Bitcoin (BTC) recently reached an all-time high (ATH) of $109,588. However, the coin’s price has since dropped by 8%, partly attributed to a reduction in retail trading activity.

With waning demand from this cohort of BTC investors, BTC could extend its price drop in the short term.

Bitcoin Retail Traders Reduce Accumulation

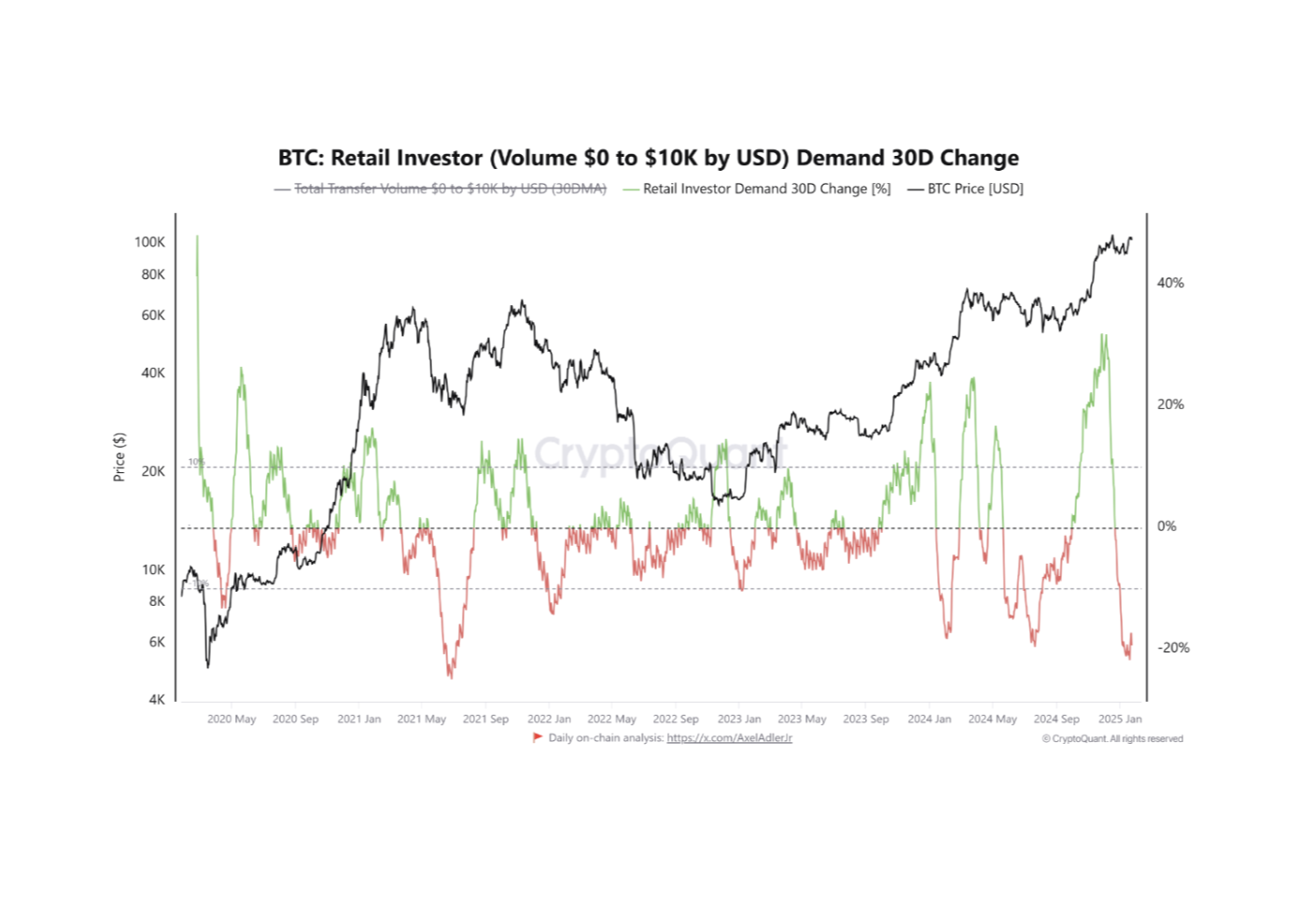

In a new report, pseudonymous CryptoQuant analyst Caueconomy notes that retail traders, who typically drive smaller yet significant market movements, have shown a steady decline in Bitcoin accumulation over the past month.

According to Caucenomy, over the past few days, on-chain activity for BTC transactions up to $10,000 has dropped by 19.34%, reflecting a decline in retail trading activity. This decline has occurred even as the coin’s price touched an ATH of $109,588 on Monday.

This dip in retail activity is noteworthy given Bitcoin’s current high volatility. Typically, periods of high price swings like this are accompanied by an increase in on-chain activity, as retail investors look to buy dips or take profits during upward movements. However, this decline in on-chain transactions suggests that retail traders are not engaging with BTC at the levels expected during such market conditions.

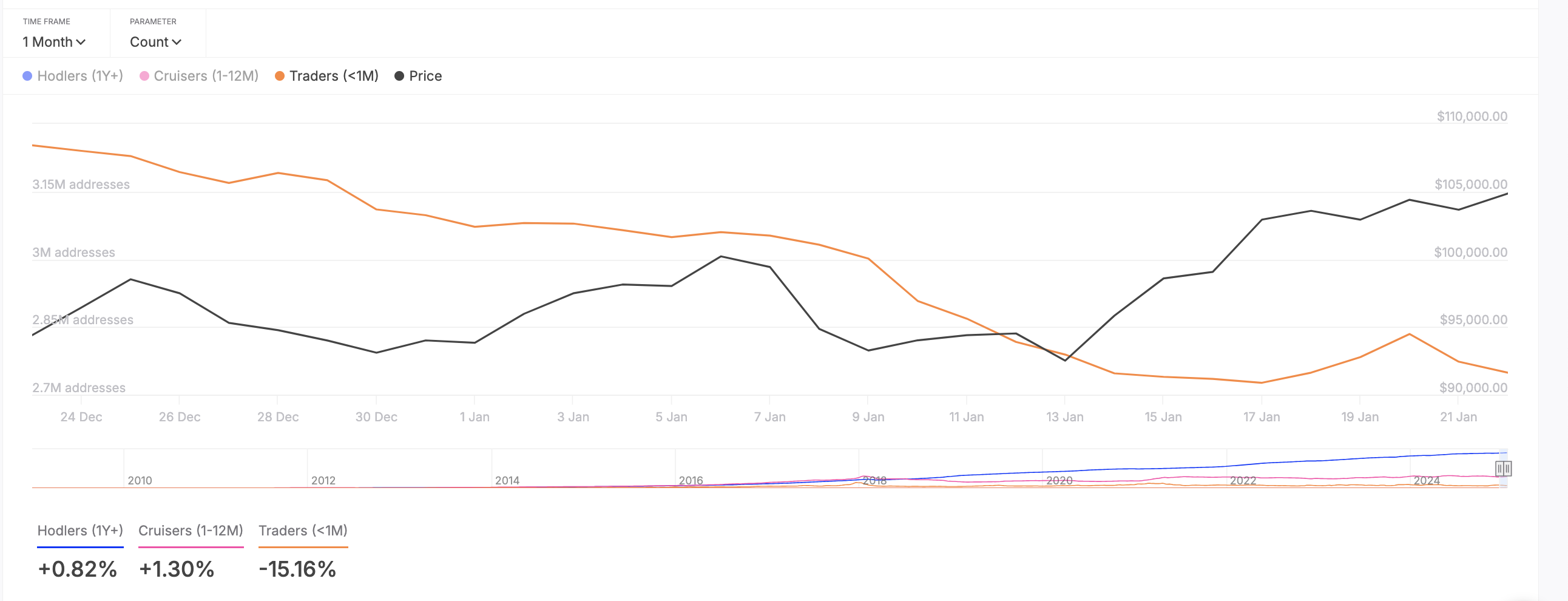

Moreover, despite the hype surrounding the recent ATH, BTC retail investors are not holding onto their positions for long, confirming their declining accumulation. According to IntoTheBlock, this group of investors has reduced their holding times by 15% over the past month.

When retail traders reduce their holding times, it signals a loss of confidence and increased caution among smaller investors. This can lead to more frequent buy-and-sell cycles, increasing market volatility and potentially putting downward pressure on the coin’s price.

BTC Price Prediction: Will $94,000 Be the Next Stop?

Without the significant participation of smaller traders, the BTC market may lack the necessary support to maintain its upward momentum toward its all-time high. If these coin holders continue to sell, BTC’s price could drop to $94,523.

On the other hand, if they resume coin accumulation, BTC’s price might attempt to revisit its all-time high and climb beyond it.