wouldn’t call the market leader’s dramatic price decline a “panic.” What do you think of Joost van der Burgt’s correlation? Do you think Bitcoin will fully recover in the coming months? Let us know your thoughts in the comments below!

Top crypto projects in the US | April 2024

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Kyle Baird

Kyle migrated from the East Coast USA to South-East Asia after graduating from Pennsylvania's East Stroudsburg University with a Bachelor of Science degree in 2010. Following in the footsteps of his grandfather, Kyle got his start buying stocks and precious metals in his teens. This sparked his interest in learning and writing about cryptocurrencies. He started as a copywriter for Bitcoinist in 2016 before taking on an editor's role at BeInCrypto at the beginning of 2018.

Kyle migrated from the East Coast USA to South-East Asia after graduating from Pennsylvania's East Stroudsburg University with a Bachelor of Science degree in 2010. Following in the footsteps of his grandfather, Kyle got his start buying stocks and precious metals in his teens. This sparked his interest in learning and writing about cryptocurrencies. He started as a copywriter for Bitcoinist in 2016 before taking on an editor's role at BeInCrypto at the beginning of 2018.

READ FULL BIO

Sponsored

Sponsored